Our Site uses cookies to improve your experience on our website. For more details, please read our Cookie Policy.

By closing this message or starting to navigate on this website, you agree to our use of cookies.

This page is translated using machine translation. Please note that the content may not be 100% accurate.

Investment Real Estate Market Report | 2Q FY2023

Foreword

Thank you very much for your continued support and business.

We, at Mitsui Fudosan Realty, have been providing a broad range of services in order for our valued clients to make the "Best Use" of precious assets, and attentive consultation about concerns and worries clients have with respect to assets in various conditions, not only through brokerage of business and investment properties but also by helping clients to utilize assets effectively for such purposes as estate and tax planning.

As part of these efforts, we prepare an "Investment Real Estate Market Report" for reference to help clients grasp the situation affecting real estate holdings. Since the investment real estate market is susceptible to external factors such as economic trends, an objective point of view is essential to understand the current market conditions. It is our great pleasure if this report is instrumental for readers to develop asset building strategies.

We will continue striving to deliver long-term support through development, implementation, and follow-up of plans that will satisfy clients, meet demands of each client on a "one to one" basis by making the most of professional expertise and experience gained over the years, and prove worthy of clients' trust.

Please feel free to contact us at the office below with any comments or requests concerning this report, or any matters related to real estate assets.

We look forward to opportunities to serve you soon.

Mitsui Fudosan Realty Co., Ltd.

Solution Business Division

■Toll-free Number: 0120-321-376

■Hours: 9:30 am - 6:00 pm Closed Wednesdays, Sundays

■3-2-5, Kasumigaseki, Chiyoda-ku, Tokyo 100-6019, Japan

We, at Solution Business Division of Mitsui Fudosan Realty Co., Ltd., have been producing a "Investment Real Estate Market Report" to serve as an aid to hopefully assisting our valued clients formulate a medium-to long term asset building plan.

Please also take a look at our website, which is full of useful information such as properties for sale, various consultation services, and articles by real estate experts.

Areas subject to collection of data

Tokyo Central submarket: Minato-ku, Chiyoda-ku, Chuo-ku, Shibuya-ku, Shinjuku-ku, and Bunkyo-ku

Tokyo South submarket: Shinagawa-ku, Meguro-ku, Setagaya-ku, and Ota-ku

Tokyo North / West submarket: Suginami-ku, Nakano-ku, Nerima-ku, Toshima-ku, Itabashi-ku, Kita-ku, and Taito-ku

Tokyo East submarket: Koto-ku, Sumida-ku, Arakawa-ku, Edogawa-ku, Katsushika-ku, and Adachi-ku

Yokohama / Kawasaki region: Yokohama city and Kawasaki city

Detailed descriptions

Pick Up Area: For investment real estate, trends in the average gross yields on contract price and initial asking price, together with the number of closed contracts by submarkets are represented in the graph. The details of the transition of actual market value and properties both for sale and sold in certain neighborhoods are also shown.

Market Overview: As an overview of all the submarkets, the trend from the past to this quarter is available. Trends in the average gross yields based on contract price and initial asking price together with the number of closed contracts by area are shown for comparison.

Data Source: Information is extracted from the database containing properties offered for sale and contracts concluded through Mitsui Fudosan Realty Network (En-bloc condominiums / office buildings / apartment buildings).

- Number of Transactions & Average Gross Yield on Contract Price: Number of contracts closed in a quarter (three months) and average gross yield of them (including estimated values)

- Average Gross Yield on Initial Asking Price: Quarterly average gross yield of closed contracts based on their asking price initially quoted

