Our Site uses cookies to improve your experience on our website. For more details, please read our Cookie Policy.

By closing this message or starting to navigate on this website, you agree to our use of cookies.

This page is translated using machine translation. Please note that the content may not be 100% accurate.

Investment Real Estate Market Report | 4Q FY2023

Foreword

Thank you very much for your continued support and business.

We, at Mitsui Fudosan Realty, have been providing a broad range of services in order for our valued clients to make the "Best Use" of precious assets, and attentive consultation about concerns and worries clients have with respect to assets in various conditions, not only through brokerage of business and investment properties but also by helping clients to utilize assets effectively for such purposes as estate and tax planning.

As part of these efforts, we prepare an "Investment Real Estate Market Report" for reference to help clients grasp the situation affecting real estate holdings. Since the investment real estate market is susceptible to external factors such as economic trends, an objective point of view is essential to understand the current market conditions. It is our great pleasure if this report is instrumental for readers to develop asset building strategies.

We will continue striving to deliver long-term support through development, implementation, and follow-up of plans that will satisfy clients, meet demands of each client on a "one to one" basis by making the most of professional expertise and experience gained over the years, and prove worthy of clients' trust.

Please feel free to contact us at the office below with any comments or requests concerning this report, or any matters related to real estate assets.

We look forward to opportunities to serve you soon.

Mitsui Fudosan Realty Co., Ltd.

Solution Business Division

■Toll-free Number: 0120-321-376

■Hours: 9:30 am - 6:00 pm Closed Wednesdays, Sundays

■3-2-5, Kasumigaseki, Chiyoda-ku, Tokyo 100-6019, Japan

We, at Solution Business Division of Mitsui Fudosan Realty Co., Ltd., have been producing a "Investment Real Estate Market Report" to serve as an aid to hopefully assisting our valued clients formulate a medium-to long term asset building plan.

Please also take a look at our website, which is full of useful information such as properties for sale, various consultation services, and articles by real estate experts.

Areas subject to collection of data

Tokyo Central submarket: Minato-ku, Chiyoda-ku, Chuo-ku, Shibuya-ku, Shinjuku-ku, and Bunkyo-ku

Tokyo South submarket: Shinagawa-ku, Meguro-ku, Setagaya-ku, and Ota-ku

Tokyo North / West submarket: Suginami-ku, Nakano-ku, Nerima-ku, Toshima-ku, Itabashi-ku, Kita-ku, and Taito-ku

Tokyo East submarket: Koto-ku, Sumida-ku, Arakawa-ku, Edogawa-ku, Katsushika-ku, and Adachi-ku

Yokohama / Kawasaki region: Yokohama city and Kawasaki city

Detailed descriptions

Pick Up Area: For investment real estate, trends in the average gross yields on contract price and initial asking price, together with the number of closed contracts by submarkets are represented in the graph. The details of the transition of actual market value and properties both for sale and sold in certain neighborhoods are also shown.

Market Overview: As an overview of all the submarkets, the trend from the past to this quarter is available. Trends in the average gross yields based on contract price and initial asking price together with the number of closed contracts by area are shown for comparison.

Data Source: Information is extracted from the database containing properties offered for sale and contracts concluded through Mitsui Fudosan Realty Network (En-bloc condominiums / office buildings / apartment buildings).

- Number of Transactions & Average Gross Yield on Contract Price: Number of contracts closed in a quarter (three months) and average gross yield of them (including estimated values)

- Average Gross Yield on Initial Asking Price: Quarterly average gross yield of closed contracts based on their asking price initially quoted

*Figures in each chart represent indices based on values for 1Q / FY2017 set at 100.

(Average Gross Yield on Contract Price is shown as an index to Average Gross Yield on Initial Asking Price for 1Q / FY 2017 set at 100.)

[Note] The historical data may be revised subsequently due to maintenance carried out from time to time, such as adding newly acquired data.

