Our Site uses cookies to improve your experience on our website. For more details, please read our Cookie Policy.

By closing this message or starting to navigate on this website, you agree to our use of cookies.

PROPERTY MARKET TRENDS | 3Q 2022

PROPERTY MARKET TRENDS | 3Q 2022

Office: COVID-19 caused a shift in demand.

Hospitality: Occupancy rate returned to normal for limited-service hotels, the largest segment of the market.

SC: Sales bounced up in the year-end shopping season after ease of restrictions.

Logistics: Tight market condition was alleviated by a large supply from new entrants, and tenants became more selective.

TEXT: Yoko Fujinami, ib Research & Consulting Inc.

Toru Kawana, Industrial Marketing Consultants Co., Ltd.

Residential

The market condition in Kinki region remained stable, while a market supply and contract rate shrank in Tokyo metropolitan area. However, big-ticket units in central Tokyo fared well (in either sales or leasing) helped by growing inbound demand.

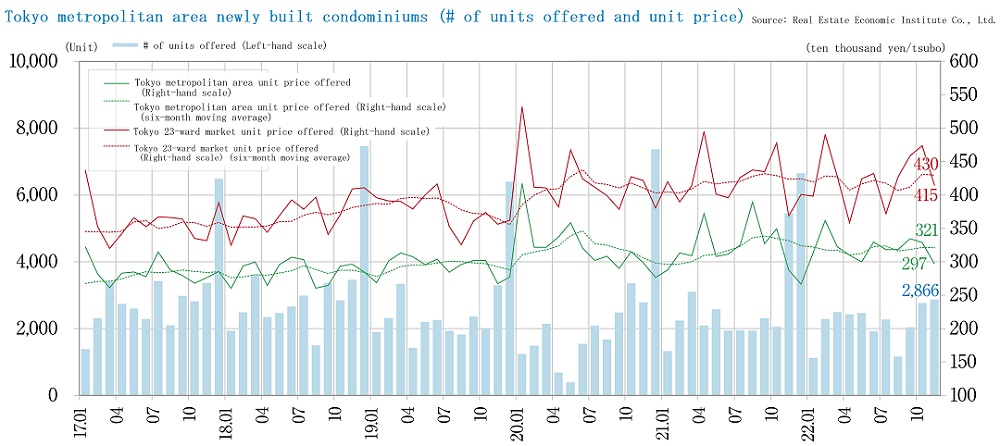

■New condo. sales in Tokyo metropolitan area

・In January 2023, there was a new supply of 710 units, and average initial sales price, floor area, and unit price were JPY 65.1 million, 65.04 sqm, and JPY 3.303 million per tsubo, respectively. The month-end inventory was 5,610 units, while contract rate in the first month of sales was 54.6%, down 20.2 ppt MoM and 3.8 ppt YoY. The drop in new supply was quite significant. Throughout 2022, an annual supply was 29,569 units, and average sales price and unit price were JPY 62.88 million (up by 0.4% YoY), JPY 3.143 million per tsubo (up by 1.6% YoY), respectively. The average price within Tokyo 23 wards stood out at JPY 82.36 million, far exceeding price levels in suburbs of Tokyo and the three neighboring prefectures.

■New condo. sales in Kinki region

・In January 2023, there was a new supply of 574 units, and average initial sales price, floor area, and unit price were JPY 47.47 million, 59.33 sqm, and JPY 2.640 million per tsubo, respectively. The month-end inventory was 3,566 units, while the contract rate in the first month of sales was 69.3%, down 5.5 ppt MoM and 8.2 ppt YoY. Throughout 2022, an annual supply was 17,858 units, and average sales price and unit price were JPY 46.35 million (up by1.6% YoY) and JPY 2.558 million per tsubo (up by 3.1% YoY), registering the 5th consecutive annual increase in sales price and 10th consecutive annual increase in unit price, respectively.

