Our Site uses cookies to improve your experience on our website. For more details, please read our Cookie Policy.

By closing this message or starting to navigate on this website, you agree to our use of cookies.

PROPERTY MARKET TRENDS | 3Q 2023

PROPERTY MARKET TRENDS | 3Q 2023

There was imbalance between supply and demand in parallel with market recovery.

Residential: Since the rise in price and decline in supply have remained unchanged, there was a remarkable bipolarization between urban central areas and others.

Office: The issue is an improvement in office environment arising from work-style reform.

Retail: The market structure has transitioned into a phase of change as department stores and shopping centers and GMS promote management reform.

TEXT: Yoko Fujinami, ib Research & Consulting Inc.

Toru Kawana, Industrial Marketing Consultants Co., Ltd.

Residential

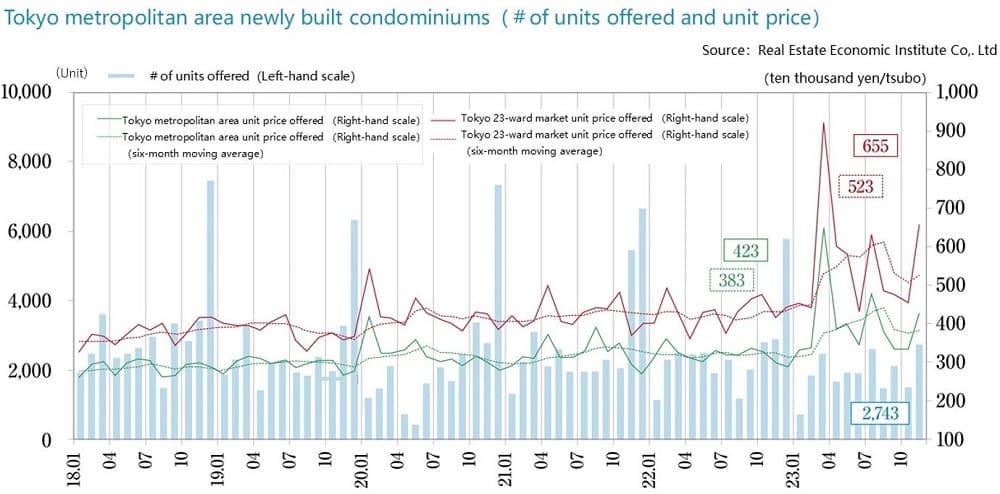

In both the Tokyo metropolitan area and the Kinki region, the prices of new and second-hand condo units have increased to historic highs. Sale of these units remain good though it takes some time.

■ New condo. sales in the Tokyo metropolitan area ・In January 2024, there was a new supply of 1,112, and the average initial sales price, floor area, and unit price were JPY 79.56 million, 68.96 sqm, and JPY 3.815 million per tsubo, respectively. The month-end inventory was 5,921, while the contract rate in the first month of sales was 72.8%, up 6.7 ppt MoM and 18.2 ppt YoY. For the full year 2023, the price and unit price were largely above the historic high as the average initial sales price, floor area, and unit price were JP 81.01 million, 66.07 sqm, and JP 4.053 million per tsubo, respectively.

■ New condo. sales in the Kinki region ・In January 2024, there was a new supply of 727, and the average initial sales price, floor area, and unit price were JPY 63.90 million, 69.18 sqm, and JPY 3.054 million per tsubo, respectively. The month-end inventory was 3,265, while the contract rate in the first month of sales was 68.5%, down 4.9 ppt MoM and 0.8 ppt YoY. For the full-year 2023, the average initial sales price, floor area, and unit price were JP 46.66 million, 59.06 sqm, and JP 2.611 million per tsubo, while the contract rate in the first month of sales remained around 70% for October to December 2023.

■ Second-hand condo. sales in the Tokyo metropolitan area ・The number of contracts made in January 2024 was 2,711, up 5.0% YoY. The average age of contracted units was 23.53 years, while the price, floor area, and unit price were JP 48.60 million (up 13.7%), 63.97 sqm (up 2.2%), and JP 2.511 million per tsubo (up 11.2%). The number of contracts and the unit price recorded the 8th consecutive month and the 45th consecutive month of increases on a YoY basis, respectively. The number of units newly listed and in inventory were 16,526 units (down 0.4% YoY) and 47,449 (up 8.6% YoY), recording the 24th consecutive month of increases on a YoY basis. The sales unit price also increased with the unit price of contracts increasing 11.2% YoY in the Tokyo metropolitan area. The number of units in inventory is on an upward trend, but the market seems to be strong because of continuing increases in the number of contracts and the sales unit price.

