Our Site uses cookies to improve your experience on our website. For more details, please read our Cookie Policy.

By closing this message or starting to navigate on this website, you agree to our use of cookies.

This page is translated using machine translation. Please note that the content may not be 100% accurate.

Investment Real Estate Market Report | 2Q FY2024

Areas subject to collection of data

Tokyo Central submarket: Minato-ku, Chiyoda-ku, Chuo-ku, Shibuya-ku, Shinjuku-ku, and Bunkyo-ku

Tokyo South submarket: Shinagawa-ku, Meguro-ku, Setagaya-ku, and Ota-ku

Tokyo North / West submarket: Suginami-ku, Nakano-ku, Nerima-ku, Toshima-ku, Itabashi-ku, Kita-ku, and Taito-ku

Tokyo East submarket: Koto-ku, Sumida-ku, Arakawa-ku, Edogawa-ku, Katsushika-ku, and Adachi-ku

Yokohama / Kawasaki region: Yokohama city and Kawasaki city

Detailed descriptions

Pick Up Area: For investment real estate, trends in the average gross yields on contract price and initial asking price, together with the number of closed contracts by submarkets are represented in the graph. The details of the transition of actual market value and properties both for sale and sold in certain neighborhoods are also shown.

Market Overview: As an overview of all the submarkets, the trend from the past to this quarter is available. Trends in the average gross yields based on contract price and initial asking price together with the number of closed contracts by area are shown for comparison.

Data Source: Information is extracted from the database containing properties offered for sale and contracts concluded through Mitsui Fudosan Realty Network (En-bloc condominiums / office buildings / apartment buildings).

- Number of Transactions & Average Gross Yield on Contract Price: Number of contracts closed in a quarter (three months) and average gross yield of them (including estimated values)

- Average Gross Yield on Initial Asking Price: Quarterly average gross yield of closed contracts based on their asking price initially quoted

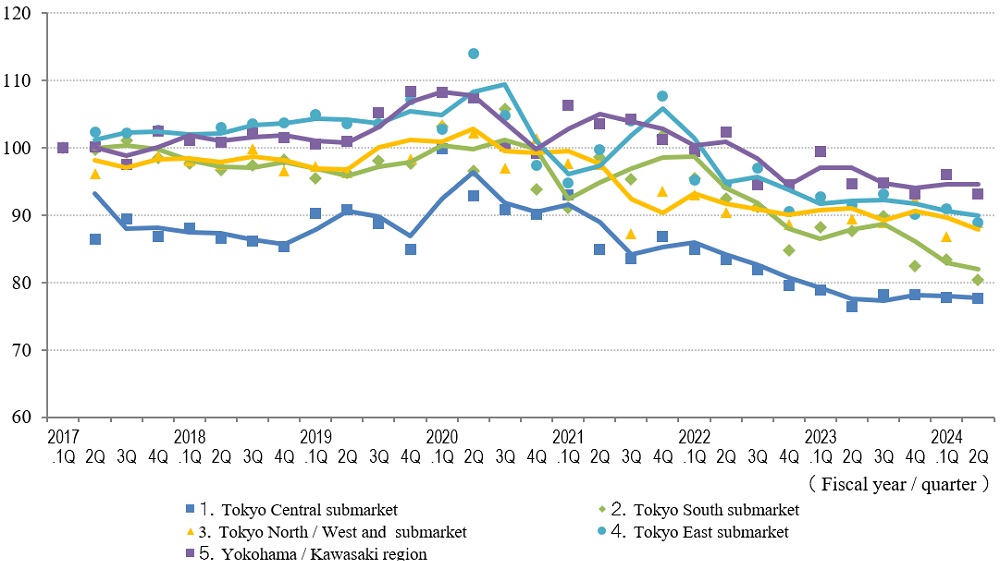

*Figures in each chart represent indices based on values for 1Q / FY2017 set at 100.

