Our Site uses cookies to improve your experience on our website. For more details, please read our Cookie Policy.

By closing this message or starting to navigate on this website, you agree to our use of cookies.

This page is translated using machine translation. Please note that the content may not be 100% accurate.

Quarterly Report for Premium Condominiums in Tokyo | 1Q FY 2024

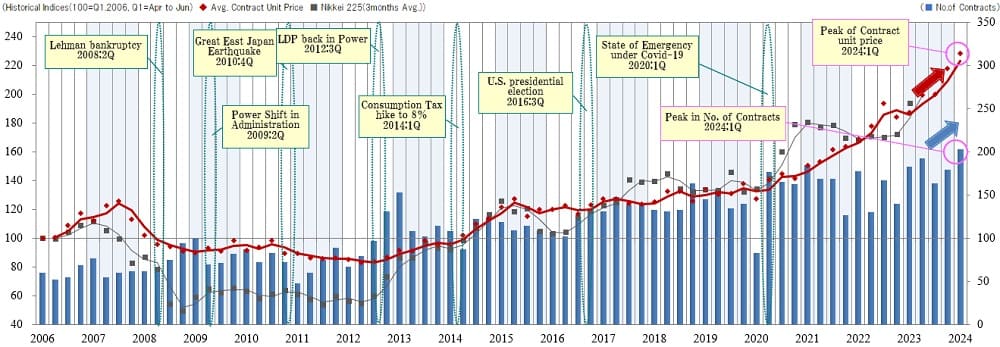

【Chart 1】

This graph shows an index of changes in average contract price per tsubo (*Notes: 1. Indexation using average contract price per tsubo in 1Q / FY 2006 as 100. 2. Tsubo is a Japanese traditional unit of area equal to approx. 3.31sqm.) and the number of contracts concluded every quarter for premium condo. units in 7 prestigious areas of central Tokyo.

Major economic events and Nikkei Stock Average are also shown for reference. The bar graph represents the number of contracts concluded each quarter. The red-line shows a movement in the index of average contract price per tsubo, while the gray-line shows one in the Nikkei stock average.

In the first quarter reviewed here (2024: 1Q), the index of the average contract price per tsubo for premium condominium units sold (see above) rose by 11.1 points QoQ to 228.7, setting a new record since the beginning of data collection for the fourth consecutive quarter. The number of contracts rose by 20 QoQ to 202, reaching the 200-contract level for the first time since the beginning of data collection.

【Chart 2】

The chart above shows the trend of the average contract price per tsubo for each area. There were declines in the following three areas: “Aoyama / Shibuya Area,” “Hiroo / Daikanyama / Ebisu Area”, and “Meguro / Shinagawa Area”. On the other hand, the trend of the average contract price per tsubo increased in the other six areas. Each of the other six areas reached a record historical high since the beginning of data collection. In particular, “Ichigaya / Yotsuya Area” and “Ginza Area” have set new record highs for three consecutive quarters, while “Shirokane Takanawa / Azabu-jyuban Area” did so for the fourth consecutive quarters and “Azabu / Akasaka / Roppongi Area” for the eighth consecutive quarter, respectively.

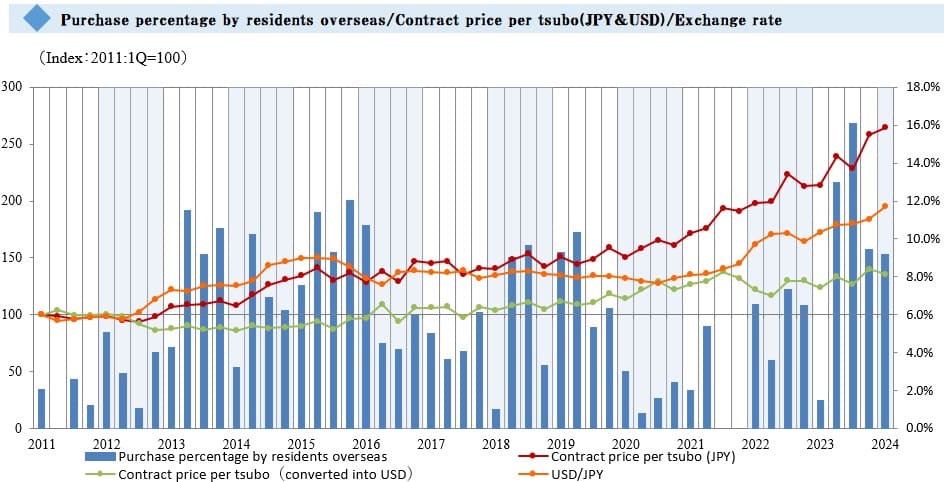

【Chart 3】

In the chart above, it shows the percentage of purchases by the residents overseas, contract price per tsubo (JPY and USD) among Mitsui Fudosan Realty Group transactions, and the exchange rate. The percentage of purchases by the residents overseas remained virtually unchanged at 9.2%, down 0.2% from the previous quarter. The contract price per tsubo (converted into USD) fell by $2,030 QoQ to $60,955 this quarter. This is lower than the level in 2021: 3Q ($61,944), showing the obvious effects of the recent yen depreciation.

The number of contracts hit a new record high since the beginning of data collection while the average price per tsubo set a new record high for the fourth consecutive quarter. The number of the listings for sale in all nine areas combined as of the end of this quarter was 413, declining for the fourth consecutive quarter. It will be worthwhile to note how this trend will affect the number of contracts and the average price per tsubo in the ensuing quarters. It will be necessary to keep watching closely the trend in inbound demand on top of economic and financial trends, such as the Nikkei Average, and exchange rates in the next quarter and beyond.