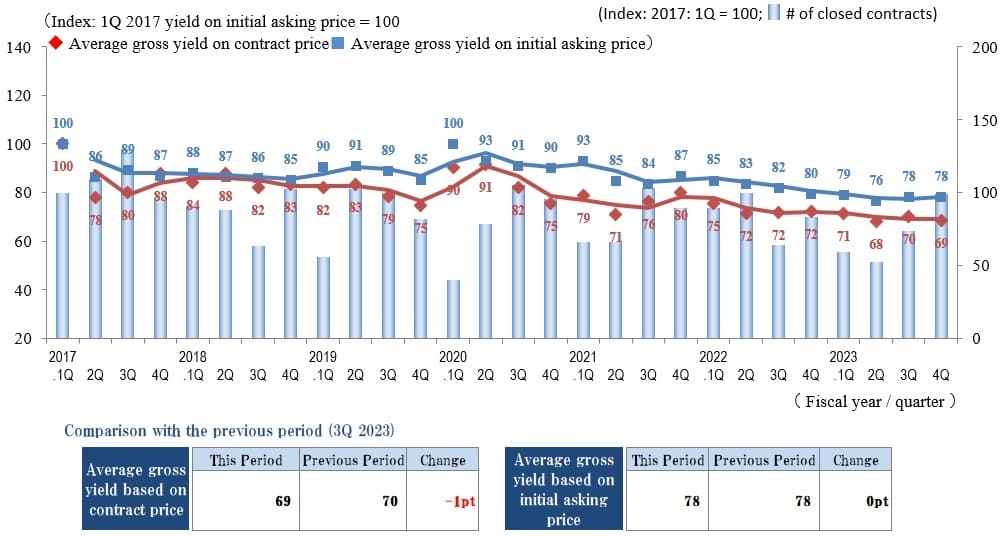

Pick Up Area -Tokyo Central submarket-

(*)Tokyo Central submarket: Minato-ku, Chiyoda-ku, Chuo-ku, Shibuya-ku, Shinjuku-ku, and Bunkyo-ku

◆Movements by Quarter: Average Gross Yield on Contract Price / Average Gross Yield on Initial Asking Price / Number of Transactions

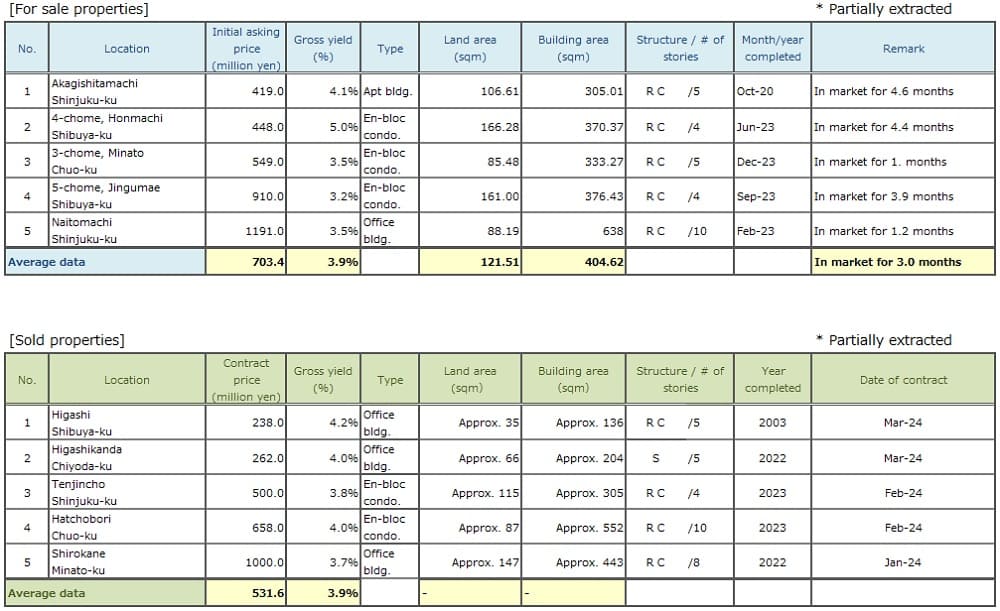

◆Brokered Transactions of Investment Real Estate in the Submarket

In 4Q / FY 2023 in the Tokyo Central submarket the Index of the Gross Yield on Initial Asking Prices remained largely unchanged, while the Index of the Gross Yield on the Contract Price fell 1 pt (price rose). While in 3Q / FY 2023 the Index of Average Gross Yield on Contract Prices in the Tokyo Central submarket had increased (+2 pt QoQ / price dropped) for the first time in about two years, this period it fell 1 pt QoQ to 69 as market conditions remain favorable. Although prices of properties for sale remain at high levels, the number of transactions was increased, both QoQ and YoY, as the increasing trends continued from 3Q / FY 2023.

Conceivable future risks include interest-rate trends (further hikes by the BoJ), economic downturns overseas, and financial-market volatility. While sufficient attention needs to be paid to these risks, even on the assumption that yields remain largely unchanged, conditions in the Tokyo Central submarket’s real estate investment market can be relatively optimistically expected to remain steady or favorable, continuously improving gently, thanks to improvement in vacancy rates on residential, office, and retail properties and an upward trend in rents in the leasing market.