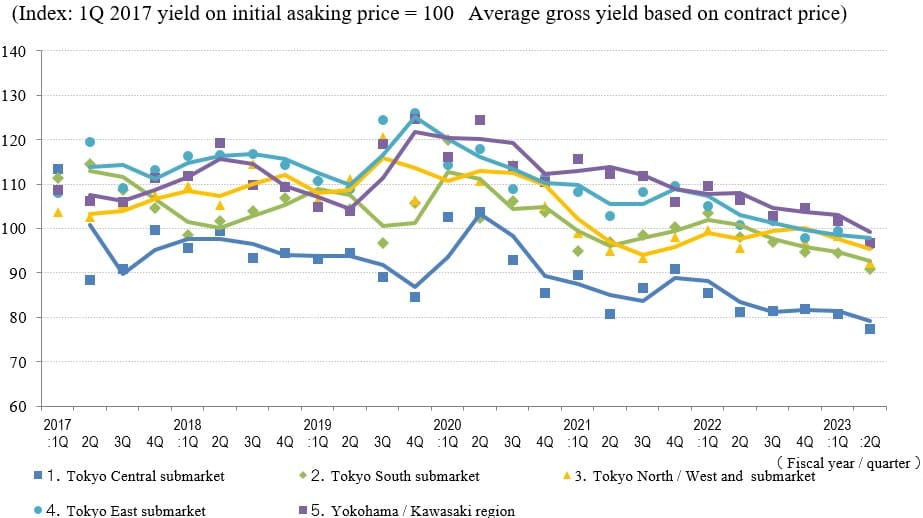

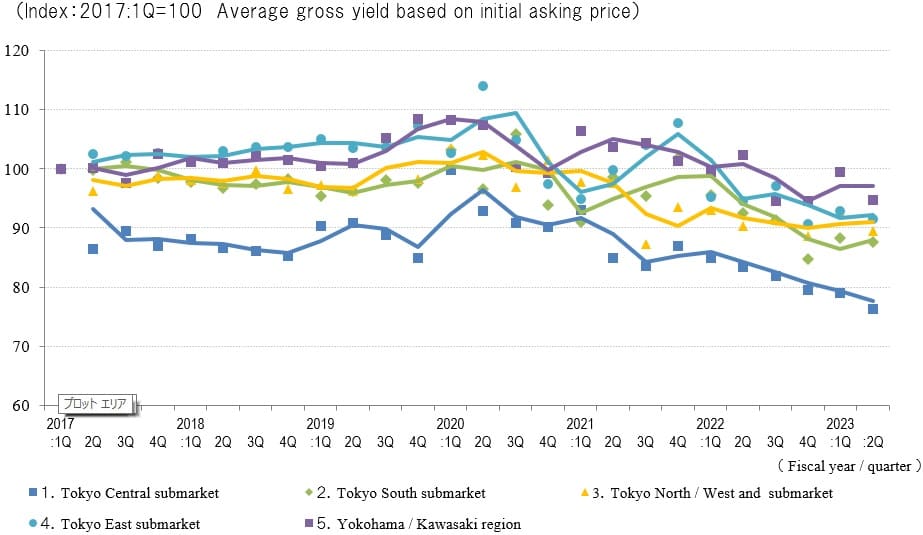

*Figures in each chart represent indices based on values for 1Q / FY2017 set at 100.

(Average Gross Yield on Contract Price is shown as an index to Average Gross Yield on Initial Asking Price for 1Q / FY 2017 set at 100.)

[Note] The historical data may be revised subsequently due to maintenance carried out from time to time, such as adding newly acquired data.

Pick Up Area -Tokyo Central submarket-

(*)Tokyo Central submarket: Minato-ku, Chiyoda-ku, Chuo-ku, Shibuya-ku, Shinjuku-ku, and Bunkyo-ku