(Average Gross Yield on Contract Price is shown as an index to Average Gross Yield on Initial Asking Price for 1Q / FY 2017 set at 100.)

[Note] The historical data may be revised subsequently due to maintenance carried out from time to time, such as adding newly acquired data.

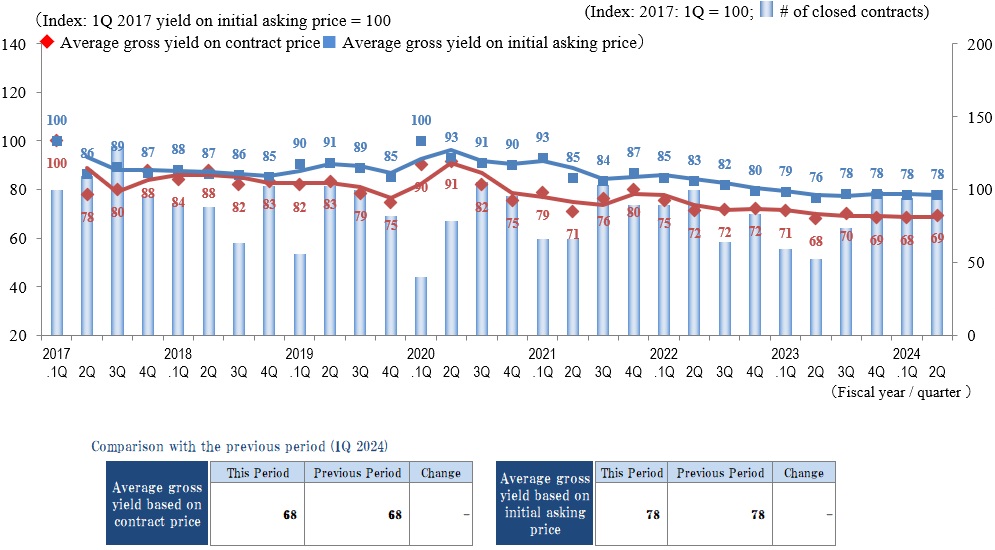

Pick Up Area -Tokyo Central submarket-

(*)Tokyo Central submarket: Minato-ku, Chiyoda-ku, Chuo-ku, Shibuya-ku, Shinjuku-ku, and Bunkyo-ku

◆Movements by Quarter: Average Gross Yield on Contract Price / Average Gross Yield on Initial Asking Price / Number of Transactions

◆Brokered Transactions of Investment Real Estate in the Submarket

In 2Q/FY 2024 both the Index of the Average Gross Yield on the Initial Asking Price and the Index of the Average Gross Yield on the Contract Price remained largely unchanged in the Tokyo Central submarket as favorable market conditions continue. The number of transactions contracted showed an increasing trend both from 1Q/FY 2024 and YoY.

In the central Tokyo leasing market, residential rents remain in an increasing trend, while for offices, vacancy rates have improved, and rents have stopped decreasing with some rent increases apparent as well. Inbound consumption is having a positive effect on retail business results. Rents are rising centered on street-level stores in name-brand areas in central Tokyo. As the recovery trend continues, in trading in investment real estate, some cases are apparent here and there of contracts concluded on properties for which rent can be expected to increase even if their current yields are relatively low regardless of asset type.

Overall, the majority view continues to be the relatively optimistic one that favorable conditions should continue as the real-estate investment market in the Tokyo Central submarket remains steady or improves moderately and supported by improved vacancy rates, rising rents, and booming inbound demand. At the same time, as in the last quarter, future risks include upward pressure on investment yields due to such factors as continued inflation, interest-rate trends (concern about further rate hikes), and financial-market volatility. These still need to be monitored closely since there is a possibility that they could fluctuate with variation in domestic and international situations and economic trends following the recent general elections for the lower house of the Japanese parliament and the US presidential election.