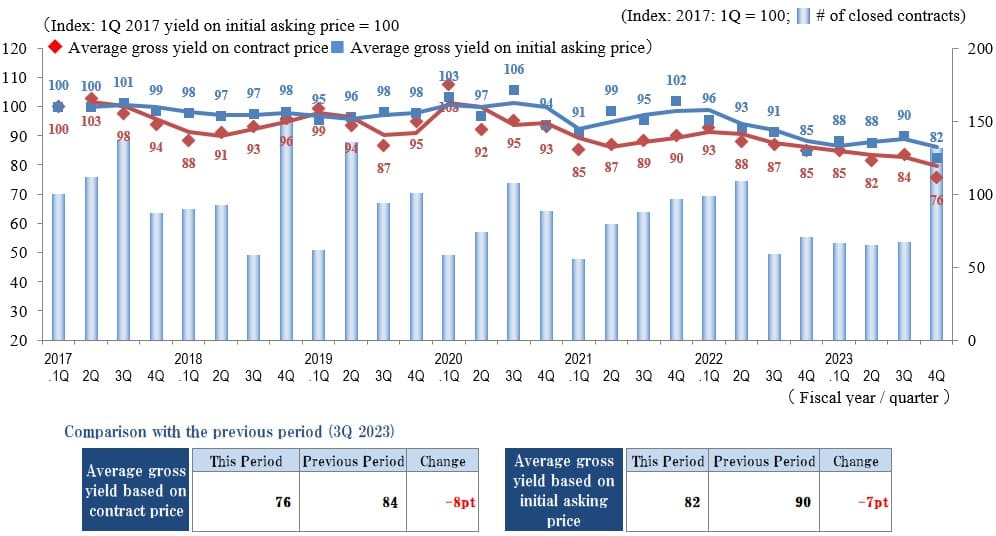

Pick Up Area -Tokyo South submarket-

(*) Tokyo South submarket: Shinagawa-ku, Meguro-ku, Setagaya-ku, and Ota-ku

◆Movements by Quarter: Average Gross Yield on Contract Price / Average Gross Yield on Initial Asking Price / Number of Transactions

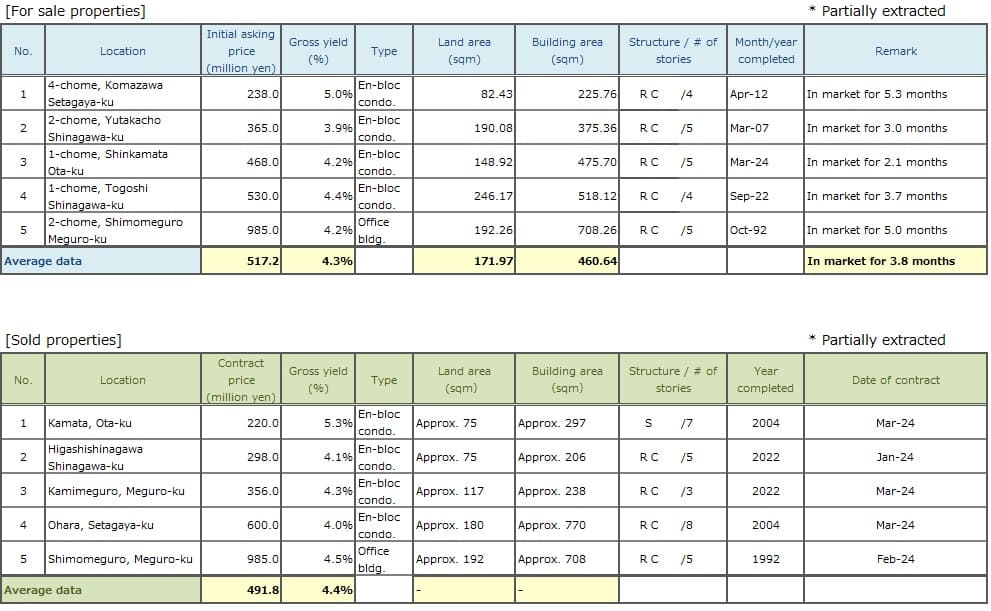

◆Brokered Transactions of Investment Real Estate in the Submarket

The Index of Average Gross Yield on Contract Prices in the Tokyo South submarket in 4Q / FY 2023 fell sharply by 8 pt QoQ to reach its lowest level since statistics began in 1Q / FY 2017 at 76 (as prices rose). The Index of the Average Gross Yield on Initial Asking Prices also fell sharply QoQ by 7 pt to 82, its lowest level in this submarket since statistics began.

