Our Site uses cookies to improve your experience on our website. For more details, please read our Cookie Policy.

By closing this message or starting to navigate on this website, you agree to our use of cookies.

PROPERTY MARKET TRENDS | 2Q 2022

PROPERTY MARKET TRENDS | 2Q 2022

Residential: Apparently the market is on the way to recovery helped by inbound demand.

Hospitality: International luxury brands and a new breed of hotels opens as demand comes back.

Logistics: There is a lull in demand increase. Measures to improve distribution efficiency and fulfill staffing levels are gathering weight.

TEXT: Yoko Fujinami, ib Research & Consulting Inc.

Toru Kawana, Industrial Marketing Consultants Co., Ltd.

Residential

Both market size and contract rate declined in Tokyo metropolitan area, while they were stable in Kinki region. The market condition (both selling and leasing) for high-end properties in central Tokyo is robust helped by growing inbound demand.

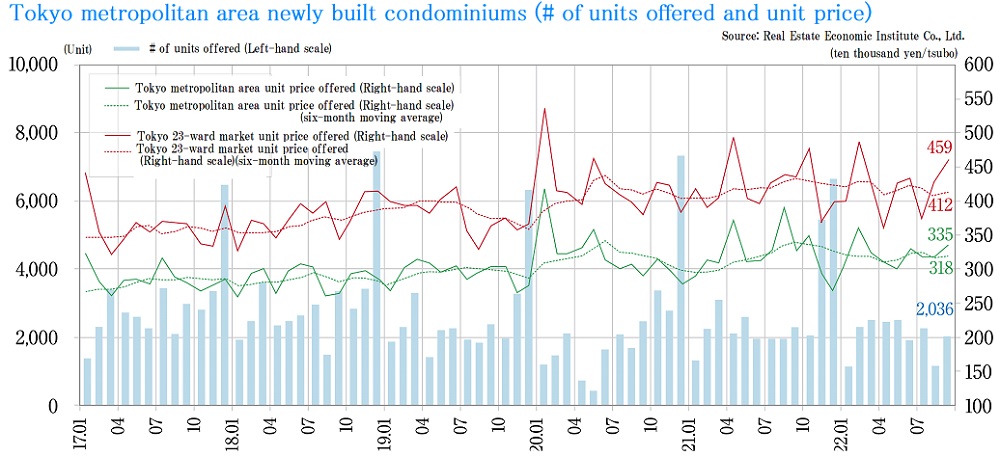

■New condo. sales in Tokyo metropolitan area

・In September 2022, there was a new supply of 2,036 units, and average initial sales price, floor area and unit price were JPY 66.53 million, 65.74 sqm, and JPY 3.345 million per tsubo, respectively. The month-end inventory was 4,797 units, while contract rate in the first month of sales was 61.6%, down 0.4 ppt MoM and 6.1 ppt YoY. The average unit price in the 23 wards of Tokyo stood out at JPY 4.588 million per tsubo, compared to JPY 2.803 million per tsubo in suburban Tokyo, JPY 2.644 million per tsubo in Kanagawa Pref., JPY 2.515 million per tsubo in Saitama Pref., and JPY 2.066 million per tsubo in Chiba Pref.

■New condo. sales in Kinki region

・In September 2022, there was a new supply of 1,332 units, and average initial sales price, floor area and unit price were JPY 46.98 million, 62.28 sqm, and JPY 2,492 million per tsubo, respectively. The month-end inventory was 3,396 units, while contract rate in the first month of sales was 71.5%, down 5.5 ppt MoM and up 12.1 ppt YoY. Despite concerns about sales before summer, average prices have been exceeding 40 million in prime areas, so the market is deemed firm.