■ Market overview ・The price rise was remarkable in the Tokyo 23 Wards as the average price increased 39.4% YoY in 2023 and the number of condos priced at JPY 100 million or more per unit was 4,174 (15% of share) in the entire Tokyo metropolitan area. ・In the condo market in the Kinki region, prices declined 9.7% in Osaka City, where there was a large supply, from 2022 to 2023, while increasing 5% to 15% in other areas. Also in the Kinki region, prices are on an upward trend. ・We think that a price rise in second-hand condos will remain unchanged in 2024 because of the decreasing supply and increasing prices of condos. It was said that there was a limit price on second-hand condos, but the number of contracts made has increased despite the increasing prices. It needs to focus on second-hand condos as a tray of residential demand substituting Brand New condos.

Data: As for new supply = Real Estate Economic Institute Co., Ltd., and as for secondary market = Real Estate Information Network for East Japan

Office

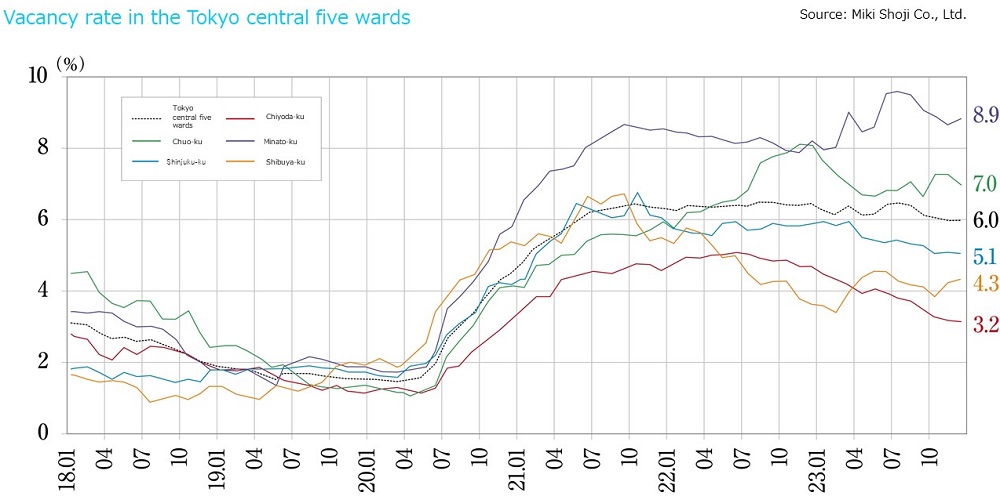

The vacancy rate was below 6% in the Tokyo CBD, and there was improvement in the market conditions in regional cities, and rent remarkably showed an upward trend.

■ Large-scale office buildings in Tokyo CBD (Central 5 Wards)

・As of January 2024, the vacancy rate decreased by 0.20 ppt MoM to 5.83%. It was below 6% for the first time in 31 months since June 2021.

・The average rent was JPY 19,730 per tsubo, down JPY 18 MoM and JPY 296 YoY, on a downward trend, but it remains in the JPY 19,700s.

・For new buildings, the vacancy rate has continuously remained at more than 30% since June 2023 due to the average rent of JPY 27,565 per tsubo with a large gap with that of existing buildings and excess supply, and the vacant area was 60,000 tsubo or more. There is no improvement in the situation wherein new buildings struggle to win tenants.