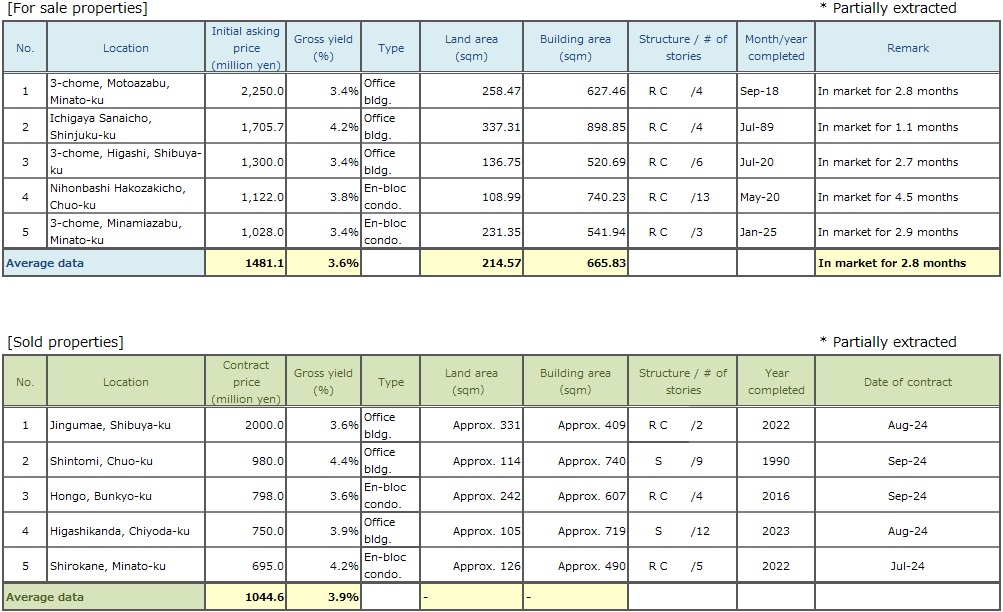

Pick Up Area -Tokyo South submarket-

(*) Tokyo South submarket: Shinagawa-ku, Meguro-ku, Setagaya-ku, and Ota-ku

◆Movements by Quarter: Average Gross Yield on Contract Price / Average Gross Yield on Initial Asking Price / Number of Transactions

◆Brokered Transactions of Investment Real Estate in the Submarket

The Index of the Average Gross Yield on the Initial Asking Price in the Tokyo South submarket in 2Q/FY 2024 reached its lowest level since statistics began in 1Q/FY 2017 at 80. The Index of the Average Gross Yield on the Contract Price also reached its lowest level since statistics began, at 74.

The trend in the number of transactions contracted remains favorable, up both from 1Q/FY 2024 and YoY. As the gap between the number of transactions contracted and the Average Gross Yield continues to contract this period, selling and buying are well balanced, although at high price levels in the Tokyo South submarket, and trading is steady.

Interest-rate hikes have appeared as multiple financial institutions raised variable rates in October. In the elections for the lower house of Japanese parliament, the ruling LDP-Komeito coalition lost its overall majority, making its management of government more challenging. At the same time, there are expectations for a livelier policy debate between the parties in power and the opposition. There also is a need to monitor trends in stock prices and exchange rates in response to the results of the recent US presidential election. It would appear to be vital to monitor market conditions calmly without getting distracted by short-term movements.

