Our Site uses cookies to improve your experience on our website. For more details, please read our Cookie Policy.

By closing this message or starting to navigate on this website, you agree to our use of cookies.

This page is translated using machine translation. Please note that the content may not be 100% accurate.

PROPERTY MARKET TRENDS | 1Q 2023

PROPERTY MARKET TRENDS | 1Q 2023

Office & Logistics: Softening due to oversupply. Demand for office has shrunk as more people work from home. Too much hype for e-commerce has led to overbuilding logistics.

Hotel & Retail: Thriving as a flow of people comes back after the pandemic of COVID-19.

Residential: Condo. price has risen due to a decline in supply. Generally brisk market for both new & second-hand condo. units and rental apartments.

TEXT: Yoko Fujinami, ib Research & Consulting Inc.

Toru Kawana, Industrial Marketing Consultants Co., Ltd.

Residential

While the sizes of both Tokyo and Kinki metropolitan markets have shrunk, contract rates have been stable around 60 to 70%.

Market prices for both new and second-hand condo. units and rents for rental apartments are expected to keep going up.

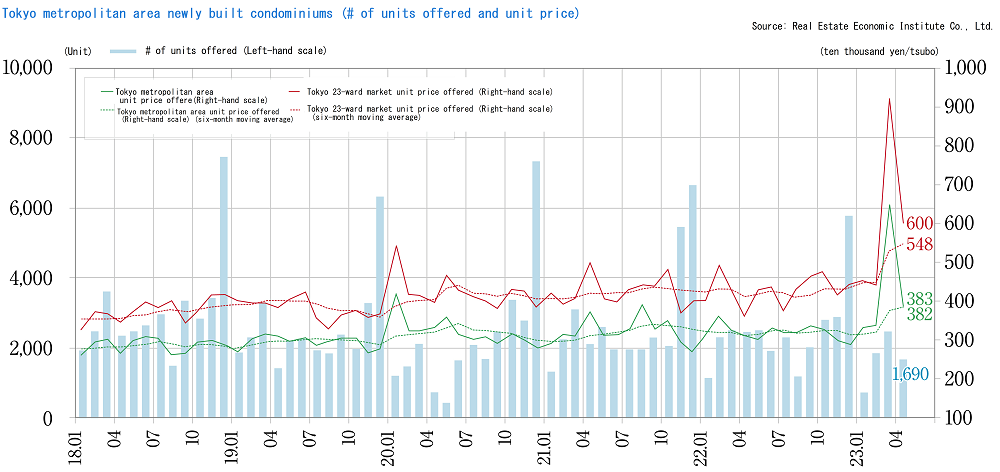

■New condo. sales in Tokyo metropolitan area

・In May 2023, there was a new supply of 1,936 units, and average initial sales price, floor area and unit price were JPY 80.68 million, 66.87 sqm and JPY 3.981 million per tsubo, respectively. The month-end inventory was 4,936 units, while contract rate in the first month of sales was 74.3%, up 0.6 ppt MoM and 4.1 ppt YoY. Average initial sales price and unit price in Tokyo 23 wards were exceedingly higher than those of suburban Tokyo and neighboring 3 prefectures at JPY 114.75 million and JPY 5.782 million per tsubo, respectively.

■New condo. sales in Kinki region

・In May 2023, there was a new supply of 1,024, and average initial sales price, floor area, and unit price were JPY 50.05 million, 62.66 sqm, and JPY 2.636 million per tsubo, respectively. The month-end inventory was 3,405, while contract rate in the first month of sales was 61.0%, down 6.8 ppt MoM and 11. 0 ppt YoY. Unit prices by city were JPY 3.102 million per tsubo in Osaka and JPY 2.749 million per tsubo in Kobe. Sales in Osaka were relatively good, though supply was limited.

■Second-hand condo. sales in Tokyo metropolitan area

・The number of contracts made in May 2023 was 2,737, down 4.9% YoY, and average age of units sold was 23.50 years. Although the number of contracts decreased, their average price and unit price both rose to JPY 45.69 million (up 9.5% YoY) and JPY 709.5 K per sqm (up 8.1% YoY) respectively, recording the 37th consecutive month of increases. Both the number of units in inventory and newly listed increased to 45,779 (up 23.6% YoY) and 15,601 units (up 15.3% YoY). The decline in number of contracts must be a result of deviation of market price from buyer's budget. As an inventory has been growing, the secondary market here may soften slightly going forward.