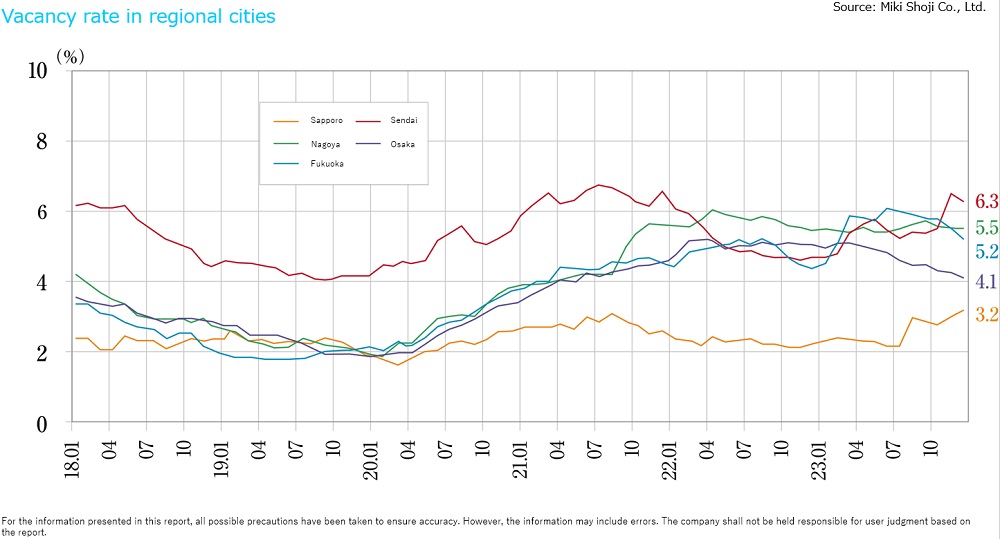

■ Vacancy rates, and movements in average rents in major regional cities / January 2024

・ Sapporo: Vacancy @ 3.32% down 0.16 ppt MoM. Average rent @ JPY 10,256 per tsubo up JPY 72 MoM. (Vacancy rate improved slightly, while average rent increased.)

・Sendai: Vacancy @ 6.48% up 0.19 ppt MoM. Average rent @ JPY 9,328 per tsubo up JPY 26 MoM. (Vacancy rate worsened, while average rent increased slightly.)

・Yokohama: Vacancy @ 6.35% down 0.44 ppt MoM. Average rent @ JPY 12,634 per tsubo up JPY 4 MoM. (Vacancy rate improved, while average rent leveled off or increased)

・Nagoya: Vacancy @ 5.65% up 0.16 ppt MoM. Average rent @ JPY 12,373 per tsubo up JPY 46 MoM. (Vacancy rate worsened, while average rent increased.)

・Osaka: Vacancy @ 4.36% up 0.2 ppt MoM. Average rent @ JPY 11,962 per tsubo down JPY 14 MoM. (Vacancy rate worsened, while average rent decreased slightly.)

・Fukuoka: Vacancy @ 5.46% up 0.27 ppt MoM. Average rent @ JPY 11,582 per tsubo up JPY 32 MoM. (Vacancy rate worsened, while average rent increased slightly.)

The vacancy rate is on a downward trend, but the average rent increased in areas other than Osaka.

■Status quo and future market outlook

・Since autumn 2023, there has been remarkable movements of large contracts made for new buildings and expansion and relocation, and the average rent has increased in business districts. We find an improvement in market conditions. The rate of going to the office has increased, but not a few workers hope for hybrid working conditions of teleworking. This progresses as construction of new office environments, including introduction of free-address office, an increase in spaces for meeting, and reinforcement of the security environment.

・There is increasing number of cancellations of contracts in medium and small-sized buildings in the regional markets resulting from the closure of sub-offices and their consolidation into other districts. There is an increase in relocation from buildings to be rebuilt and floor extension in buildings in Sapporo and Nagoya, while there is an increase in opening and extension and relocation of offices and floor extension in buildings in Yokohama and Osaka. Generally, market conditions are on a recovery trend.

Hotels

Demand is strong for travel within Japan, the number of overnight stays is above that before the COVID-19 crisis, and there is an increase in the number of stays centering on intangible goods consumption, which enjoys the experience, replacing that centering on goods consumption.

■ Recovery in the number of overnight stays has become remarkable.

・In December 2023, the total number of overnight stays in Japan was 50.74 million (up by 8.1% YoY from 46.90 million). Among this figure, the number of overnight stays by foreign tourists was 12.30 million (up by 105.7% from 5.98 million).

The total number of overnight stays was 592.75 million in 2023, compared with 543.24 million in 2019, and so it was above the level before the COVID-19 crisis, The number of overnight stays by foreign tourists was 114.34 million in 2023. It was 101.43 million in 2019, and the same applies to the total number of overnight stays by foreign tourists.