■Second-hand condo. sales in Tokyo metropolitan area

・There were only 2,990 contracts made in September 2022 (down 5.9% YoY), partly due to a gradual decrease in inventories and a contraction from the elevated level of transaction volumes during the first half of 2021. Average age of units sold was 23.11 years. Their average price and unit price both rose to JPY 44.21 million (up 11.0% YoY) and JPY 691,000 per sqm (up 11.2% YoY), respectively. The number of units in inventory and newly listed were 39,274 and 15,512, respectively.

・Number of Transactions kept falling below the level in the same month of the previous year. In cases of Tokyo metropolitan area, Tama area and Saitama Pref., the number has been lower than the previous year for the last nine months in a row. Such decline in the number of transactions is thought to be the consequence of continual increases in contract price.

■Market overview

・Inbound demand is obviously coming back to the rental housing market, and there is a shortage of available properties in the luxury rental market for foreigners. Occupancy rate of luxury rental units was shored up by enticing wealthy Japanese during the time demand from foreigners was contracted. Now the demand exceeds supply as entry restrictions to Japan are relaxed.

・As far as condominium units for sale (newly-built and/or secondhand) are concerned, an increasing number of foreigners are also buying these days. Properties in the 23 wards of Tokyo (especially within the area inside of Yamanote Line) are considered underpriced despite their high capital values and in comparison to those in other major cities in the world. They are attracting attention in overseas markets, and purchased by an increasing number of offshore buyers who can take advantage of devaluated Japanese Yen, even at such high unit prices as regarded excessive from a domestic buyer's point of view.

Data: As for new supply = Real Estate Economic Institute Co., Ltd., and as for secondary market = Real Estate Information Network for East Japan

Office

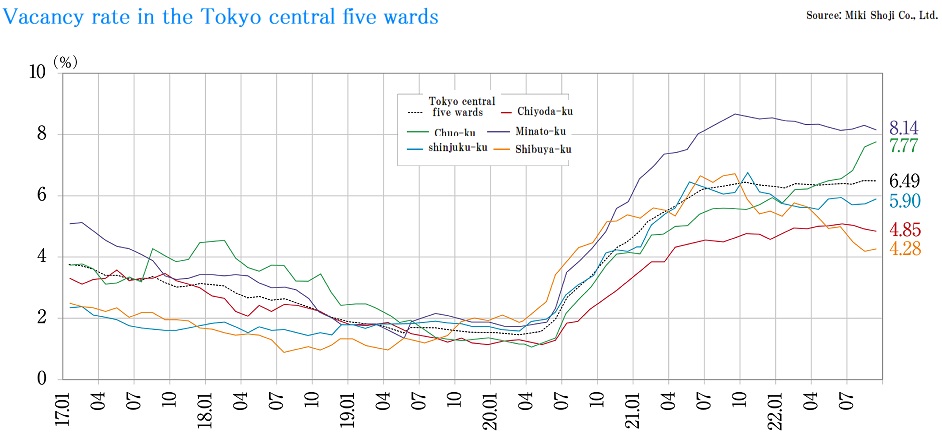

Rents in Tokyo CBD (Central 5 Wards) keep sliding, while vacancy rates in major regional cities remain stable. Attainment of a pleasant working environment takes precedence over efficiency.

■Large-scale office buildings in Tokyo CBD (Central 5 Wards)

・As of September 2022, vacancy rate stood at 6.49%, unchanged (+/-0.00 ppt MoM) from the previous month. It has been hovering around low 6% since June 2021.

・Average rent for the same month was JPY 20,156 per tsubo, down by JPY 94 MoM and JPY 702 YoY, recording a decline for 26 consecutive months.