■Second-hand condo. sales in Tokyo metropolitan area

・The number of contracts made in January 2023 was only 2,581 (down by 6.5% YoY), marking the 6th consecutive month of YoY decrease. Average age of units sold was 24.06 years. Their average price and unit price both rose to JPY 42.76 million (up by 3.1% YoY) and JPY 683,100 per sqm (up by 6.4% YoY), respectively. The number of units in inventory and newly listed were 43,688 and 16,588, respectively.

・Average floor area of units sold kept shrinking YoY for 20 consecutive months, while contract price and unit price rose YoY for 32 and 33 consecutive months, respectively. Unit prices for units sold and units in inventory have been on an upward trend for a long time as new condo prices keep going up.

■Market overview

・As prices of developable land and construction materials increase significantly these days, it becomes very difficult to cut the sales price of condo. units in either Tokyo metropolitan area or Kinki region. Now that the rising construction costs spreads out from central Tokyo to other areas, where they have been suppressed so far, it will be inevitable that prices of condo. units outside central Tokyo also start to go up. Market outlook has been getting opaque since the fall of 2022, when contract rate started to slowed down slightly in Tokyo metropolitan area.

・The rental housing market remains very active as inbound demand returns and there is a shortage of high-end units available for foreigners. Both sales prices in secondary market and rents in rental housing market are increasing as prices for new condo. units climb. However, it seems they have risen too much, especially in central Tokyo.

Data: As for new supply = Real Estate Economic Institute Co., Ltd., and as for secondary market = Real Estate Information Network for East Japan

Data: As for new supply = Real Estate Economic Institute Co., Ltd., and as for secondary market = Real Estate Information Network for East Japan

Office

Vacancy rate seemed to pass a peak. However, absorption of new space slowed down and rent levels kept declining. Demand for office space adaptable to tenant's needs is expanding, as a growing number of companies advance work style reform.

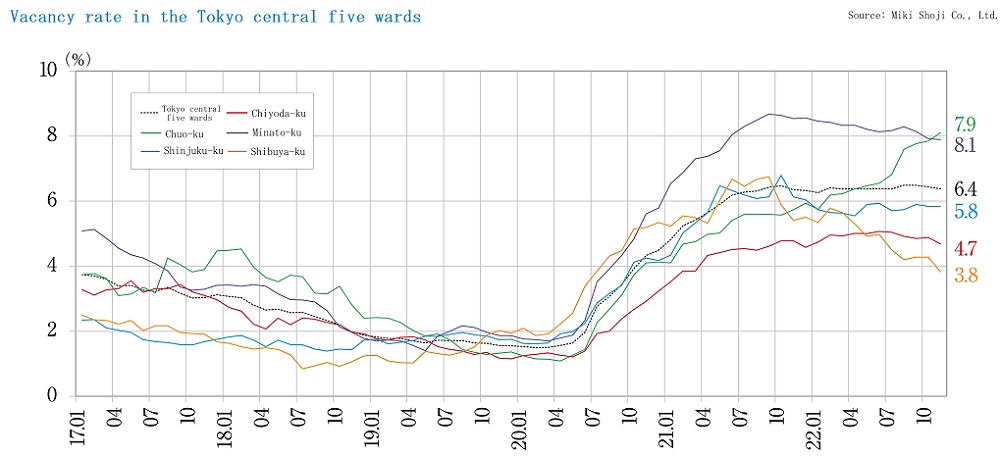

■Large-scale office buildings in Tokyo CBD (Central 5 Wards)

・As of January 2023, vacancy rate came down 0.21 ppt from the previous month to 6.26%. It has been hovering around low 6% since June 2021.

・Average rent is on a downward trend still. As of January 2023, it was JPY 20,026 per tsubo, down JPY 33 MoM and JPY 482 YoY.