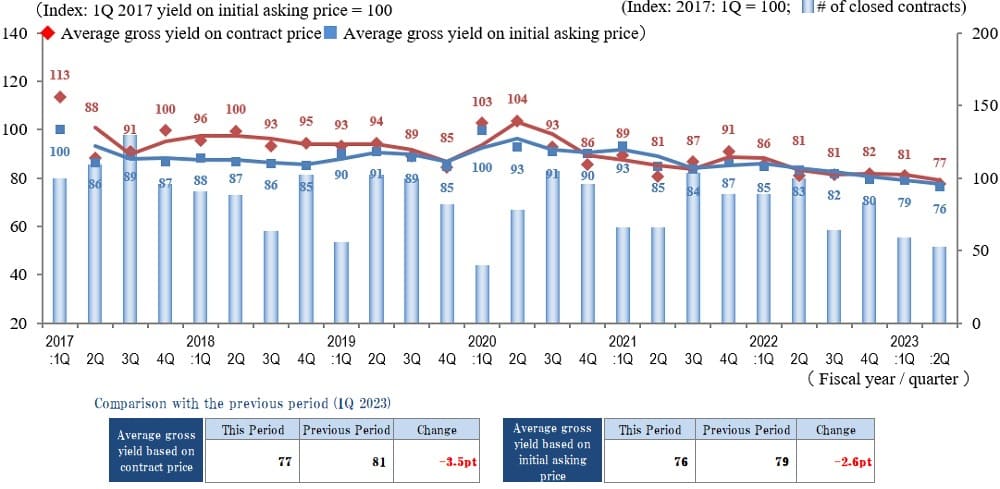

◆Movements by Quarter: Average Gross Yield on Contract Price / Average Gross Yield on Initial Asking Price / Number of Transactions

◆Brokered Transactions of Investment Real Estate in the Submarket

While in 2Q / FY 2023 the Index of Average Gross Yield on the Contract Price in the Tokyo Central submarket had remained largely unchanged for the fourth consecutive quarter, this period it fell 3.5 pt QoQ to 77, recording its largest drop (price rise) in one year.

The Index of the Average Gross Yield on the Initial Asking Price also fell by 2.6 pt QoQ (prices rose) to 76 for the sixth consecutive quarter. Yields on both Contract Price and Initial Asking Price are at record lows, indicating that favorable market conditions continue in the Tokyo Central submarket.

At the same time, the number of transactions reached its lowest point in any quarter other than 1Q / FY 2020, which was impacted strongly by the COVID-19 pandemic, as a gap in price valuations between buyers and sellers appears to be surfacing due to differences in expected yields.

Even as a recovery in inbound demand during the long-term depreciation of the yen period resulted in tailwinds for the real-estate market, factors, such as persistent inflation in consumer prices and the impending limits on working hours in 2024, are causes of uncertainty.

However, investors have strong expectations for steady trends in the domestic real-estate market, which has overcome economic hardships such as COVID-19 and the Ukrainian crisis, and favorable market conditions appear to be continuing in the Tokyo Central submarket.