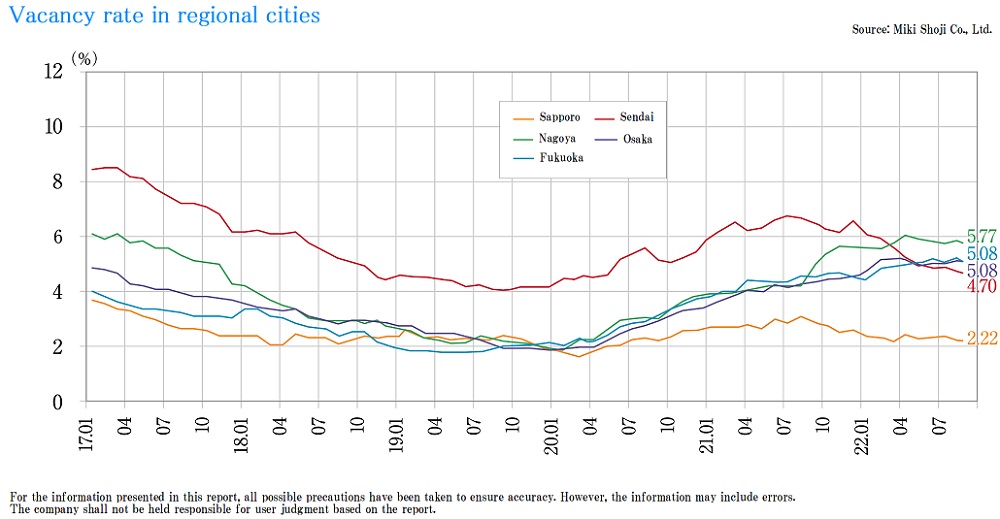

■Vacancy rates, average rents in major regional cities / September 2022

・Sapporo: Vacancy @2.22% down by 0.01 ppt MoM. Average rent up by JPY 5 MoM (Vacancy rate levelled off, while average rent improved.)

・Sendai: Vacancy @4.7%, down by 0.05 ppt MoM. Average rent +/- JPY 0 MoM. (Vacancy rate and average rent both levelled off.)

・Yokohama: Vacancy @5.11%, down by 0.15 ppt MoM. Average rent up by JPY 20 MoM. (Vacancy rate and average rent both improved.)

・Nagoya: Vacancy @5.77%, down by 0.10 ppt MoM. Average rent up by JPY 9 MoM. (Vacancy rate and average rent both improved)

・Osaka: Vacancy @5.08%, down by 0.04 ppt MoM. Average rent up by JPY 7 MoM. (Vacancy rate levelled off, average rent improved.)

・Fukuoka: Vacancy @5.08%, down by 0.15 ppt MoM. Average rent up by JPY 23 MoM. (Vacancy rate and average rent both improved)

Overall, vacancy rates have stabilized and average rents bottomed out.

■Future market outlook

・One of the reasons why vacancy rates stabilized is that people are coming back to business districts. Companies which had once recommended work-from-home started to encourage employees to commute to work. According to a questionnaire, an increasing number of workers also think they would rather come to office two or three days a week.

・However, "Work, but don't commute!" mode adopted by many companies is expected to stay, and transformation of office configurations to conform to "reformed working style" will be accelerated. Specifically, hot-desking and enhancements in information network and security are on the menu. As digital transformation of an online systems (i.e. reduction of documents and digitization) makes headway, storage space will be eliminated, and reconfiguration of office space, including downsizing, is expected to follow.

・In case of owners and managers of large-scale S-class buildings located near major stations, it will be necessary to adopt a flexible leasing policy targeting users other than large corporations by partitioning out a floor plate and taking advantage of their good accessibility.

Hospitality

A new breed of hotels specializing in various purposes of use are springing up, on top of ultra-luxury super expensive hotels.

■Statistics by Japan Tourism Agency and high demand from inbound tourists

・In August 2022, the total number of overnight stays was the largest since March 2020 at 47.45 million, of which 730,000 were by foreigners. Then in September, the number was 39.14 million, up 71.9% YoY. Though it is less than that of the same month 2019 by 19.7%, it can be regarded as a recovery to 80% of the level before the outbreak of COVID-19.