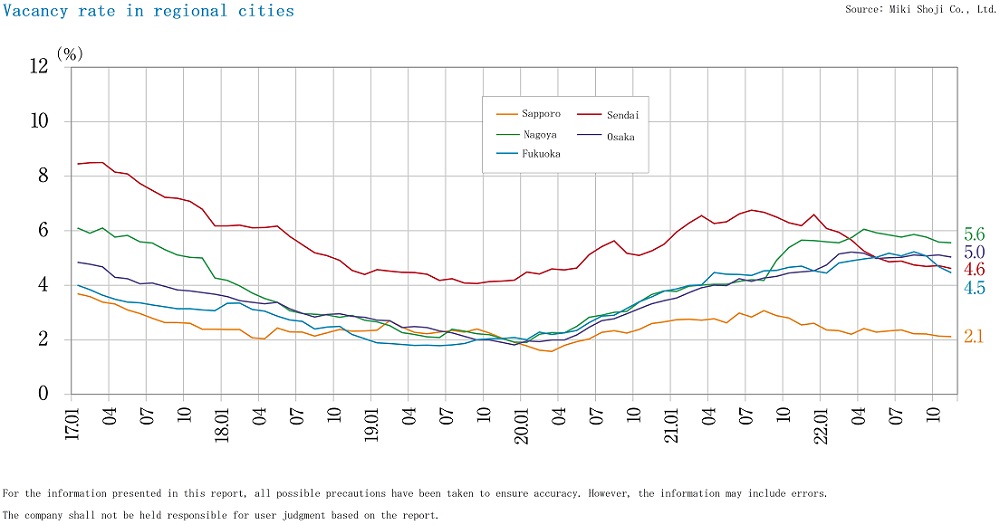

■Vacancy rates, and movements in average rents in major regional cities / January 2023

・Sapporo: Vacancy @2.23% up 0.09 ppt MoM. Average rent up JPY 19 MoM (Vacancy rate levelled off, while average rent improved.)

・Sendai: Vacancy @4.72%, up 0.04 ppt MoM. Average rent up JPY 5 MoM. (Vacancy rate and average rent both levelled off.)

・Yokohama: Vacancy @6.33%, up 1.52 ppt MoM. Average rent down JPY 17 MoM. (Vacancy rate and average rent both worsened.)

・Nagoya: Vacancy @5.52%, up 0.07 ppt MoM. Average rent up JPY 33 MoM. (Vacancy rate levelled off and average rent improved)

・Osaka: Vacancy @4.97%, down 0.09 ppt MoM. Average rent down JPY 11 MoM. (Vacancy rate levelled off and average rent worsened.)

・Fukuoka: Vacancy @4.50%, up 0.13 ppt MoM. Average rent up JPY 8 MoM. (Vacancy rate rose a little while average rent improved slightly.)

Overall, vacancy rates have hit the bottom, and average rents are on an upward trend.

■Status quo and future market outlook

・Although office attendance rate has been resumed since the fall of 2022, vacancy rates are apparently rising in such markets as Nagoya and Yokohama due to an increase in the supply of new buildings, of which large ones especially tend to be avoided by tenants.

・The reason why new large office buildings are shunned may be changing criterion on the part of tenants after experiencing new work style such as work from home. Rather than prominence and status represented by new large office buildings in CBD where rents are exceedingly higher than small-to-medium-sized buildings, companies now attach a great deal of importance to such requirements as procurement and effective utilization of the office space employees need.

・The key to ensure high occupancy rate at new buildings is how to bridge the gap between high operating costs and market rents which are on a long-term downward trend.

