Our Site uses cookies to improve your experience on our website. For more details, please read our Cookie Policy.

By closing this message or starting to navigate on this website, you agree to our use of cookies.

Quarterly Report for Premium Condominiums in Tokyo | 4Q FY 2022

Dear Valued Customers:

Thank you very much for your inquiry and business. We at International Dept. of Mitsui Fudosan Realty would like to share with you the trend in the high-end condominium market of central Tokyo here.

【Chart 1】

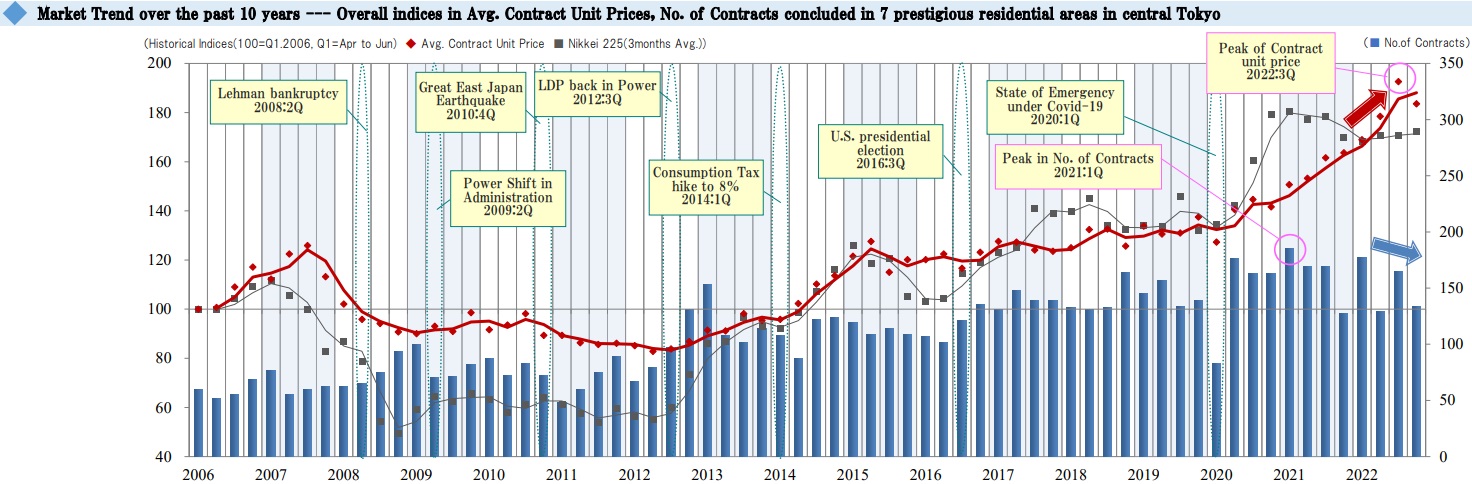

This graph shows an index of changes in average contract price per tsubo (*Notes: 1. Indexation using average contract price per tsubo in 1Q / FY 2006 as 100. 2. Tsubo is a Japanese traditional unit of area equal to approx. 3.31sqm.) and the number of contracts concluded every quarter for premium condo. units in 7 prestigious areas of central Tokyo.

Major economic events and Nikkei Stock Average are also shown for reference. The bar graph represents the number of contracts concluded each quarter. The red-line shows a movement in the index of average contract price per tsubo, while the gray-line shows one in the Nikkei stock average.

In the 4th quarter reviewed here (Jan. 1 thru March 31, 2023 based on Japanese fiscal year), the index of average contract price per tsubo for premium condominium units sold declined for the first time after roughly two years by 10.4 points QoQ to 183.6, which was, however, still the second highest level after the previous quarter’s all-time high recorded since the beginning of data collection. The number of contracts concluded in the same quarter decreased by 33 QoQ to 134.