■Recent trends by category

・Business hotels account for roughly 47% of the overnight stays, inns about 14%, and resort and city hotels combined about 30%. Demand from business travelers, once heavily impacted by the pandemic, is on its way to recovery. The total number of overnight stays at business hotels in September 2022 was only 14.78 million, whereas it was 22.5 million in the same month 2019. So the full recovery in the number is still a long way off.

■Future market outlook

・Now that the "National Travel Support Program" has started, the number of overnight stays is expected to build up starting from October 2022. Together with an increase in inbound tourists anticipated, there are high hopes for a recovery in market conditions.

While luxury brand hotels are coming on line one after another, there are a variety of new concept hotels opening these days, such as business hotels with multilingual services, hotels to stay with a dog, cashless payment only hotels, hotels with programs for spontaneous learning and personal development, hotels specializing in co-working, and hotels serving a sumptuous breakfast buffet.

Commercial

Although sales figures are on the way to recovery helped by relaxation of restrictions to prevent COVID-19 from spreading, measures to promote a structural reform are called for immediately.

■Sales volume and status quo of shopping centers

・Existing store sales for shopping centers (overall) exceeded the previous year's results for nine months in a row, and reached approximately JPY 445.4 billion (up 12.7% YoY) in September 2022, which, however, is still less than that of the same month 2019 by 18.6%. While a market recovery in September 2022 was somewhat slow due to typhoons approaching the country every weekend, the pace of a recovery started to pick up in October as restrictions on the admission of inbound tourists were eased.

・The situation is being improved further by the motivation for foreign tourists to spend enhanced by recent devaluation of the Japanese Yen which makes shopping here a bargain.

■Future market outlook

・The total number of foreign tourists entering Japan in 2019 was 31.88 million, and the number of those from mainland China was the largest at 9.59 million, accounting for 30% of the total and contributing considerably to domestic consumption then. However, international travel is virtually impossible for many of them now because of zero-COVID policy by the Chinese government, so consumption by that group is very limited. Therefore an early recovery in the number of arrivals from mainland China is longed for.

・As far as managers of department stores and SC's are concerned, they should not be only satisfied with the return of customer traffic after the COVID-19 pandemic as an ultimate solution for the turnaround, but also realize a drastic reform is imperative now and take measures such as development of a business model without a need for carrying inventory and breakaway from management that attaches too much importance on customers physically visiting stores.

Logistics

In Tokyo metropolitan area, demand is apparently slowing down, while a large amount of new supply keeps coming on market. At the same time, a structural issue of escalating transportation cost has surfaced.

■Market condition in Tokyo metropolitan area

・Vacancy rate and effective rent for large multi-tenant logistics (LMT's) in 3Q 2022 were 5.2% (up 0.8 ppt QoQ) and JPY 4,550 per tsubo (up 0.7% QoQ) respectively. The long-lasting problem of excessive demand is going away as vacancy rate rises.

・There was a new supply of 199,000 tsubo against a new demand of 148,000 tsubo in 3Q, causing a rise in vacancy rate. Out of eight new bldg.'s, four opened with uncommitted space. The fact that most of the new bldg.'s are located in Tokyo Gaikan Expressway Area, where rent levels are relatively high, has led to an increase in vacancy rate.

・Only Tokyo Bay Area showed a decrease in vacancy rate (down 2.3 ppt QoQ), while vacancy rates in other areas such as Tokyo Gaikan Expressway Area and National Route 16 Area went up.

■Market condition in other regions in 3Q

・In Kinki region, vacancy rate was 1.7% and effective rent was JPY 4,130 per tsubo. Submarkets with tight supply and demand conditions helped push the rent level.

・In Chubu region, vacancy rate was 11.0% and effective rent was JPY 3,590 per tsubo. Manufacturing sector is driving demand here.

・In Fukuoka region, vacancy rate was 0.9%, and effective rent was JPY 3,370 per tsubo. Both new supply and absorption on a quarterly basis reached record highs.