Hospitality

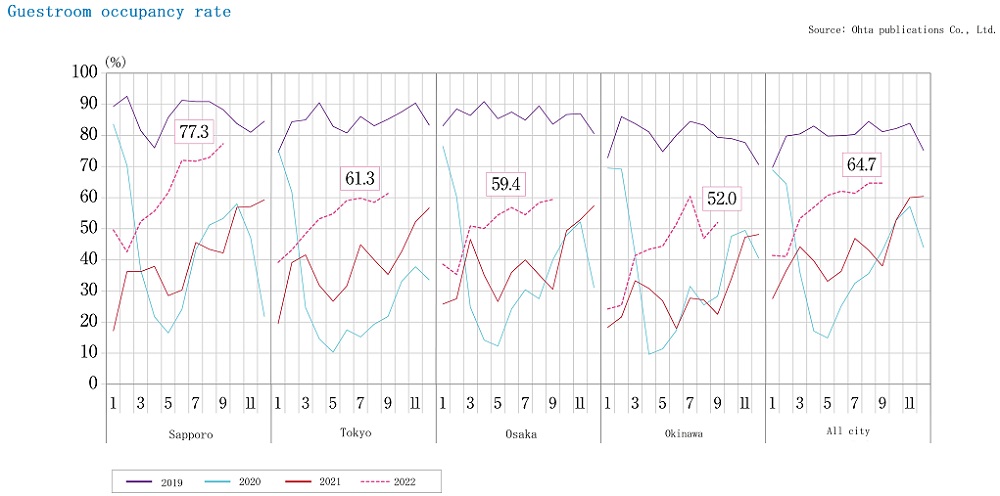

Recovery in number of overnight stays and inbound tourists has been accelerated, while occupancy rate of limited-service hotels has been improving despite its large share of the lodging market.

■Recovery in the number of overnight stays by domestic travelers is evident.

・In January 2023, the total number of overnight stays in Japan was 39.31 million (up by 38% YoY from 28.44 million). Foreigners accounted for 6.22 million nights (up by 2,730% YoY from 220,000 nights). Though the number is still a far cry from the pre-COVID level, 100 million nights per year by foreigners may be attainable judging from the pace of over 6 million in the month of January, 2023 alone.

■Recent trends by category

・So-called business hotels with limited service account for roughly 48% of the overnight stays, inns about 13%, and resort and city hotels combined about 32%. Now that the aggregate number of overnight stays at limited-service hotels in January 2023 was 19.03 million vis-a-vis 19.41 million in the same month 2019 just before COVID-19 breakout, it can be said that this market segment has almost returned to normal before COVID-19.

■Future market outlook

・Among inbound travelers, many were from South Korea (1.43 million nights) and Taiwan (850,000 nights). As far as travelers from China, who used to make up the overwhelming majority before COVID-19, were concerned, the count was mere 320,000 nights. Recovery in the number of Chinese tourists is crucial going forward.

・Hotel managers are now attempting to meet various needs of guests. For example, comic book rental service introduced at Sunshine City Prince Hotel in Ikebukuro, the holy land of cartoon films, opening of a new concept facility, 'Sauna by the Swimming Pool,' at Tokyo Dome Hotel in Suidobashi, an unmanned check-in system adopted at a hotel in Iwaki City, Fukushima Prefecture, by Sendai Terminal Building, a JR East Japan company, and the opening of Hoshino Resort's 'Risonare Osaka' within Hyatt Regency Osaka.

Commercial

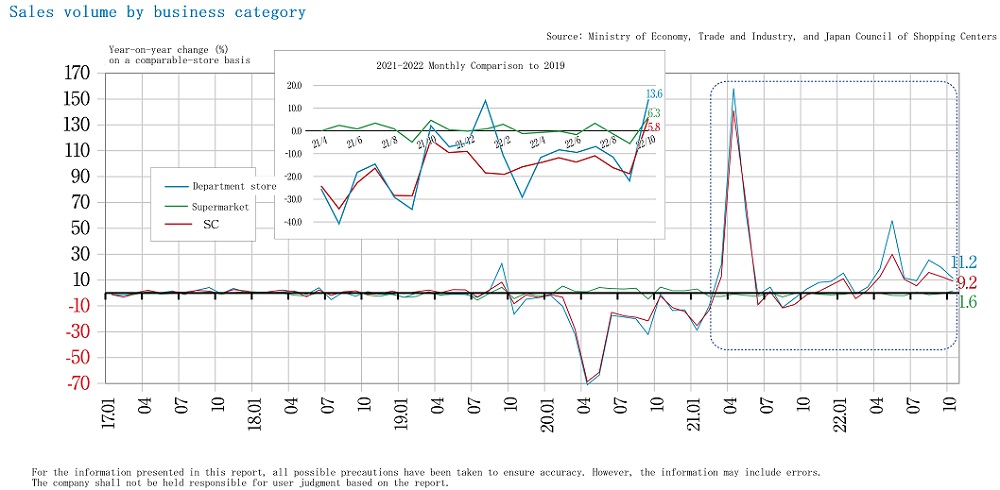

YoY increase in monthly sales lasted 11 months in a row, and annual sales grew from the previous year by 8.6%. Business conditions have been sound as economy recovers from adversity of COVID-19 and consumption by inbound tourists returns.