Pick Up Area -Tokyo South submarket-

(*) Tokyo South submarket: Shinagawa-ku, Meguro-ku, Setagaya-ku, and Ota-ku

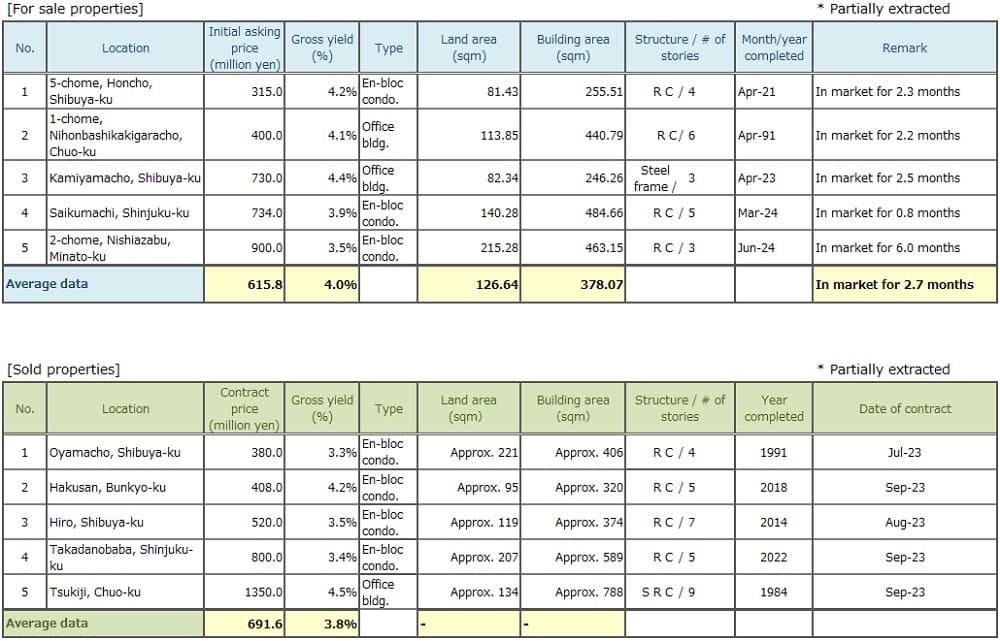

◆Movements by Quarter: Average Gross Yield on Contract Price / Average Gross Yield on Initial Asking Price / Number of Transactions

◆Brokered Transactions of Investment Real Estate in the Submarket

Index of Average Gross Yield on the Contract Price in the Tokyo South submarket in 2Q / FY 2023 reached its lowest level since statistics began in 1Q / FY 2017 at 91 (as prices rose). In addition, the Index of the Average Gross Yield on the Initial Asking Price remained largely unchanged QoQ at 88. The resulting gap between the Index of Average Gross Yield on the Contract Price and the Index of the Average Gross Yield on the Initial Asking Price contracted to 3 pt.

On the other hand, the number of transactions contracted YoY for four consecutive quarters as yields remained low. Despite demand driven by a strong appetite for acquisitions among investors, rising property prices and fewer superior properties on the market appear to be curtailing growth in the number of transactions.

News reports are becoming more frequent of foreign investors taking more of an interest in the acquisition of real estate in Japan due to the weak yen, and such cases are becoming more common in the sales field as well. Since inbound investment by wealthy foreign investors is expected to remain brisk, it will be essential to monitor this trend closely to see what kind of impact the resulting growth in demand will have on real-estate prices.