【Chart 2】

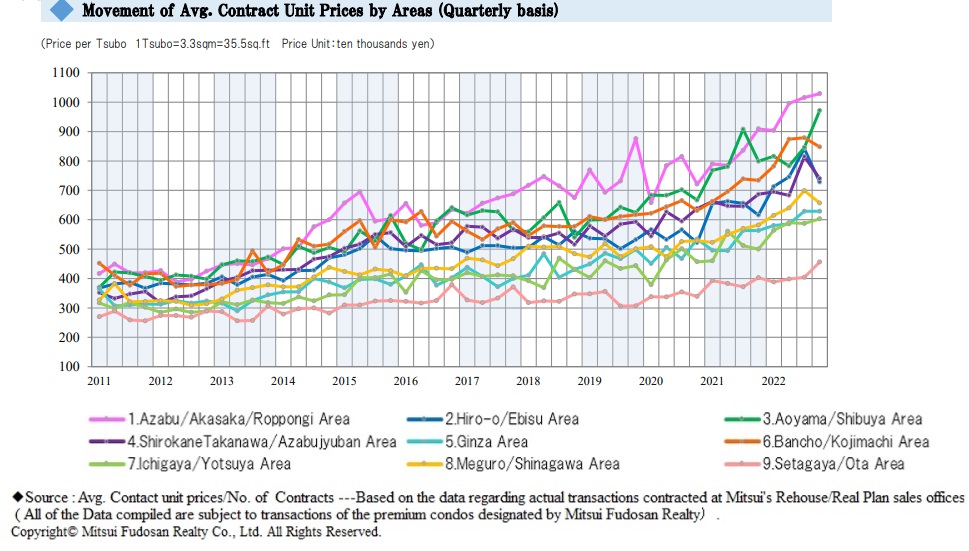

The chart above shows average contract price per tsubo. In this quarter, average contract price per tsubo went up to record historical highs since the beginning of data collection in the following four areas “Azabu / Akasaka / Roppongi Area,” "Aoyama / Shibuya Area," "Ichigaya / Yotsuya Area," and “Setagaya / Ohta Area,” while it contracted in another four areas of "Hiro-o / Ebisu Area," “Shirogane Takanawa / Azabu-jyuban Area,” "Bancho / Kojimachi Area," and "Meguro / Shinagawa Area." There was little change in "Ginza Area." Especially in case of “Azabu / Akasaka / Roppongi Area” and “Setagaya / Ohta Area,” this was the third and second consecutive time to hit the record high, respectively.

【Chart 3】

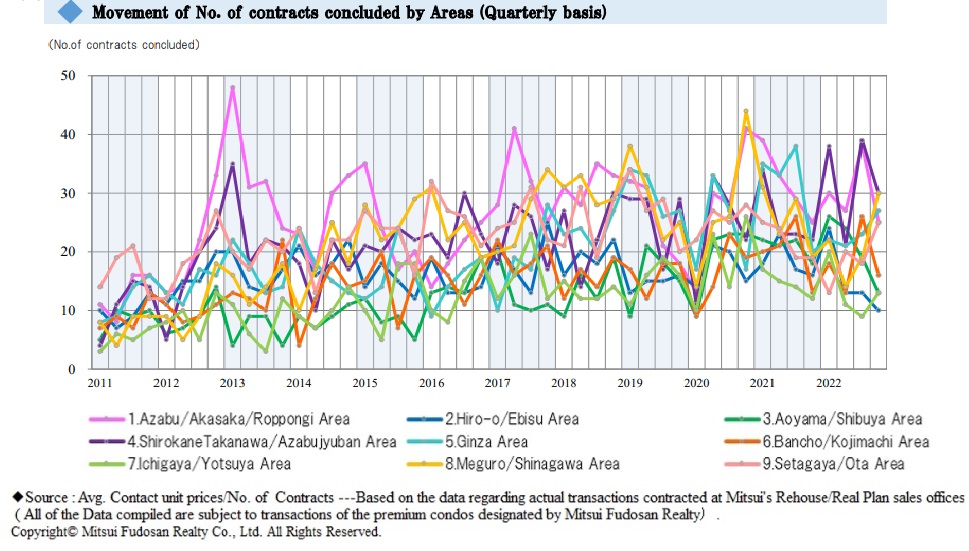

Now let's look at the chart above for number of contracts concluded. While the number declined in five areas, i.e. “Azabu / Akasaka / Roppongi Area,” “Hiro-o / Ebisu Area,” "Aoyama / Shibuya Area," “Shirogane Takanawa / Azabu-jyuban Area,” and "Bancho / Kojimachi Area," it went up in four other areas of “Ginza Area,” “Ichigaya / Yotsuya Area,” “Meguro / Shinagawa Area,” and “Setagaya / Ohta Area.” Both the decrease in “Azabu / Akasaka / Roppongi Area” and increase in “Meguro / Shinagawa Area” were as significant as eleven.

In summary, the index of average contract price per tsubo took a dip for the first time after about two years of upward swing, though still remained in the second highest level below the record high. The downward shift may be attributed largely to the decrease in the number of contracts concluded this quarter in high price per tsubo areas such as Minato ward.

By the way, the inventory in the market as of the end of this quarter was 594 for all the nine areas combined, showing a as significant as 20%+ increase from 494 in the previous quarter (or 485 a year earlier). It will be worthwhile to note how such a large inventory will affect the number of contracts and average price per tsubo in the ensuing quarters.

It will be prudent to keep closely watching impact from large-scale developments and inbound demand, on top of the economic and financial situations.

We hope this is helpful and are looking forward to another opportunity to serve you. Thank you and best regards,

International Dept. Mitsui Fudosan Realty Co., Ltd.

E-mail : tokyoproperty@mf-realty.jp

Phone : +81-3-6758-4019

Toll free (from Japan): 0120-599-321

Office Hour: 10:00 am – 6:00pm (Japan Time)

Office Closed: Saturdays, Sundays and National holidays