■Market overview

・As prices of developable land and construction materials increase significantly these days, it becomes very difficult to cut the sales price of condo. units in either Tokyo metropolitan area or Kinki region. Both market price for second-hand condo. units and rent for apartments are rising along with the price increase of new condo. units. Since contract rate is pretty high, prices and rents will continue to rise further.

・As far as the rental market is concerned, it remains brisk stimulated by inbound demand and there is a shortage in number of high-end units available for foreigners. Especially the rental market in Tokyo has been quite strong supported by solid demand, and the market rent there has risen eight months in a row to JPY 13,322.1 per tsubo.

Data: As for new supply = Real Estate Economic Institute Co., Ltd., and as for secondary market = Real Estate Information Network for East Japan

Office

Vacancy rate of new buildings stayed high, although there was a lull in an upswing of the rate overall.

Demand for a pleasant working environment adaptable to new work style is swelling.

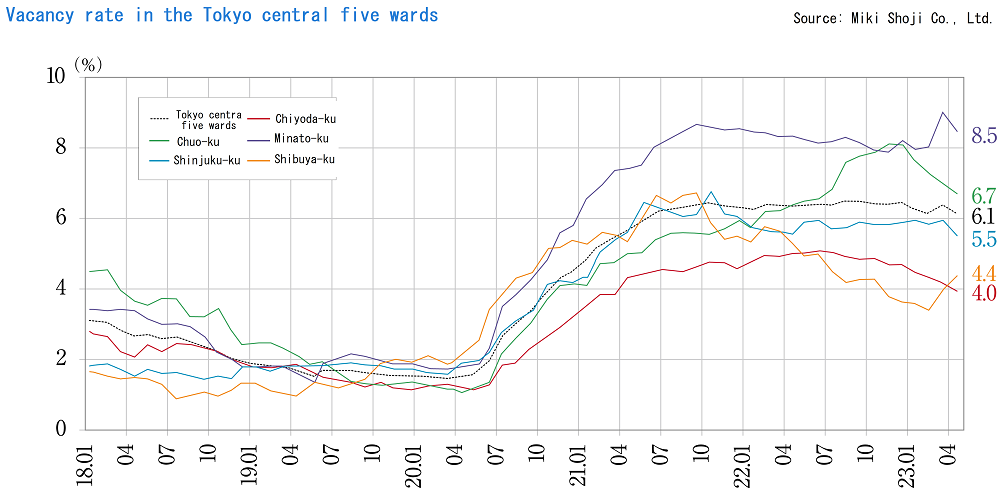

■Large-scale office buildings in Tokyo CBD (Central 5 Wards)

・As of May 2023, vacancy rate rose slightly by 0.05 ppt MoM to 6.16%. It has been hovering around low 6% since June 2021.

・Average rent is on a downward trend still. As of May 2023, it was JPY 19,877 per tsubo, down JPY 19 MoM and JPY 442 YoY.

・It has been taking time to fill up new buildings, for which vacancy rate has remained high since June 2022. For example, it was 27.46% in April and 27.61% in May for new buildings only.