■Sales volume and status quo of shopping centers

・Existing store sales for shopping centers (overall) were approximately JPY 642 billion (up by 4.9% YoY) in December 2022. Especially those within city centers grew by 8.4% YoY, as a growing number of shoppers come back during Christmas and year-end shopping season after behavior restrictions were lifted for the first time in three years.

・In terms of region, sales in Hokkaido were boosted significantly by 20.3% YoY, mainly by rebound in the number of homecoming guests, domestic and inbound tourists more noticeable than other regions.

■Future market outlook

・There were a number of retail facilities temporarily shut down, such as LaLaport Tokyo Bay, Mitsui Outlet Park Marinepia Kobe, Tokyu Department Store Main Store, and Odakyu Department Store Shinjuku Main Building. There were also closures of PARCO in Matsumoto and Tsudanuma. Some of those facilities either temporarily shut down or permanently closed are to be reconstructed due to obsolescence, and others are to be reemerged as shopping centers.

・In November 2022, opening of the world's first brick-and-mortar shop of Chinese SHEIN made a great stir. The shop carries nothing but samples, and goods can only be bought on-line. This combination of a showroom and e-commerce has demonstrated a promising breakthrough for department stores and shopping centers.

Logistics

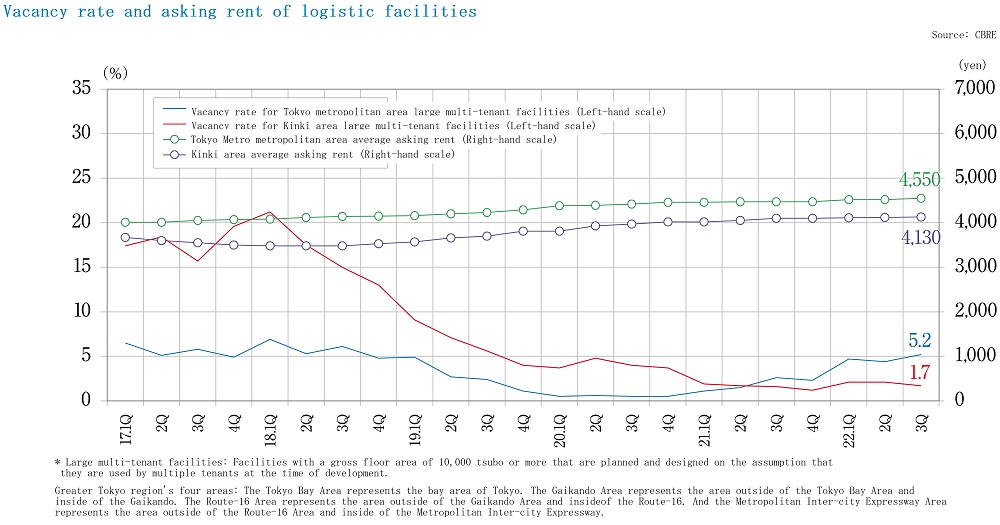

As a supply of space by new entrants has increased, occupancy rate at the opening of new buildings has declined. Tenants are getting more selective about a property to lease, and there is a concern for rising vacancy rate.

■Market condition in Tokyo metropolitan area

・Vacancy rate and effective rent for large multi-tenant logistics (LMT's) in 4Q 2022 were 5.6% (up 0.4 ppt QoQ) and JPY 4,540 per tsubo (down by 0.2% QoQ) respectively. On top of a large supply of space as much as 199,000 tsubo in 3Q, there was another new supply of 130,000 tsubo in 4Q, whereas absorption remained low at 103,000 tsubo. As a result, vacancy rate went up while all five new buildings missed full occupancy at the time of opening.