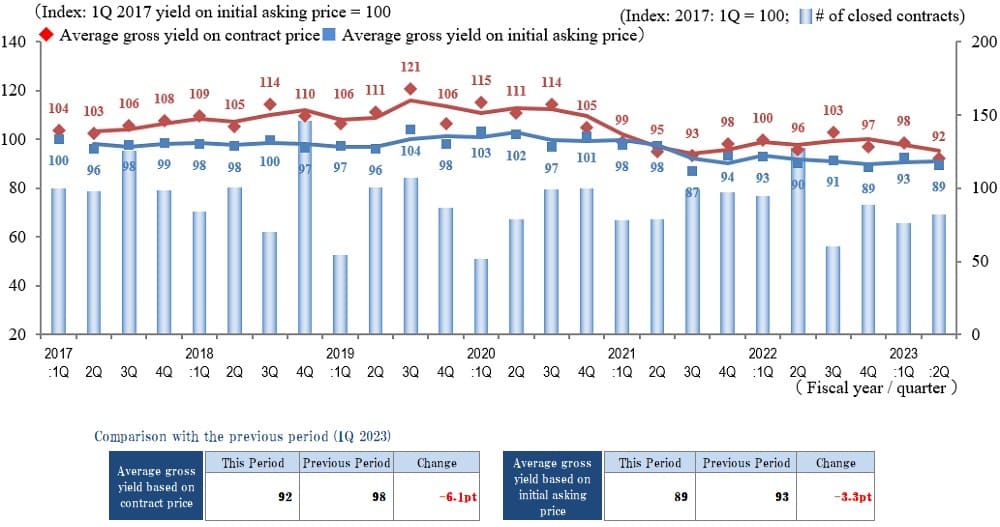

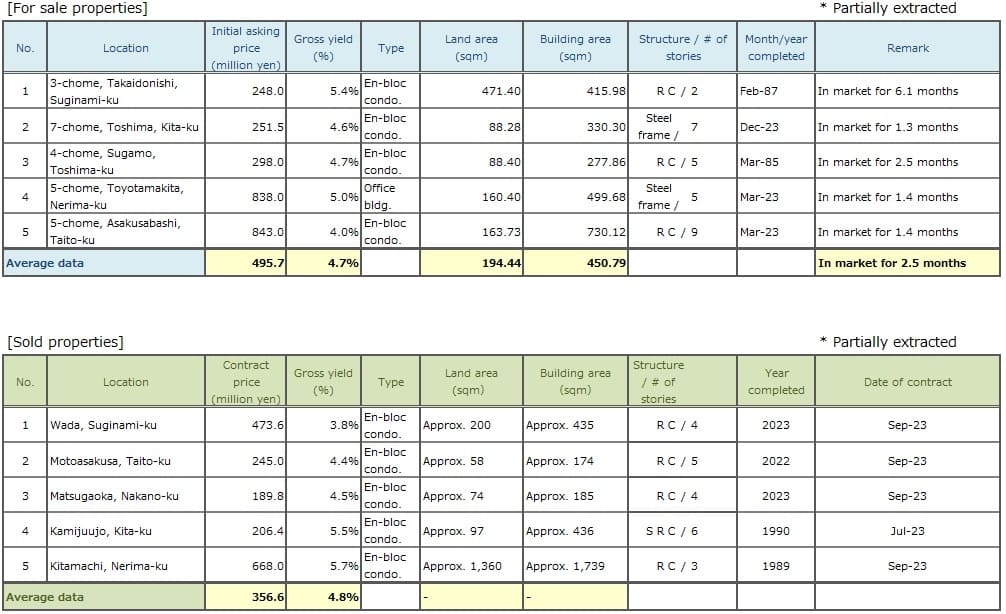

Pick Up Area -Tokyo North / West submarket-

(*) Tokyo North / West submarket: Suginami-ku, Nakano-ku, Nerima-ku, Toshima-ku, Itabashi-ku, Kita-ku, and Taito-ku

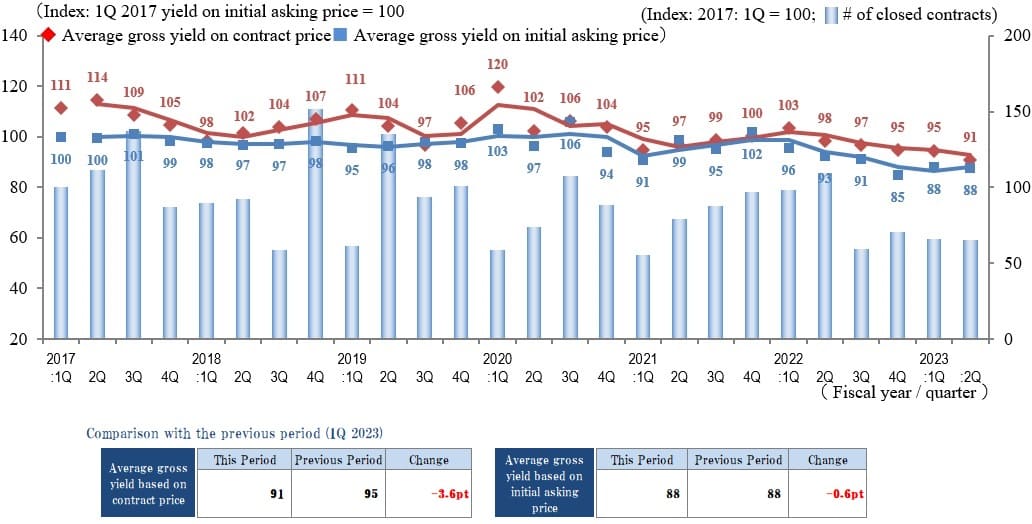

◆Movements by Quarter: Average Gross Yield on Contract Price / Average Gross Yield on Initial Asking Price / Number of Transactions

◆Brokered Transactions of Investment Real Estate in the Submarket

The number of transactions in the Tokyo North / West submarket in 2Q / FY 2023 grew QoQ.