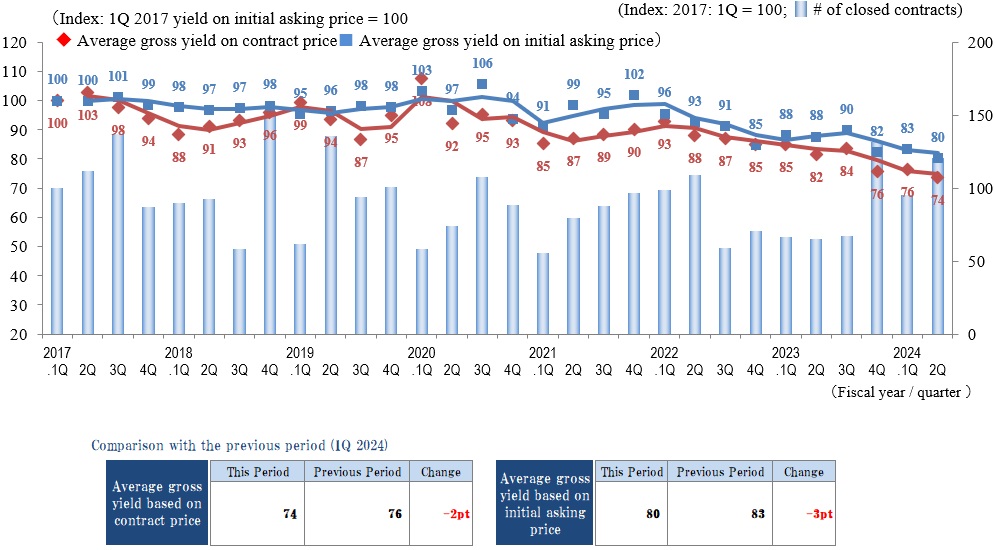

Pick Up Area -Tokyo North / West submarket-

(*) Tokyo North / West submarket: Suginami-ku, Nakano-ku, Nerima-ku, Toshima-ku, Itabashi-ku, Kita-ku, and Taito-ku

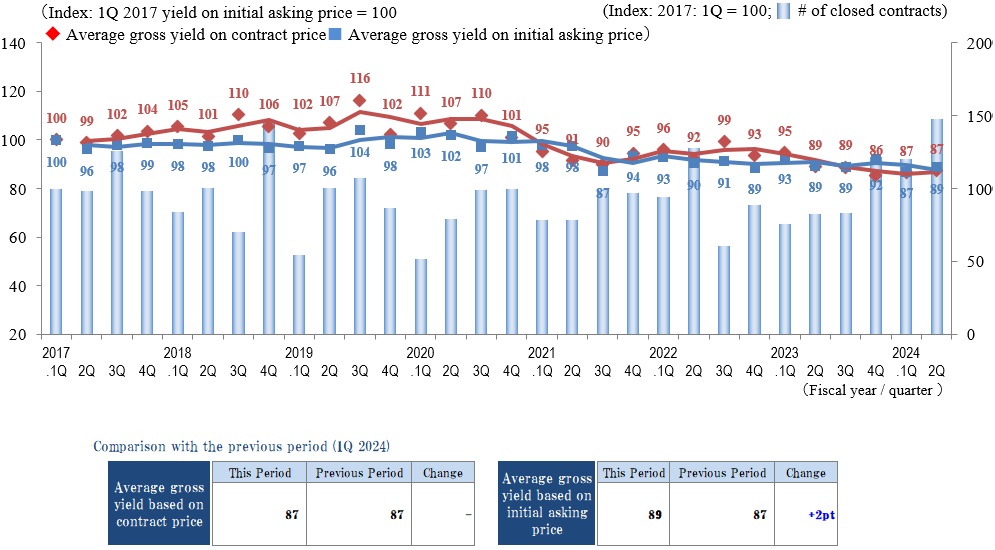

◆Movements by Quarter: Average Gross Yield on Contract Price / Average Gross Yield on Initial Asking Price / Number of Transactions