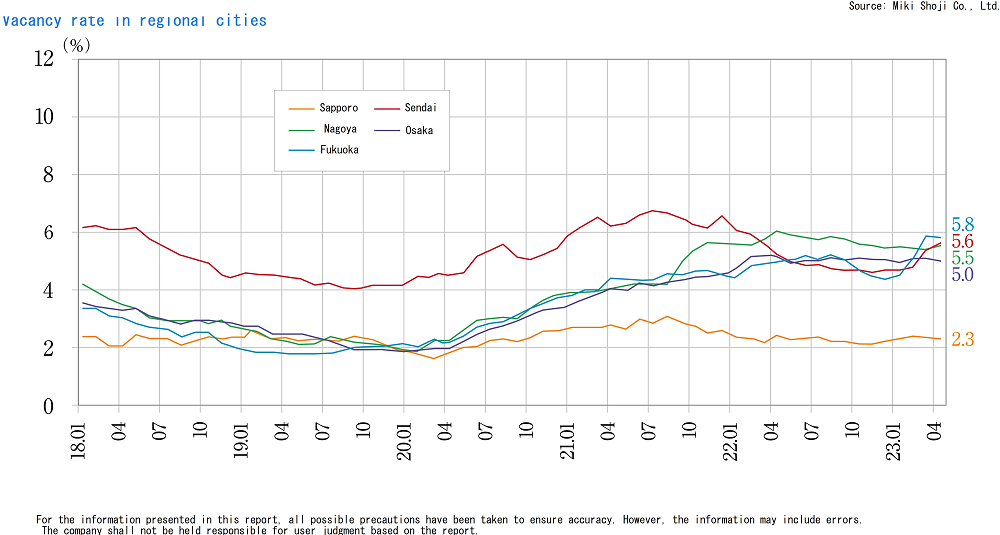

■Vacancy rates, and movements in average rents in major regional cities / May 2023

・ Sapporo: Vacancy @2.30% down 0.02 ppt MoM. Average rent up JPY 85 MoM. (Vacancy rate levelled off, while average rent improved.)

・Sendai: Vacancy @5.79% up 0.15 ppt MoM. Average rent up JPY 6 MoM. (Vacancy rate rose, while average rent changed little.)

・Yokohama: Vacancy @ 6.67% down 0.06 ppt MoM. Average rent up JPY 17 MoM. (Vacancy rate changed little, while average rent improved slightly.)

・Nagoya: Vacancy @ 5.44% down 0.10 ppt MoM. Average rent up JPY 18 MoM. (Vacancy rate improved, while average rent improved slightly.)

・Osaka: Vacancy @ 4.92% down 0.11 ppt MoM. Average rent up JPY 8 MoM. (Vacancy rate improved, while average changed little.)

・Fukuoka: Vacancy @ 5.75% down 0.06 ppt MoM. Average rent down JPY 12 MoM. (Vacancy rate changed little, while average rent worsened slightly.) Vacancy rates are either levelling off or improving in most cities, while average rent levels are on an upward trend except for Fukuoka.

■Status quo and future market outlook

・Although office attendance rate has risen as COVID-19 has declined in influence, new work styles such as work from home and remote work have become firmly established. Diversification of working styles gives rise to various changes in office space configuration. Now there is a growing need for securing a space for remote conferencing, providing a semi-private environment for individuals to do online meetings, ensuring spaces for hybrid workers, and reinforcing security. In the future, designing an office space pleasant for workers will take on increasing importance in Japan, where the workforce shrinks due to a declining birthrate.

・Criteria in selecting an office space are shifting from location, proximity to station, scale of a bldg., size of a floor plate, new (or relatively new) construction, and management quality before the COVID-19 to features making an office environment pleasant to workers. New ideas and plans to transform a "place to just work" to a "place where workers creatively perform " will lead to a higher assessment of an office space.

Hospitality

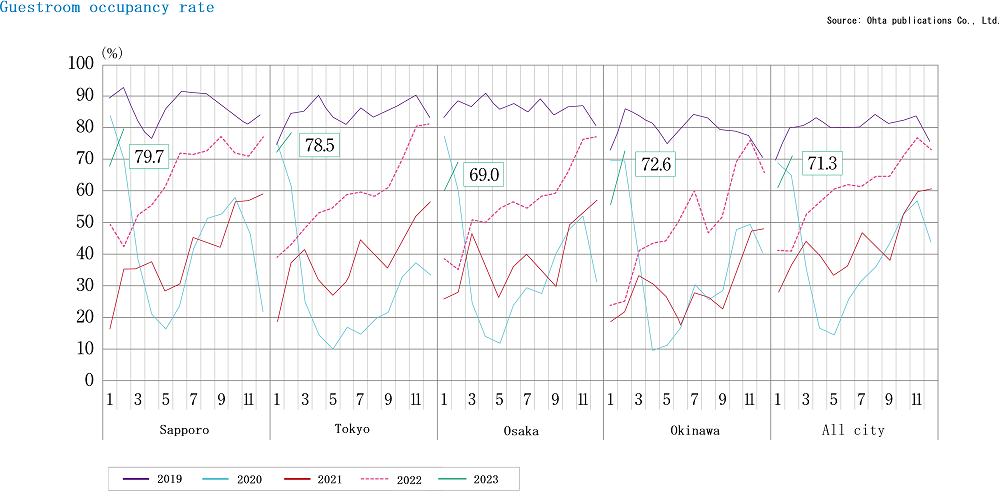

Number of overnight stays including inbound tourists has recovered to the pre-COVID levels.