The number of transactions in the Tokyo North / West submarket in 2Q / FY 2023 grew QoQ.

The Index of Average Gross Yield on the Contract Price fell by 6.1 pt, and the Index of the Average Gross Yield on the Initial Asking Price fell by 3.3 pt QoQ (prices rose).

While both the Index of Average Gross Yield on the Contract Price and the Index of the Average Gross Yield on the Initial Asking Price had increased in the previous quarter (prices fell), they rose in this quarter thanks to growth in the number of transactions.

The Index of Average Gross Yield on the Contract Price, which had remained above 95 since 4Q / FY 2021, fell to 92 as even this submarket, which had seemed to be in a slight downturn, recovered in this quarter.

At the same time, a trend toward polarization continues as properties in good locations sell quickly while properties, such as those for which yields and sales have been outpaced by the market and those located far from railway stations remain on the market for lengthy periods.

Both domestic and foreign real economic conditions remain uncertain due to such factors as the situations in the Middle East and Ukraine, inflation, and foreign-exchange risk. It will be essential to monitor constantly what kind of effect such factors have on the domestic market for investment real estate in the future.

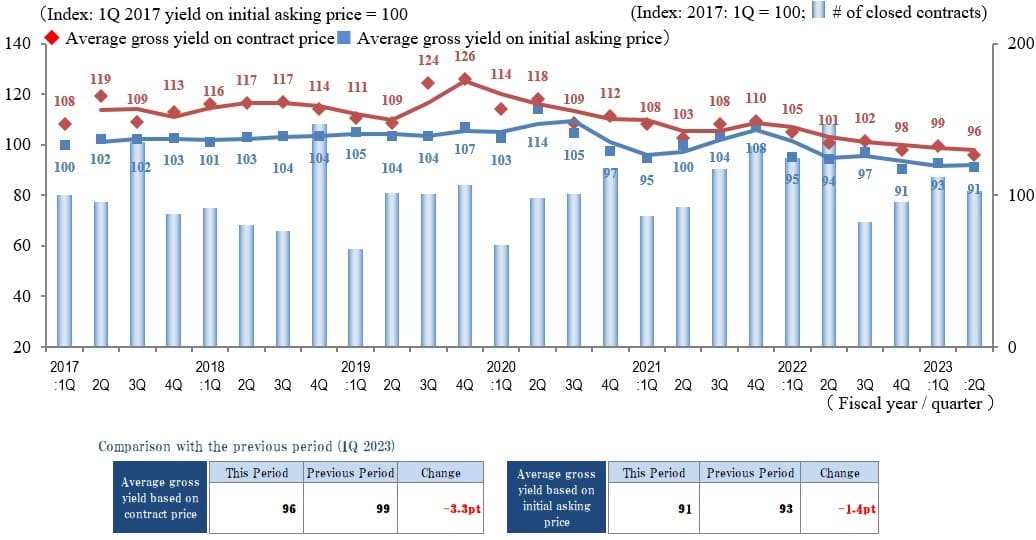

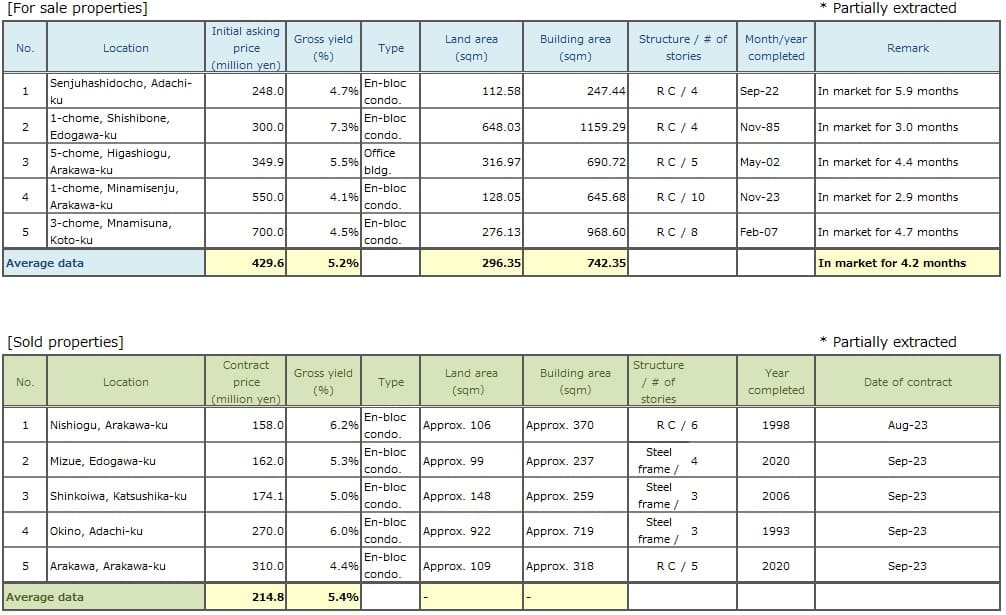

Pick Up Area -Tokyo East submarket-

(*) Tokyo East submarket: Koto-ku, Sumida-ku, Arakawa-ku, Edogawa-Ku, Katsushika-ku, and Adachi-ku

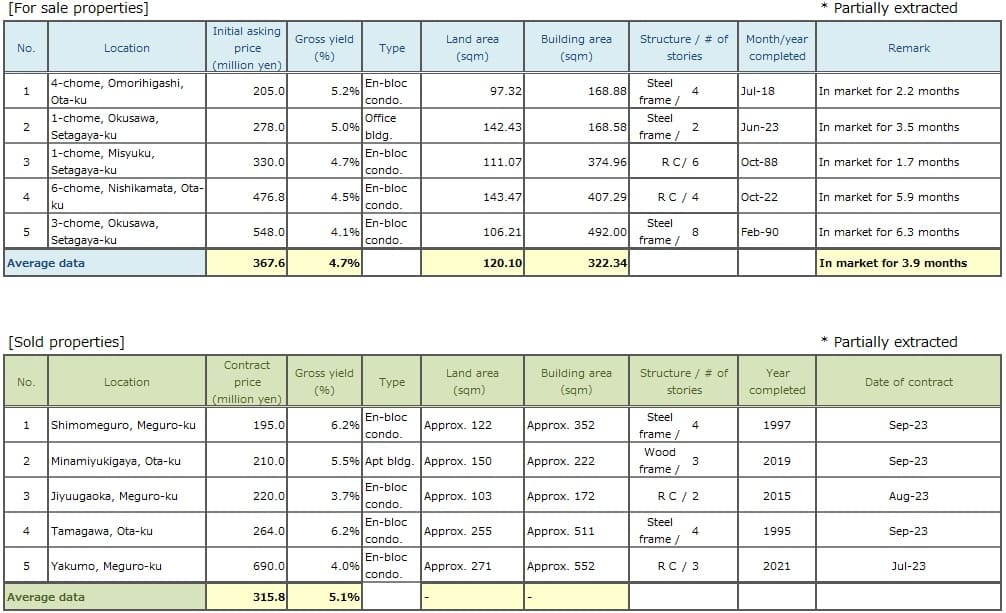

◆Movements by Quarter: Average Gross Yield on Contract Price / Average Gross Yield on Initial Asking Price / Number of Transactions

◆Brokered Transactions of Investment Real Estate in the Submarket

The Indices of the Average Gross Yield on the Contract Price and the Initial Asking Price in the Tokyo East submarket in 2Q / FY 2023 here were 96 (down 3.3 pt QoQ) and 91 (down 1.4 pt QoQ), respectively.