While the number of transactions had remained largely unchanged for five quarters, it rose sharply this quarter, indicating active trading despite high price levels. While the international situation and continued inflation are numbered among domestic and international topics that could impact the economy, at present, factors that could have a major downward effect on real estate prices are few, in light of conditions of the monetary policy of maintaining low interest rates and inbound demand and increasing construction costs against the backdrop of a historically low value of the yen on international currency markets. Accordingly, favorable market conditions are expected to continue.

While conditions remain favorable in the real estate market in the Tokyo South submarket, there is a need to closely monitor the trends to see whether these conditions will accelerate or undergo a rebound in the next quarter.

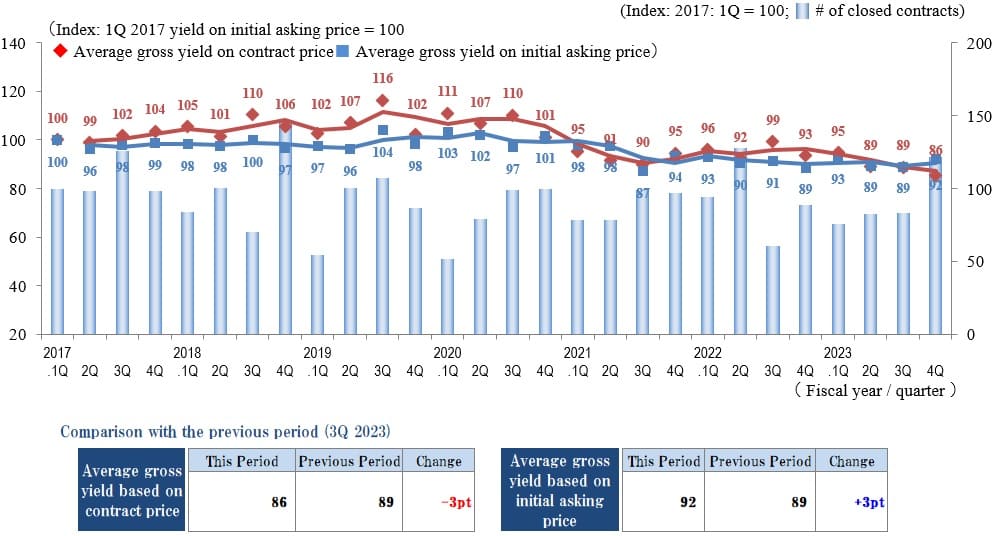

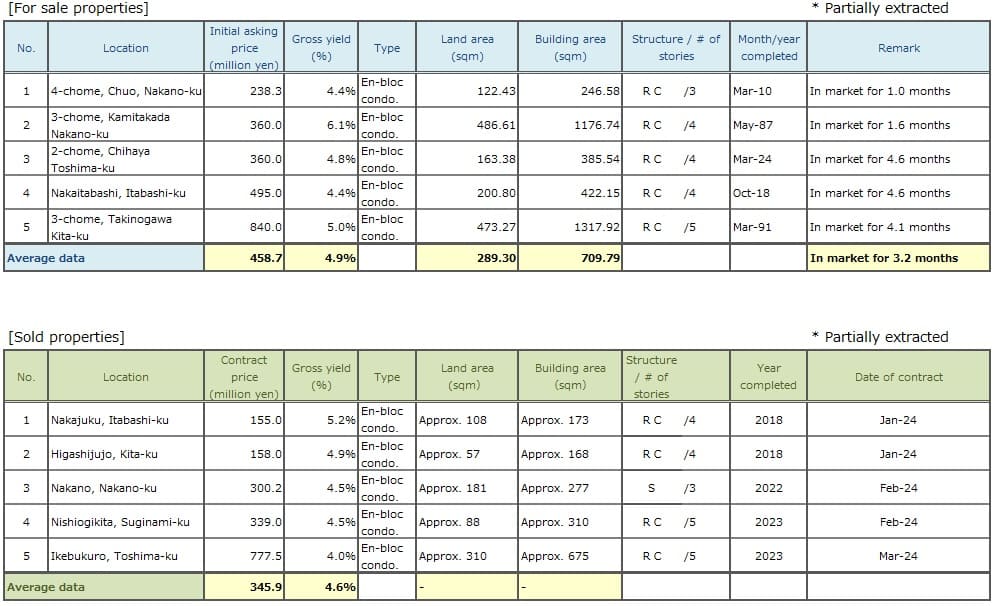

Pick Up Area -Tokyo North / West submarket-

(*) Tokyo North / West submarket: Suginami-ku, Nakano-ku, Nerima-ku, Toshima-ku, Itabashi-ku, Kita-ku, and Taito-ku

◆Movements by Quarter: Average Gross Yield on Contract Price / Average Gross Yield on Initial Asking Price / Number of Transactions