In addition to demand of inbound tourists, an increase in Japanese tourists (total number of overnight stays: 437.21 million in 2022 to 478.42 million in 2023, up 9.4% YoY) also largely contributed to the result as a positive factor.

■ Recent trends by category

・Overnight stays for each category largely increased YoY in all categories in 2023 (full-year) with so-called business hotel: 287.71 million nights (up 31.4% YoY),RYOKAN(Traditional Japanese Inn): 77.27 million nights (up 16.6% YoY) and Resort hotel: 76.68 million nights (up 18.5% YoY) and City hotel: 104.36 million nights (up 56.0% YoY). Business hotel and city hotel categories remain strong, recording the occupancy rate of 60% or more for the 11th consecutive month since February 2023.

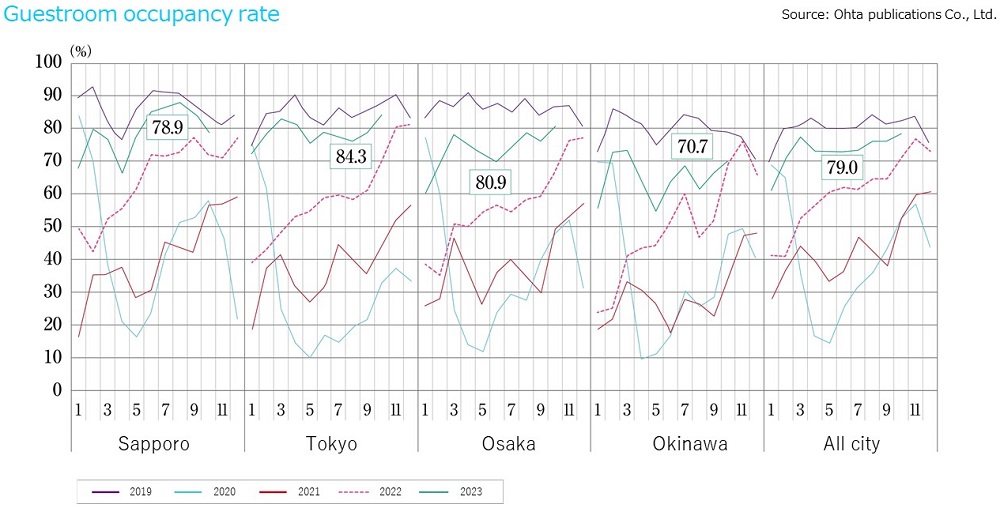

Occupancy rates of hotels by region (for October 2023 according to Ohta publications) remained solid with Sapporo: 78.9% (up 6.8 ppt YoY), Tokyo: 84.3% (up 14.4 ppt YoY), Osaka: 80.9% (up 14.5 ppt YoY), and Okinawa: 70.7% (up 3.2 ppt YoY).

■ Status quo and future market outlook

・Several New Hotels started business in regions in 2023. In addition to Japanese brands, major foreign brands have actively started business, including the Unbound Collection by Hyatt, Bulgari Hotel Tokyo, Double Tree by Hilton Kyoto Higashiyama, and voco Osaka Central.

Demand for travel within Japan largely grows while that by inbound tourists is strong. The opening is often seen of new types of hotels (such as extended-stay hotels). We think that winning new demand through diversification of and specialization in needs including development of high value added products based on likes and tastes of guests will further promote revitalization of the market.

Commercial

In 2024, it seems that industrial consolidation will be remarkable as large chains perform divestiture of stores and GMS transits to the small shopping center, which consists of supermarket and specialized stores.