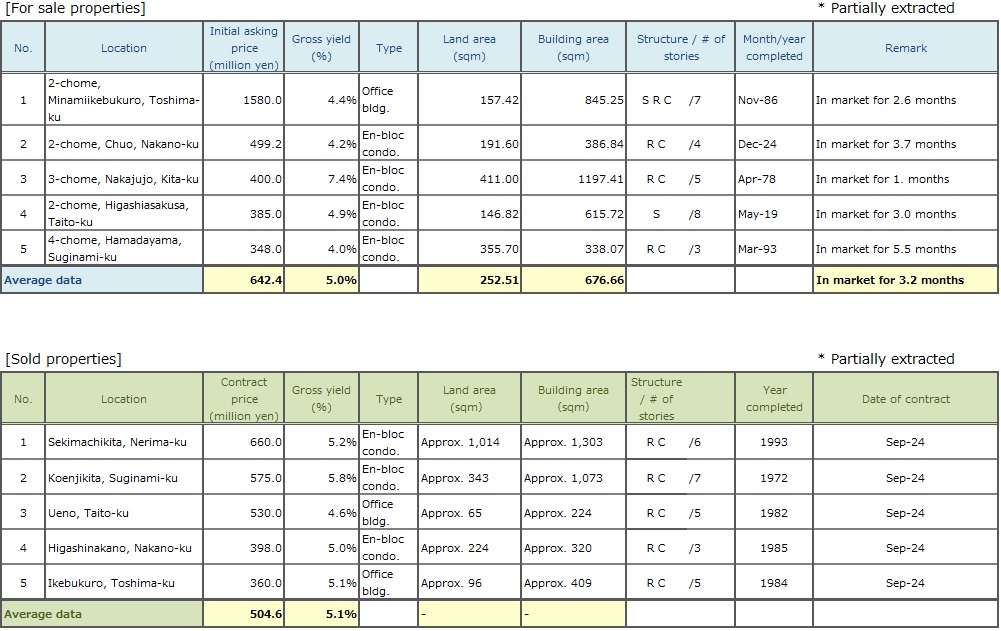

◆Brokered Transactions of Investment Real Estate in the Submarket

The Index of the Average Gross Yield on the Contract Price remained unchanged and the Index of the Average Gross Yield on the Initial Asking Price was up 2 pt (prices fell) QoQ in the Tokyo North / West submarket in 2Q/FY 2024.

The difference between these two yields was small since market conditions appear to remain near equilibrium between demand and supply. The difference between the Index of the Average Gross Yield on the Contract Price and the Index of the Average Gross Yield on the Initial Asking Price has remained small since FY 2023. Thus, the market environment appears to be a favorable one in which demand and supply are well balanced.

The stable market environment is having a positive effect, and the number of transactions contracted is up 122% QoQ to its highest level since statistics began in FY 2017. For the above reasons, too, the investment real estate market in this submarket can be said to be enjoying extremely favorable conditions.

Despite these favorable market conditions, there are a number of topics of concern regarding the future, such as high construction costs and additional BoJ interest rate hikes. It is important to remain alert for the optimal timing to sell and buy while closely monitoring the market impacts of any changes in investor sentiment.

Pick Up Area -Tokyo East submarket-

(*) Tokyo East submarket: Koto-ku, Sumida-ku, Arakawa-ku, Edogawa-Ku, Katsushika-ku, and Adachi-ku