・4Q vacancy rates were 5.3% in the Tokyo Bay Area (down 5.4 ppt QoQ), 1.3% in Tokyo Gaikan Expressway Area (down 3.0 ppt QoQ), 6.1% in National Route 16 Area (up 0.3 ppt QoQ), and 7.7% in Metropolitan Inter-City Expressway Area (up 3.8 ppt QoQ). Effective rents were JPY 7,580 per tsubo (up) in Tokyo Bay Area, JPY 5,170 per tsubo (unchanged) in Tokyo Gaikan Expressway Area, JPY 4,530 per tsubo (up) in National Route 16 Area, and JPY 3,620 per tsubo (unchanged) in Metropolitan Inter-City Expressway Area, respectively. Due to limited new supply, rents went up in Tokyo Bay Area, and National Route 16 Area.

■Market condition in other regions in 4Q

・In Kinki region, vacancy rate was 1.7% and effective rent was JPY 4,130 per tsubo. It is taking a long time for some buildings to be leased up, and rents are softening.

・In Chubu region, vacancy rate was 8.5% and effective rent was JPY 3,600 per tsubo. Absorption in 2022 hit the record of 142,000 tsubo.

・In Fukuoka region, vacancy rate was 1.0%, and effective rent was JPY 3,360 per tsubo. Potential demand is building up in conjunction with a new semiconductor plant in Kumamoto Prefecture.

■Future market outlook

・As a record amount of new annual supply as much as 910,000 tsubo is coming on line in Tokyo metropolitan area in 2023, vacancy rate is destined to rise while condition of oversupply lingers .

・New supply is also increasing in other areas, because buildings by developers who have newly entered in the past few years are being completed. Demand is still solid overall, but tenants are becoming selective about which property to lease. Development of competitive products will be called for as the market shifts from excess demand to excess supply.

J-Reit

In logistics sector, large-scale property acquisitions are attracting attention, and in office sector, there are concerns for deterioration of income due to soaring costs. Movements toward merger and restructuring of investment corporations are brisk.

■J-Reit market trend

・As of the end of December 2022, the Tokyo Stock Exchange Reit Index closed at 1,894.06, down by 2.63% from the end of September 2022, and at the same time the aggregate market capitalization of J-Reit's also declined by 1.97% to JPY 15.837 trillion. Despite heightened expectations for economic recovery due to relaxation of measures against COVID-19, J-Reit performance was down in 4Q (October thru December) from 3Q (July thru September) as central banks of the US and EU kept raising interest rates and the BoJ made a surprise announcement that it would revise monetary easing policy in December. On the other hand, average dividend yield for all J-Reit's rose to 3. 91% as of the end of December because of softening investment unit prices.

・The aggregate AUM of J-Reit's grew by JPY 238.0 billion from the end of September to JPY 21.887.4 trillion as of the end of December. Such growth in AUM was supported by a series of PO's. There were PO's made public as many as 10 in 4Q, while there were only 4 in 3Q. Particularly, external growth of logistics issues was advanced by acquisition of large-scale logistics assets.

■Status quo

・Because of sluggish leasing market on top of rising electricity bill, operating income for office issues has kept dwindling. Further slack in supply-demand balance is anticipated for 2023, as large-scale office buildings come on line in Tokyo CBD. Managers of office J-Reit's are, therefore, reconfiguring portfolios to maintain a certain level of NOI yields and realizing built-in gains by disposing assets facing a danger of falling earnings at the same time.

・Performance of hospitality issues has improved significantly. As hotel occupancy rate has bounced back since October with a help from the national travel subsidy program and relaxation of immigration restrictions, hotel operators can do without fixed-rent abatement measures at long last.

・There are vigorous moves toward replacement of sponsors and M&A's. For example, there was a change of the main sponsor for Nippon Reit Investment Corporation, which manages office and residential assts, from Sojitz Corporation to SBI Financial Services. Also in March, Mori Trust Sogo Reit Inc. and Mori Trust Hotel Reit Inc., both of which are sponsored by Mori Trust Co., Ltd., merged to form Mori Trust Reit Inc., and became a comprehensive Reit with offices and hotels as its core assets.