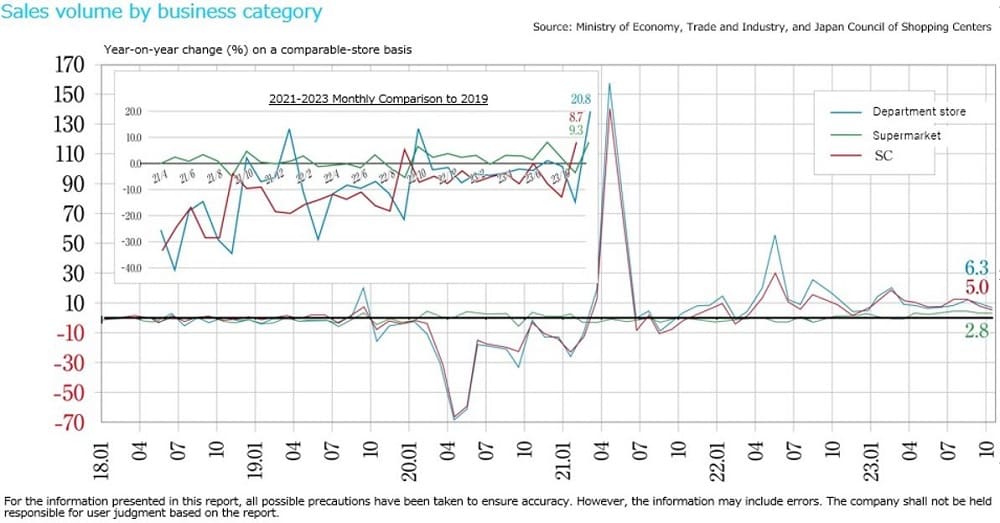

■Sales volume and status quo of shopping centers

・Existing store sales for shopping centers (overall) were approximately JPY 722.06 billion (up 4.6% YoY) in December 2023. Sales growth in overall shopping centers were positive on a YoY basis for the 22nd consecutive month.

In the 2023 autumn-winter shopping season, the first season since the reclassification of COVID-19 into class 5, sales were driven by strength in the restaurant business, which was caused by an increase in opportunities for people to gather, such as Halloween, Christmas, and year-end parties.

■Future market outlook

・There are large movements in Seven & i Holdings, including the sale of Sogo & Seibu (department store) in Ikebukuro to the U.S. Investment fund Fortress Investment Group and announcement of the closing of 17 stores in Hokkaido, Tohoku, and Shinetsu of Ito Yokado under the group. In regions where the population decreases, the tendency becomes strong that GMS ceases offering of apparel and transits to the supermarket.

・Thirty-four shopping centers were newly opened in 2023. For the opening of shopping centers by region, there were five cases in Tokyo and Osaka, respectively, four cases in Fukuoka, three cases in Kanagawa, and seventeen cases in other areas. By developer, there were ten cases by the Aeon affiliated group, three cases by the Mitsui Fudosan affiliated group, and two cases by the Daiwa House affiliated group. The strength of the Aeon group is shown.

・Inbound tourist spending in 2023 announced by the Japan Tourism Agency (preliminary figures) was a historical high of JPY 5,292.3 billion. Of the spending, a percentage of the shopping expense decreased to 26.4% from 34.7% in 2019. The tendency seems to be strong that as a consumption trend, inbound tourists focus on the experience rather than shopping. It is expected that the sales of experiences (intangible goods consumption) will attract attention.