■Future market outlook

・As far as the relation between supply and demand in regional markets is concerned, it has shifted from excess in demand to equilibrium due to a large amount of new supply. In Tokyo metropolitan area, however, supply is supposed to be slightly exceeding demand. So, properties to lease are being scrutinized more closely based upon additional criteria such as ease of personnel recruitment on top of basic location requirements such as access to expressways.

・Cargo volume has declined and freight costs have increased due to worsening state of Ukraine conflict and a steep rise in fuel costs. Space for distribution is still in heavy demand as far as large-size properties completed recently are concerned, because many of them are better suited for dealing with swelling demand from e-commerce delivery. However, measures to mitigate rising transportation costs are called for urgently.

J-Reit

J-Reit issues were bipolarized by the effect of COVID-19, and the reshuffling of portfolios ensued.

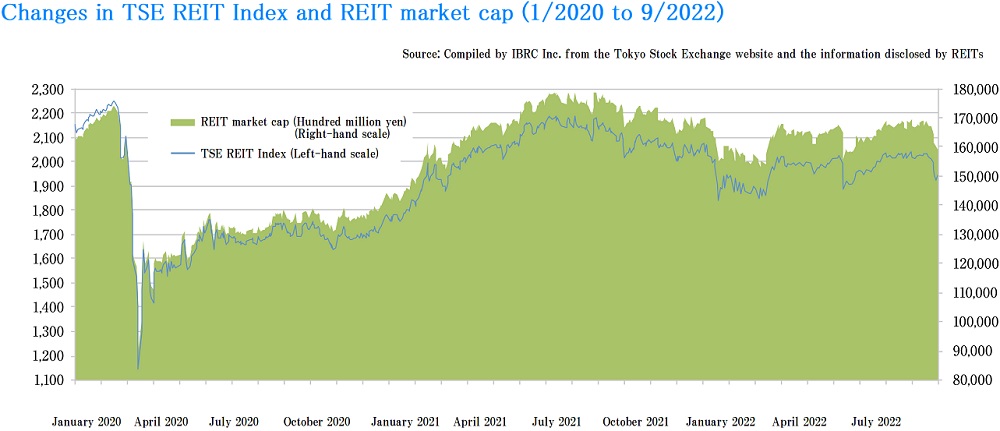

■J-Reit market trend

・As of the end of September 2022, the Tokyo Stock Exchange Reit Index closed at 1945.25, down 2.89% from the end of March 2022, and at the same time the aggregate market capitalization of J-Reit's also declined 2.86% to JPY 16.143 trillion, while AUM grew by JPY 106.7 billion to JPY 21.649.3 trillion.

Number of public offerings in 1Q and 2Q combined (April thru September) was only six, a big drop from 4Q 2021 (January thru March) when there were so many public offerings, because of sharp decline in investment unit prices starting from the beginning of the year. The pace of external growth of J-Reit's seems to be slowing down.

・Although the Tokyo Stock Exchange Reit Index at one time in June fell below 1,900 in anticipation of interest rate hikes as tight monetary policies were announced one after another in Europe and the United States to bring down inflation, the index and average dividend yield hovered around 1,950 to 2,050 and 3.5% to 3.7% respectively since then as the Bank of Japan kept monetary easing policy.

While hospitality and retail issues gained because of relaxation of the immigration restrictions, and residential issues remained stable due to steady flow of income, office and logistics issues softened.

■Status quo

・The pace of acquisitions by J-Reit's has slowed down, and dispositions picked up. Decline in rental income due to softening office leasing market is being made up for by dispositions taking advantage of an opportunity to realize capital gains earned from a strong appreciation in property values helped by an ultra-low interest rate.

・In case of comprehensive type J-Reit's, portfolio composition has been reorganized. Properties vulnerable to fluctuations in income flow and/or adverse effect of COVID-19 such as office bldg.'s, urban commercial facilities, hotels, and others are being disposed of, while properties with steady income and/or insusceptible to an adverse effect of COVID-19 such as residential bldg.'s and suburban shopping centers are being acquired instead.