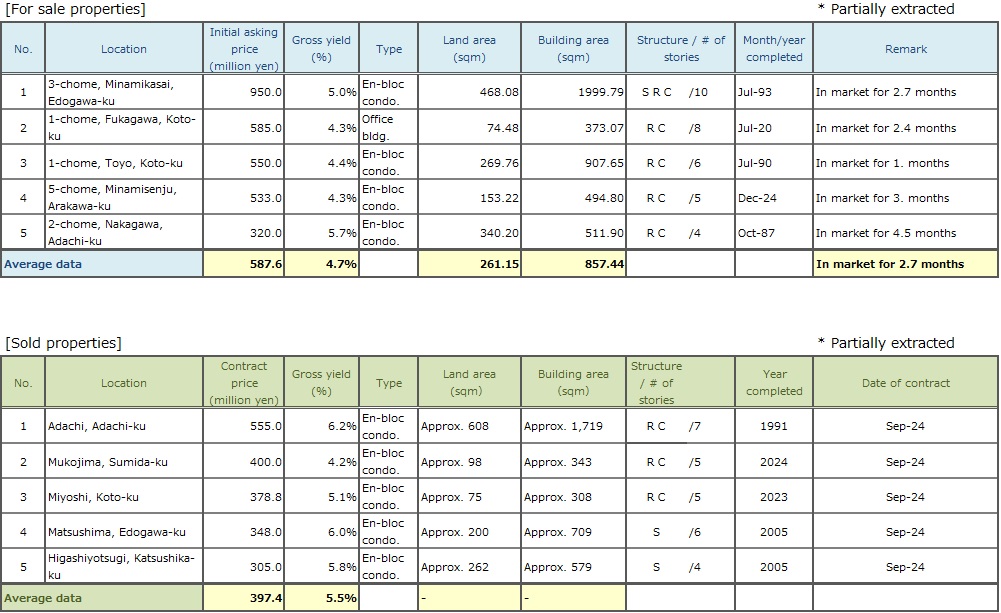

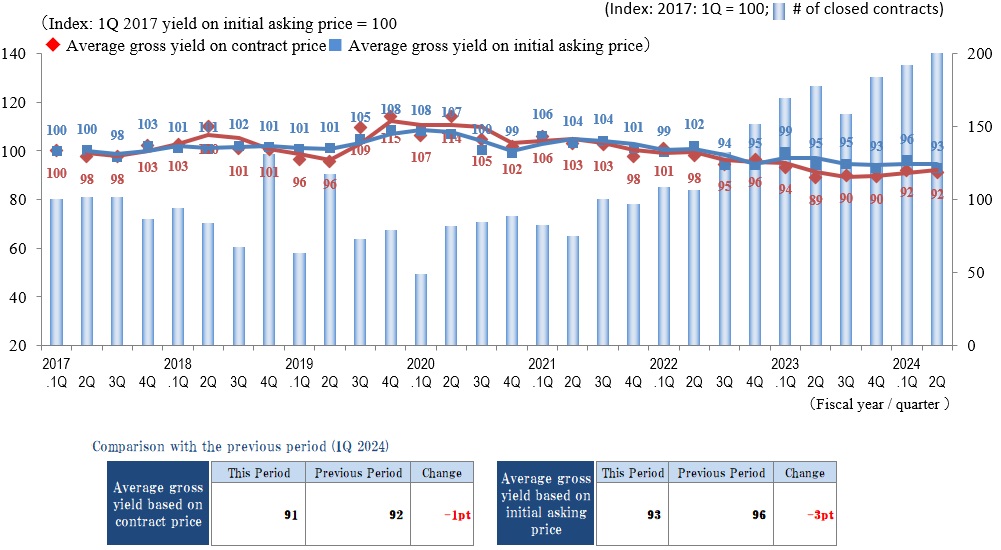

◆Movements by Quarter: Average Gross Yield on Contract Price / Average Gross Yield on Initial Asking Price / Number of Transactions

◆Brokered Transactions of Investment Real Estate in the Submarket

The Index of the Average Gross Yield on the Contract Price was down 3 pt, and the Index of the Average Gross Yield on the Initial Asking Price was down 2 pt (prices rose) QoQ in the Tokyo East submarket in 2Q/FY 2024. The Index of the Average Gross Yield on the Contract Price in the Tokyo East submarket reached its lowest level since statistics began in 1Q/FY 2017 at 83.

A look at transactions shows that sellers and buyers are reaching agreement on prices as difference between the contract price and the initial asking price is small. The number of transactions also is high compared to the same period last year. As such, it appears that buyers are keeping up with sellers' asking prices. Favorable conditions can be said to continue in the real estate market of the Tokyo East submarket.