Accommodation plans in collaboration with other industries are driving the hospitality market.

■Recovery in the number of overnight stays by the Japanese tourists has become remarkable.

・In March 2023, the total number of overnight stays in Japan was 50.678 million (up by 52.7% YoY from 33.184 million). Foreigners accounted for 7.55 million nights (up by 2,220% YoY from 330,000 nights). The number was getting close to the pre-COVID record of 9.52 million (in March, 2019). An increase in the number of the Japanese travelers (by 7.92 million MoM from February to March) contributed significantly to the strong market on top of the recovery in inbound demand.

■Recent trends by category

・Overnight stays and occupancy rates for each category are as follows. So-called business hotel: 23.97 million nights (up 19% MoM) and 69.5%. Inn: 7.05 million nights (up 35% MoM) and 38.2%. Resort hotel: 6.92 million nights (up 24% MoM) and 54.0%. City hotel: 8.78 million nights (up 20% MoM) and 70.9%.

Business hotels, which account for 48% of the whole market, has still performed well, with the good occupancy rate and number of stays surpassing the pre-COVID record of 23.1 million (in March, 2019).

■Future market outlook

・ Among inbound travelers, the most came from the U.S.A. followed by South Korea and Taiwan in March. And the number of travelers from those three countries combined was 2.566 million, whereas travelers from China, Taiwan, and South Korea combined before the breakout of COVID-19 (March, 2019) ran as high as 4.226 million. Inbound market can be deemed as fully recovered, if tourists from China come back.

・The hospitality industry was negatively impacted by a sudden drop in occupancy rate due to COVID-19. Now such new movements as to adopt "Supporting my fave" theme into accommodation packages have been well received. For example, "IKEPRI 25" plan at Sunshine City Prince Hotel, and packages at Excel Hotel Tokyu and Hotel New Otani in collaboration with anime production companies, are aimed at boosting occupancy by offering high added value products in accordance with guests' hobbies and diversions.

Commercial

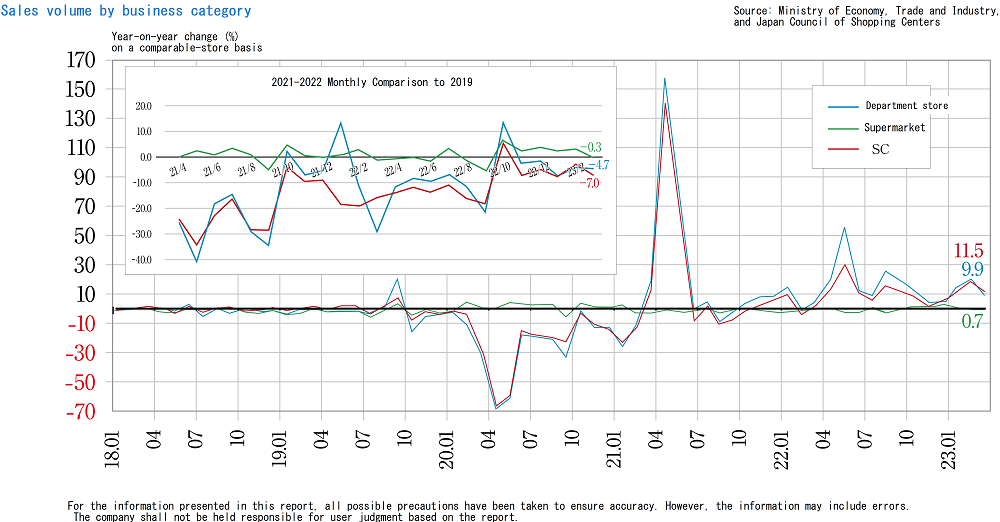

SC sales were robust exceeding JPY 500 billion in April, thanks to easing of behavioral restrictions and recovery in inbound demand. Re-examination of a product line has been undertaken at GMS, a driving force of domestic consumption, and reinforcement of the food department has been under way.

■Sales volume and status quo of shopping centers

・Existing store sales for shopping centers (overall) were approximately JPY 522.46 billion (up 10.4% YoY) in April 2023. Growth was driven by such factors as increase in sales by revenge spending and in clothings, shoes, and bags in preparation for the start of an academic / fiscal year, and recovery of inbound demand on top of relaxation of a face covering policy, the national travel assistance program, and spring break.