◆Brokered Transactions of Investment Real Estate in the Submarket

The Index of the Average Gross Yield on Contract Prices and Initial Asking Prices 4Q / FY 2023 in the Tokyo North / West submarket fell by 3 pt QoQ (prices rose) and rose by 3 pt QoQ (prices fell), respectively. The Index of Average Gross Yield on Contract Prices in this quarter was at its lowest level since statistics began in 1Q / FY 2017 at 86, while the Index of Average Gross Yield on Initial Asking Prices rose for the first time in three quarters to 92. This is the first time in about two years that the Index of Average Gross Yield on Contract Prices fell below the Index of Average Gross Yield on Initial Asking Prices.

The number of transactions also rose sharply QoQ to its highest level in FY 2023 as conditions in this submarket's real estate investment market can be said to be favorable.

The main factors behind the above results include upward pressure on the Gross Yield on Initial Asking Prices from the demand for sale as this is considered a time to sell amid favorable real estate market conditions, active demand for purchasing propped up by inbound investment backed by the low value of the yen vs. the dollar, and a favorable demand-supply balance leading to increased numbers of transactions.

The FY 2024 appears likely to prove a major turning point in the policies of monetary easing that have continued for a long time. In its March 19, 2024, Monetary Policy Meeting, the BoJ decided to discontinue its negative interest-rate policy, leading to a consciousness of rising interest rates on debt in the real estate market. Construction costs also are rising due to higher prices and labor costs, and the effects of the devalued yen. This is having an effect in such areas as new building construction and remodeling. While investment money is booming domestically and internationally, there is a need to closely monitor how trends in interest rates, exchange rates, and prices could impact the real estate market in the future.