A look at changes in the real estate environment shows a number of matters that need to be watched closely, such as the fact that “Japan's five largest banks raised mortgage base interest rates by 0.15% in October,” “record high prices on new condominiums in the greater Tokyo area in H1/FY 2024 as the number of units listed for sale hit a record low and costs of building materials and labor remained high on the average (according to the Real Estate Economic Institute Co., Ltd.),” “the massive loss of seats by the LDP in the 50th elections to the lower house of parliament, which caused the LDP-Komeito coalition to lose its overall majority,” and “Donald Trump's election as US president.” While the impacts of these factors on the market for real estate for investment or business use may differ in degree, it is thought that they will have some effect.

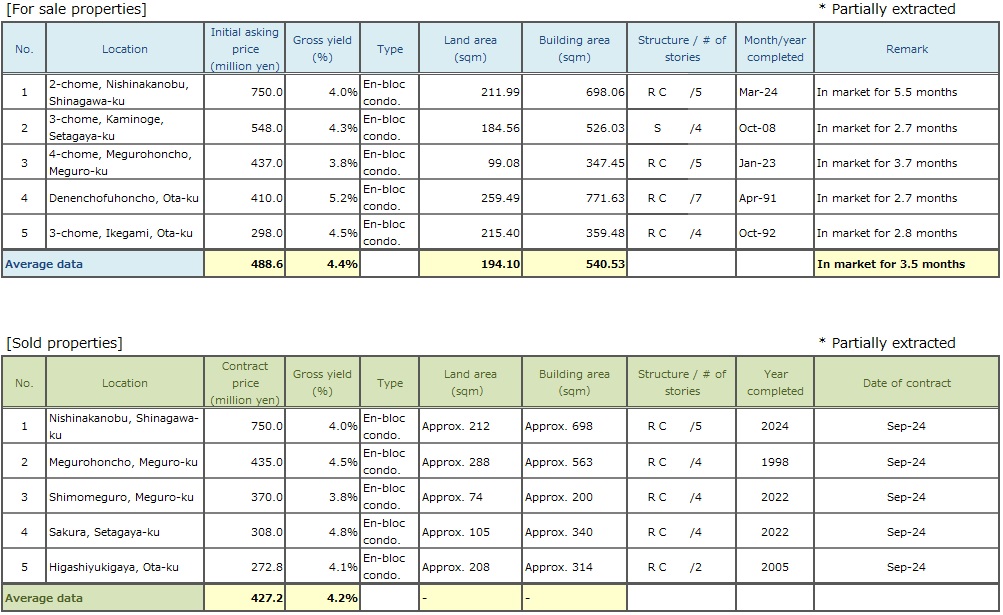

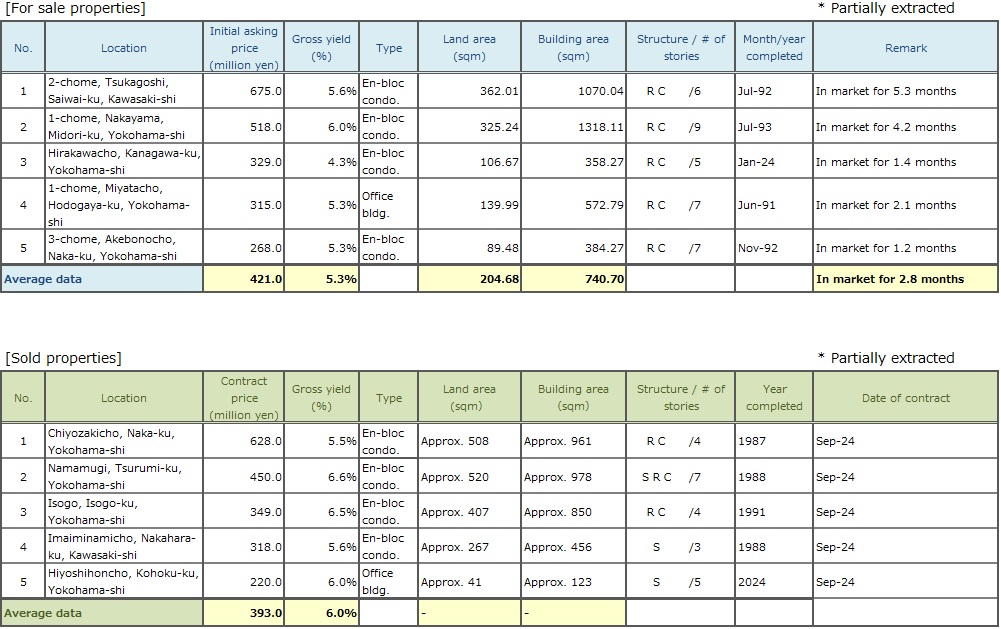

Pick Up Area -Yokohama / Kawasaki region-

(*) Yokohama and Kawasaki region: Yokohama city, Kawasaki city

◆Movements by Quarter: Average Gross Yield on Contract Price / Average Gross Yield on Initial Asking Price / Number of Transactions

◆Brokered Transactions of Investment Real Estate in the Submarket