Logistics

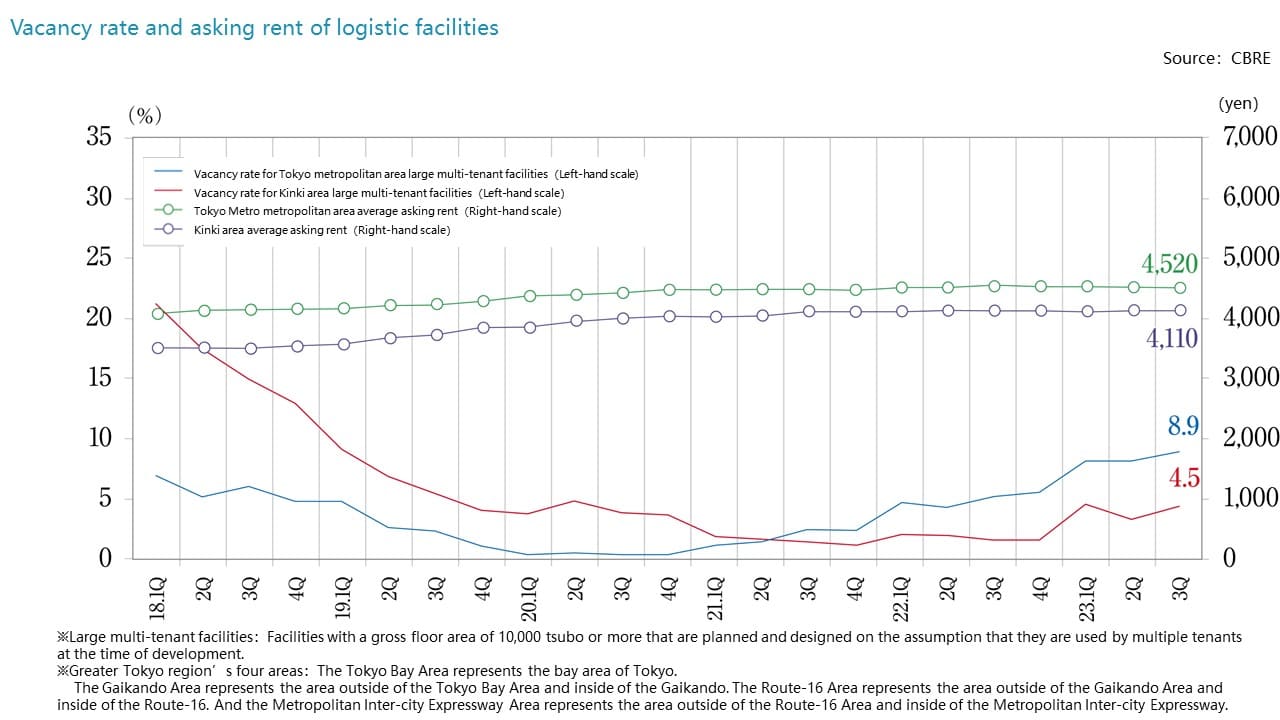

In the Tokyo metropolitan area, demand is generally solid, though there are some areas where the vacancy rate rises, and there is a polarization trend. In local markets, construction of factories leads to revitalization.

■ Market conditions in the Tokyo metropolitan area and conditions by area

・In the Tokyo Bay area, the vacancy rate was 12.1% (down 1.5 ppt YoY), and rent was JPY 7,640 per tsubo (down 0.1%). In the second half of 2023, the vacancy rate was in the 10 percent range, and there were properties with certain space unleased. The rate is expected to improve in future. The rent remained low at JPY 7,600.

・In the Tokyo Gaikan Expressway area, the vacancy rate was 2.9% (up 0.1 ppt), and rent was JPY 5,180 per tsubo (flat). There are few properties with certain space unleased, but the newly supplied space will be larger in 2024 than in 2023. Future movements will attract attention.

・In the National Route 16 area, the vacancy rate was 9.4% (up 1.2 ppt), and rent was JPY 4,530 per tsubo (flat). In this term, the supply exceeds new demand and also there are a lots of vacancies, and so rent will be expected to decline.

・In the Metropolitan Intercity Expressway area, the vacancy rate was 13.5% (down 0.8 ppt), and rent was JPY 3,590 per tsubo (down 0.3 %). There were no newly supplied spaces in the area, but the vacancy rate remained high, and it took time to solve the unleased spaces. The pressure to reduce rent is strong in Saitama and Ibaraki. Demand is strong in the logistics market itself, but there is excess supply in the entire market as even in the Tokyo Bay area, some new properties were completed with unleased spaces. The concern is about an increase in the vacancy rate in the National Route 16 area and the Metropolitan Intercity Expressway area.

■ Market condition in other regions

・In the Kinki region, the vacancy rate was 6.0%, and the effective rent was JPY 4,130 per tsubo. All three buildings newly supplied were completed with unleased spaces. Lower aged properties struggle to win tenants. On the other hand, existing properties are strong with the vacancy rate lower, and their rent is expected to remain on an upward trend.

・In the Chubu region, the vacancy rate was 10.5%, and the effective rent was JPY 3,630 per tsubo. The vacancy rate was 10% or more because two buildings newly supplied were completed with certain space unleased. It is expected that the vacancy rate will decrease because the market will be revitalized because of the estimated increase resulting mainly from the manufacturing and active supplies arising from large properties to be completed in 2024.

・In the Fukuoka region, the vacancy rate was 8.1%, and the effective rent was JPY 3,450 per tsubo. In the second half of 2023, many new supplies increased the vacancy rate. Given strong demand mainly from logistics, the rate is expected to decrease.