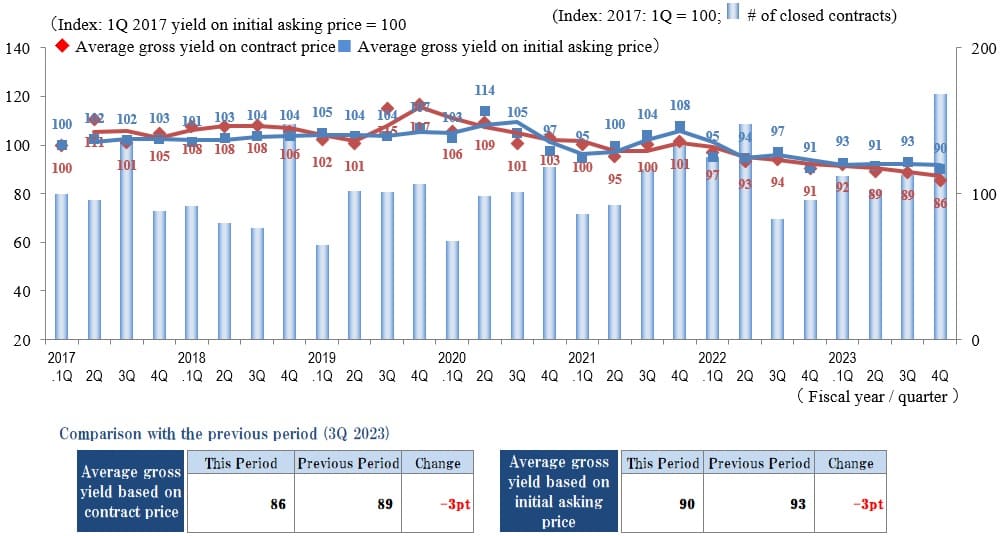

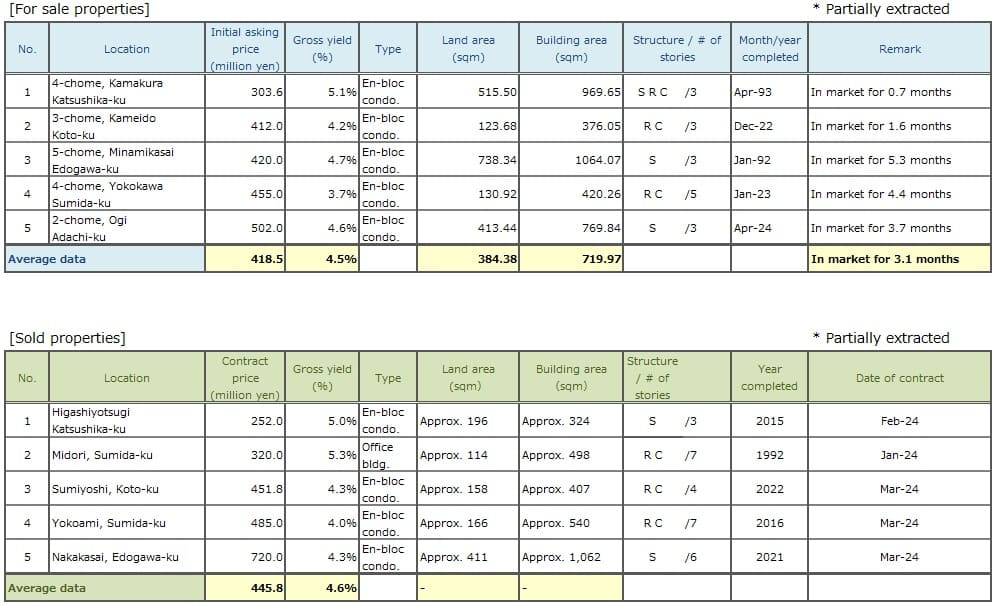

Pick Up Area -Tokyo East submarket-

(*) Tokyo East submarket: Koto-ku, Sumida-ku, Arakawa-ku, Edogawa-Ku, Katsushika-ku, and Adachi-ku

◆Movements by Quarter: Average Gross Yield on Contract Price / Average Gross Yield on Initial Asking Price / Number of Transactions

◆Brokered Transactions of Investment Real Estate in the Submarket

Indexes of Average Gross Yield on Contract Prices and Initial Asking Price here in 4Q / FY 2023 were 86 (down 3 pt QoQ) and 90 (down 3 pt QoQ), respectively, as both decreased further (prices rose). In addition, the quarterly number of transactions for which statistics have been kept since 2017, reached a record high in this submarket, a sign of active trading during the quarter.

Factors behind the favorable real estate market conditions include increasing numbers in some areas of investors and businesses considering the acquisition of existing or completed properties (instead of acquiring land and building new buildings on it) in response to high and rising prices of new construction due to such factors as the rising costs of building materials and a shortage of labor in the construction industry. Factors on the seller's side include some cases of properties coming on the market due to decisions to sell because planned rebuilding would be unprofitable due to rising construction costs and growing inbound demand due to the low yen. Whether favorable market conditions will continue in the future is worth closely monitoring from various angles.

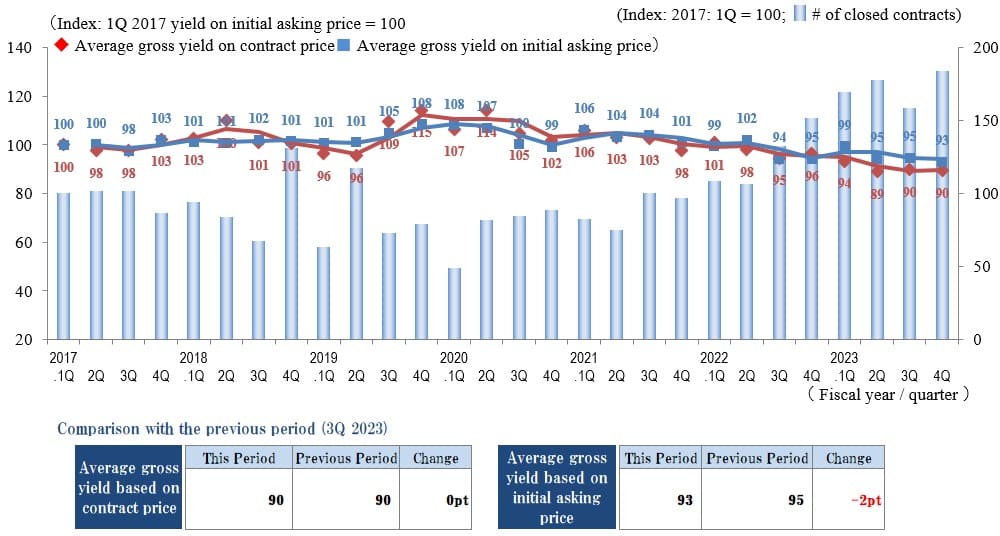

Pick Up Area -Yokohama / Kawasaki region-

(*) Yokohama and Kawasaki region: Yokohama city, Kawasaki city

◆Movements by Quarter: Average Gross Yield on Contract Price / Average Gross Yield on Initial Asking Price / Number of Transactions

◆Brokered Transactions of Investment Real Estate in the Submarket

The number of transactions here in 4Q / FY 2023 increased significantly on both QoQ and YoY bases. Despite decreasing last quarter (3Q) for the first time in five quarters, the market appears to remain active.