■Future market outlook

・General merchandise stores (GMS's) such as Ito Yokado and AEON are attracting tenants at a good pace while scaling back their clothing dept. They expect an increase in foot traffic by providing more opportunities for visitors to not only shop their own private brand (PB) merchandises but also to compare them with tenants' PB and national brand products.

・ A pattern of domestic consumer spending is shifting to goal-oriented one as there are increasingly diversified store formats to choose from, and the dominance by GMS is being eroded. For high palatability items such as clothing, marketing strategies to capture the minds of the people are required.

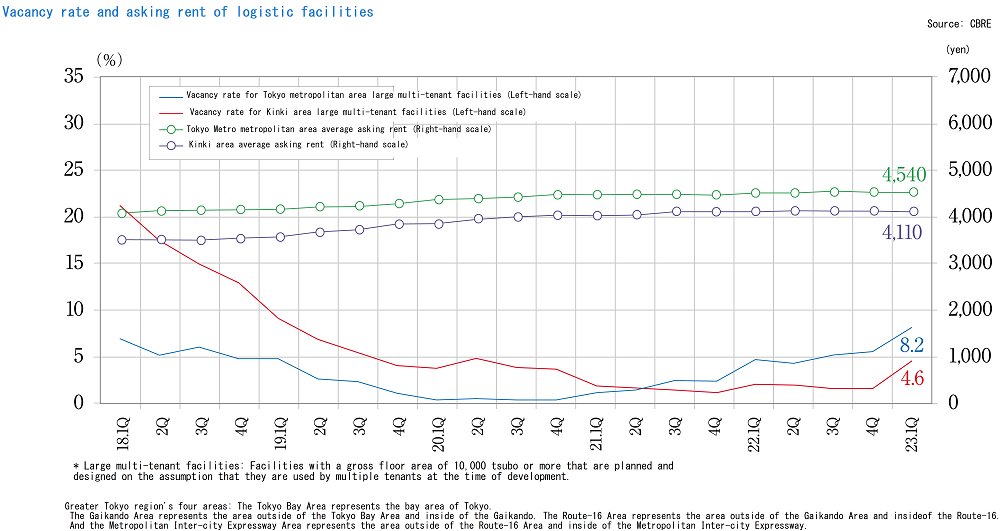

Logistics

A significant rise in vacancy rates for newly-supplied properties was observed in each area, as high as over 10% in the suburbs of Tokyo metropolitan area.

The market will stay soft as an excessive supply is expected going forward.

■Market condition in Tokyo metropolitan area

・Vacancy rate for large multi-tenant logistics (LMT's) in 1Q 2023 was 8.2% (up 5.6 ppt QoQ) . There was a newly completed space of 324,000 tsubo, a quarterly record, but an occupancy rate at the time of opening was low, causing an uptick in vacancy. Despite new absorption of 154,000 tsubo, which is higher than normal, the market is clearly over-supplied.

・1Q vacancy rates were 4.7% in Tokyo Bay Area (down 0.6 ppt QoQ), 0.5% in Tokyo Gaikan Expressway Area (down 0.8 ppt QoQ), 10.1% in National Route 16 Area (up 4.0 ppt QoQ), and 10.7% in Metropolitan Inter-City Expressway Area (up 3.0 ppt QoQ), respectively. Rent increases have eased, while upsurge in vacancy rates stands out in outlying areas.

■Market condition in other regions in 1Q

・In Kinki region, vacancy rate was 4.6% and effective rent was JPY 4,110 per tsubo. There was a large supply of 121,000 tsubo, causing vacancy rate to climb.

・In Chubu region, vacancy rate was 6.2% and effective rent was JPY 3,590 per tsubo. Vacancy rate came down due to absorption in existing properties even though some new buildings opened with spaces untaken.

・In Fukuoka region, vacancy rate was 1.8%, and effective rent was JPY 3,380 per tsubo. Potential demand keeps building up in conjunction with a new semiconductor plant in Kumamoto Prefecture.