■Future market outlook

・New supplies of space projected in 2024 are approximately 600,000 tsubo in the Tokyo metropolitan area, 200,000 tsubo in the Kinki region, 100,000 tsubo in the Chubu region, and 80,000 tsubo in the Fukuoka region, respectively. New supplies are expected to be almost equal to or slightly below those for 2023 in all regions, and decreasing supply pressure would result in a decrease in the vacancy rate.

・Because of strong demand from corporations related to semiconductor production in the cities of Sapporo, Sendai, and areas surrounding Okayama and Hiroshima like Fukuoka, there is a shortage of properties for logistics in these areas. Therefore we need to closely watch them as areas to be developed in future.

J-Reit

Because of the projected rise in interest rates in Japan and weakness in conditions in the office market, the TSE REIT index remained weak and properties in and sponsors of portfolios were replaced.

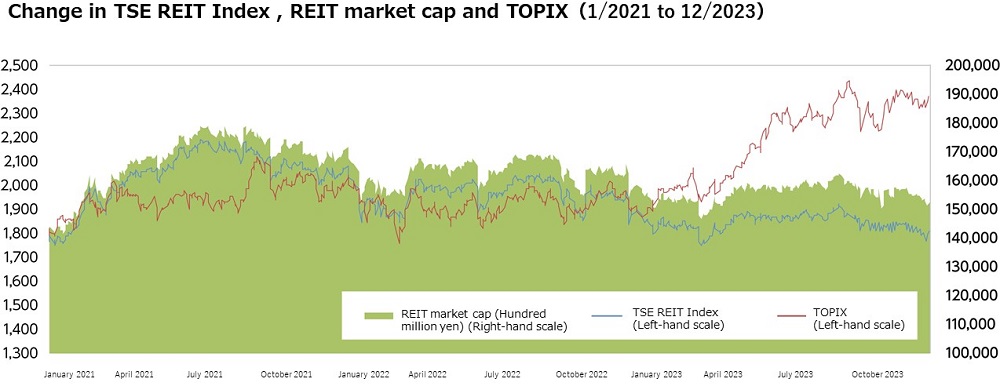

■ J-REIT market trend

・At the end of 2023, the TSE REIT index was 1,806.96, down 2.8% from the end of September, and market capitalization of J-REITs was JPY 15.4117 trillion, down 2.5% from the end of September. The average dividend yield for all J-REITs was 4.31%, up 0.15 ppt from the end of September. The growth rate of TOPIX remained high at 1.9% for the same period while the TSE REIT index recorded another decrease. The TSE REIT index was remarkably weak, compared with strong equity market conditions. In our view, this is because the projected rise in interest rates in Japan becomes further strong due to speculation that the BOJ will make another correction in the allowed range of fluctuations for yield curve control and release the negative interest rate early.

・The aggregate AUM of J-REITs grew by JPY 259.6 billion from end of September 2023 year to JPY 22.8160 trillion as of the end of 2023. By use of intent, residential was JPY 133.2 billion, accounting for more than 50% of the aggregate AUM. This is because in November, three investment corporations, which were sponsored by Kenedix, merged, and the large residential River City 21 East Towers II (acquisition cost: JPY 10.7 billion) was newly acquired at the time of the merger, and purchase prices of residential, which were succeeded because of the merger, increased.

・Weakness in investment unit prices has an effect on the capital increase through public offerings. For three months from October to December, it was three issues that announced capital increases through public offerings, down 50% from six issues for July to September. Consequently, external growth from properties newly acquired, excluding those acquired by merger, sharply slowed down.

■ Status quo

・Under the environment where market conditions for offices remain weak, there is an increase in cases where the investment policy changed to reconstruct the portfolio. Sankei Real Estate Inc. announced replacement of offices with hotels, logistic facilities, and residential to convert to a comprehensive type, and Sekisui House Reit, Inc., and Takara Leben Real Estate Investment Corporation announced disposal of offices and conversion to a comprehensive type centering on residential, respectively. For Ooedo Onsen Asset Management Co., Ltd., its sponsor was changed to APA, and its corporation name was changed to Nippon Hotel & Residential Investment Corporation February 2024.