At the same time, while transaction yields remain largely unchanged QoQ on average, a look at individual transactions shows that transaction yields vary widely from the 4% to 7% level even within the same price ranges due to conditions, such as location and building age. Disparities also are pronounced based on the time required to conclude a transaction and the level of price (discount) negotiations, as the trend toward polarization of the market is becoming even more pronounced. As the market for revenue-generating real estate heats up, investors are becoming more selective.

Turning to transactions for development sites, construction costs have risen further, and cases were apparent here and there of pressure on land purchase prices since cutting other costs and passing along higher costs to sale prices were not enough to compensate for high construction costs. The impact of this trend is particularly large in suburban areas where land prices are lower than in central Tokyo. Unpredictable conditions can be expected to continue regarding price trends on commercial sites as well as condominiums and single-family residences.

While the risk of a short-term fluctuation in the revenue-generating real estate market is not considered to be high as stock prices remain steady, there is likely to be a need to carefully and closely monitor trends in investor attitudes for the time being, in light of exchange-rate trends and the fact that the possibility of higher interest rates cannot be dismissed.

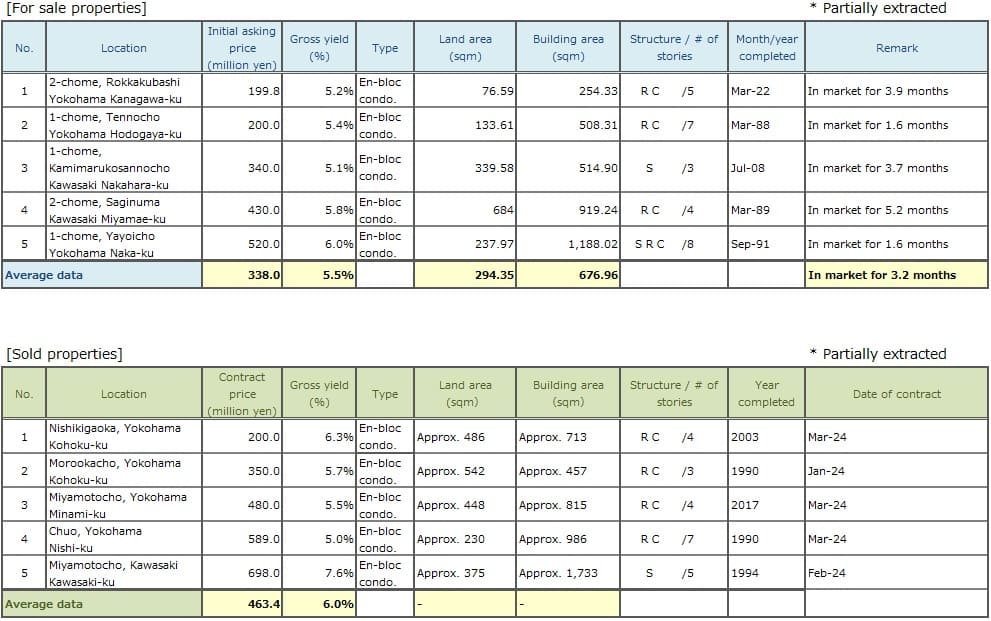

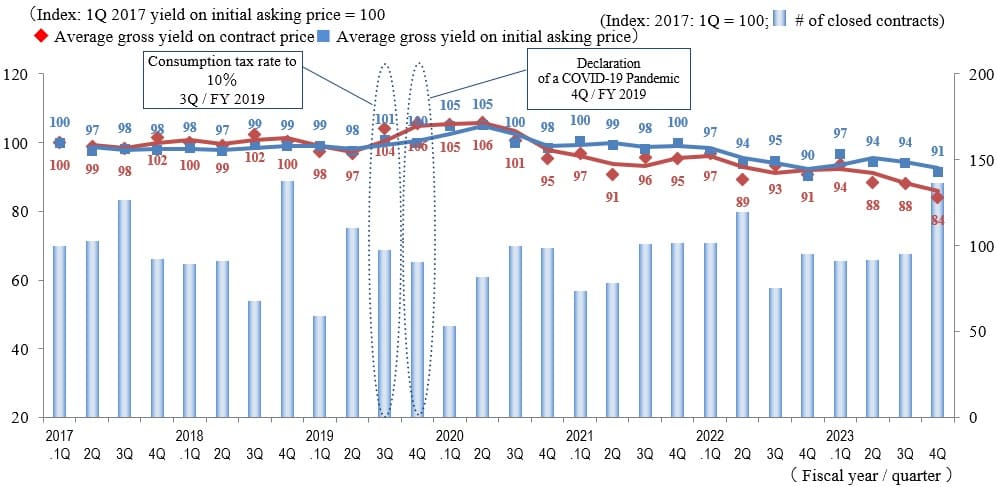

General overview

◆Movements by Quarter: Average Gross Yield on Contract Price / Average Gross Yield on Initial Asking Price / Number of Transactions for the 5 Areas