■Future market outlook

・New supplies of space projected in 2Q and 3Q, 2023, combined are approximately 460,000 tsubo in Tokyo metropolitan area, 40,000 tsubo in Kinki region, 130,000 tsubo in Chubu region, and 40,000 tsubo in Fukuoka region, respectively. The supplies in Tokyo metropolitan area and Chubu region are expected to substantially exceed average demand for the period. The market is thought to be relatively over-supplied as there are many buildings that are completed with certain space unleased.

・Reinforcement of supply chain is called for in response to the 2024 problem, when truck drivers' working hours are to be strictly regulated to result in a shortage of truck drivers. Accordingly demand for logistics space is expected to spread out to regional cities such as Sendai and Hiroshima.

J-Reit

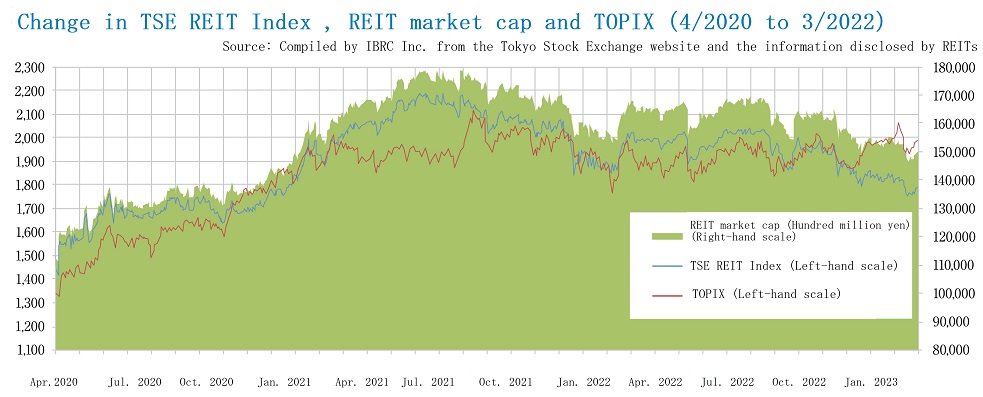

As of the end of FY 2022, yields rose while both the Tokyo Stock Exchange Reit Index and aggregate market capitalization fell.

Mergers among J-Reit's happened one after another to convert to a comprehensive type.

■J-Reit market trend

・As of the end of March 2023, the Tokyo Stock Exchange Reit Index (w/o dividend) closed at 1,785.77, down 5.72% from 2022 year end, in marked contrast to a bullish stock market where TOPIX rose 5.91% during the same time. Accordingly, the aggregate market capitalization of J-Reit's fell 5.42% from 2022 year end to JPY 14.978.1 trillion, going below JPY 15 trillion for the first time after nearly two years since January 2021. The downward trend is thought to be the result of prolonged monetary tightening anticipated in Europe and the United States and heightened anxiety about the financial system because of failures of US banks in March. On the other hand, the average dividend yield for all J-Reit's rose by 0.32 ppt to 4.23% at March end from 2022 year end, as the investment unit market softened.

■Status quo

・There were a series of mergers by J-Reit's under the same sponsor to convert to a comprehensive type. In March, Mori Trust Sogo Reit Inc. and Mori Trust Hotel Reit Inc., both of which are sponsored by Mori Trust Co., Ltd., merged to form a comprehensive J-Reit with offices and hotels as its core assets. In coming November, Kenedix Office Investment Corporation, Kenedix Residential Next Investment Corporation, and Kenedix Retail REIT Corporation, all three of which are sponsored by Kenedix, will merge into a comprehensive J-Reit. So far, they have been managed separately in accordance with each property type. The merger, however, will enhance the presence within the whole J-Reit market with enlarged AUM, and improve flexibility in management by affording to acquire assets of any property type. So, faster growth in the future is expected.

・The aggregate AUM of J-Reit's grew by JPY 324.6 billion from 2022 year end to JPY 22.1977 trillion as of the end of March. Acquisition of large office buildings recently redeveloped by sponsors happened one after another in order to realize gains and improve portfolio quality by restructuring. For example, Iidabashi Grand Bloom (@ JPY 25.4 billion), and Toyosu Bayside Cross Tower (@ JPY 21.6 billion) acquired by Nippon Building Fund Inc., Kasumigaseki Tokyu Building (@ JPY 30.6 billion) by Activia Properties Inc., and The ARGYLE aoyama (@ JPY 23.9 billion) by Japan Real Estate Investment Corporation.