As a result, the Index of the Average Gross Yield on the Initial Asking Price matched its previous low of 4Q / FY 2022 and the Index of Average Gross Yield on the Contract Price reached its lowest level since statistics began.

While down YoY (vs. 2Q / FY 2022), the number of transactions is higher than in the average year as the real estate market in this submarket can be said to remain brisk.

No large gap is apparent between the Index of the Average Gross Yield on the Initial Asking Price and the Index of Average Gross Yield on the Contract Price in the real estate market in this submarket. Under these conditions, properties whose asking prices seem not to have been outpaced by the market can be expected to attract a number of inquiries (prospective buyers).

Factors, such as recent skyrocketing construction material prices and labor shortages in the construction industry, are unlikely to lead to decreases in property prices, and total land and building prices could remain high for a while. However, it is thought that there is a need to watch closely factors that could lead to major fluctuations in the market due to geopolitical risks, such as intensification of disputes, in various parts of the world and financial risks, such as rising interest rates and exchange-rate fluctuations.

Pick Up Area -Yokohama / Kawasaki region-

(*) Yokohama and Kawasaki region: Yokohama city, Kawasaki city

◆Movements by Quarter: Average Gross Yield on Contract Price / Average Gross Yield on Initial Asking Price / Number of Transactions

◆Brokered Transactions of Investment Real Estate in the Submarket

The number of transactions in the Yokohama / Kawasaki region in 2Q / FY 2023 increased significantly on both the QoQ and YoY bases due in part to a rush before the end of the first half.

This was a new record high since the start of data collection, and the slight downward trend in the Average Gross Yield on the Contract Price continued.

Ample funds still are available from investors, and the trend in prices of revenue-generating real estate probably could be described as remaining bullish overall.

However, looking at individual transaction details, there were many cases of large disparities found between properties centrally located in the commercialized districts and properties located in suburban areas or far from stations in terms of pricing and the duration required until concluding contracts.

This tendency to bipolarization has become increasingly evident here.

A look at environmental conditions shows that some cases have appeared of pressure on land prices as construction costs continue to rise because of the skyrocketing prices of materials, energy, and labor.

As a result, there is possibility that land prices may fall temporarily, except in some prime locations.

Although it is not highly probable that the real estate market here will fluctuate wildly toward the end of the year, it would be prudent to keep a close eye on the market because there still is a possibility that it may soften slightly depending on investors' reactions to such factors as trends in long-term interest rates and the unstable international situation.

General overview

◆Movements by Quarter: Average Gross Yield on Contract Price / Average Gross Yield on Initial Asking Price / Number of Transactions for the 5 Areas

◆Movements in Number of Transactions by Area

◆Movements in Average Gross Yield on Contract Price by Area

◆Movements in Average Gross Yield on Initial Asking Price by Area

A look at yield trends in 2Q / 2023 shows that Average Gross Yields on the Contract Price fell in all submarkets.

The Index of the Average Gross Yield on the Initial Asking Price fell remained unchanged in the Tokyo central submarket but fell QoQ in the other four submarkets.

While last quarter the strength of the Tokyo Central submarket was pronounced and prices fell in some areas, the trend in the market for investment real estate in the Tokyo Central submarket appears to be remaining favorable.

The Number of Transactions this quarter exceeded last quarter's number in the Tokyo North / West submarket and the Yokohama / Kawasaki region. The Number of Transactions reached a record high in the Yokohama / Kawasaki region in particular.

The gap between Average Gross Yields on the Contract Price and on the Initial Asking Price continued its contracting trend from last quarter in all submarkets as differences in price perspectives between sellers and buyers appear to be shrinking. However, rising property prices appear to be leading to decreases in the number of transactions.

Prices of newly constructed condominiums in Tokyo are at record high levels, and contract prices on used condominiums in the Tokyo central submarket also are increasing. As these and other factors would seem to indicate that the real estate market in the Tokyo central submarket is brisk, factors such as the weak yen, inflation, and rising interest rates, which could have major impacts on the real estate market, should be monitored closely.