◆Movements in Number of Transactions by Area

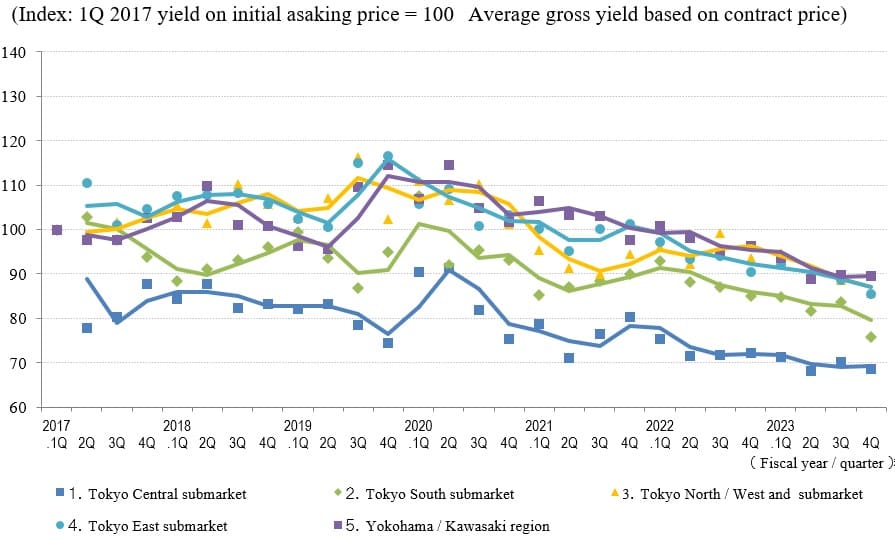

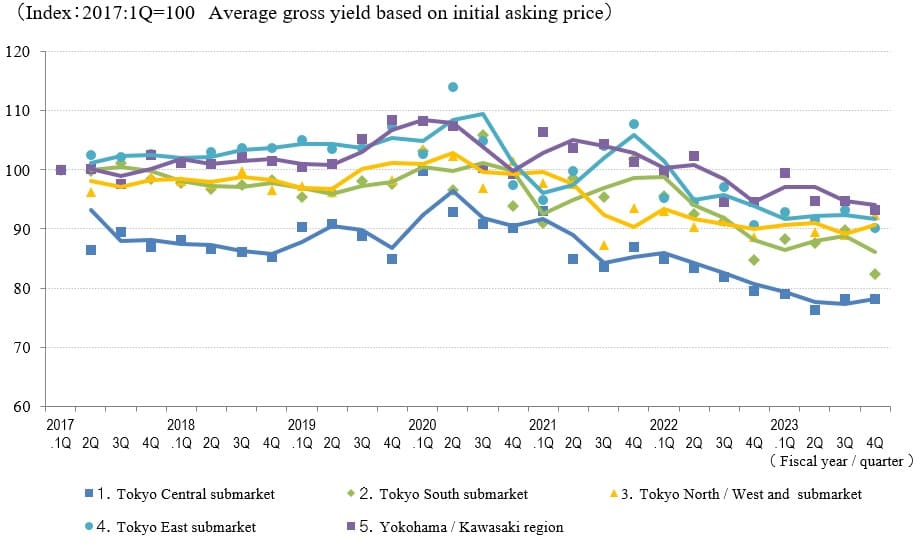

◆Movements in Average Gross Yield on Contract Price by Area

◆Movements in Average Gross Yield on Initial Asking Price by Area

A look at yield trends by submarket in 4Q / FY 2023 shows that Average Gross Yield on the Contract Price was down in all submarkets other than Yokohama / Kawasaki. The figure was down 4 pt QoQ for the market as a whole, reaching a new record low since statistics began in 2017. The Gross Yield on Initial Asking Prices was up 3 pt in the Tokyo North / West submarket, largely unchanged in the Tokyo Central submarket, and down QoQ in the other three submarkets. Yields on both Contract Prices and Initial Asking Prices were down sharply in the Tokyo South submarket in particular.

The number of transactions was up in each submarket and rose to the second highest level after 4Q / FY 2018 for the market as a whole.

The market in the Tokyo metropolitan area remains steady about one year after the transition from living with COVID to post-COVID conditions, as there appears to be active demand for purchasing among investors. In addition to paying attention to the trends in exchange rates, interest rates, and prices in the future, the market effects of the looming US presidential election in November also should be monitored closely.