The number of transactions contracted in the Yokohama/Kawasaki region in 2Q/FY 2024 was up sharply both QoQ and YoY to its highest level since statistics began (the previous high was recorded last quarter). Average yields, which showed a somewhat bearish trend in 1Q, fell QoQ for both contract prices and initial asking prices (contract prices increased) as brisk market conditions continued.

However, a look at the details of individual transactions shows that depending on property conditions it may take some time before a contract is concluded, or there may be considerable variation among contracted yields (prices) since the trend toward market polarization is pronounced. As the market for investment real estate overheats, investors can be said to be becoming even more selective.

At the same time, there is no sign of an end to high construction costs for demolition and renovation, and in many cases, they are putting pressure on land prices in transactions for development sites. The impact of this trend is particularly large in the Yokohama/Kawasaki region where land prices are lower than in central Tokyo. Uncertainty appears to continue in prices of commercial sites for development.

Amid the possibility that the future policies of the Japanese and US governments could have not a little impact on exchange rates, stock prices, and other conditions, an increase in factors leading to uncertainty in the market could be expected to have a major impact on prospective buyers' investment decisions. Continued close observation will be crucial.

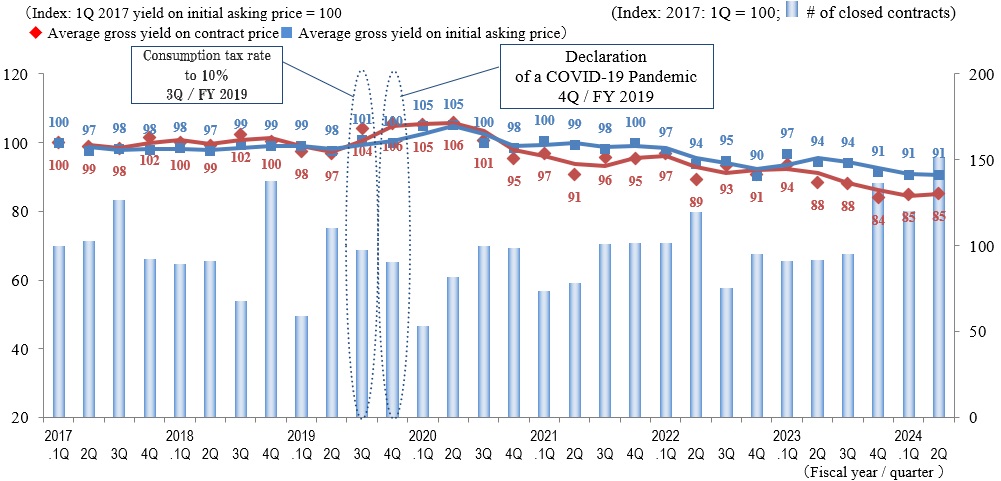

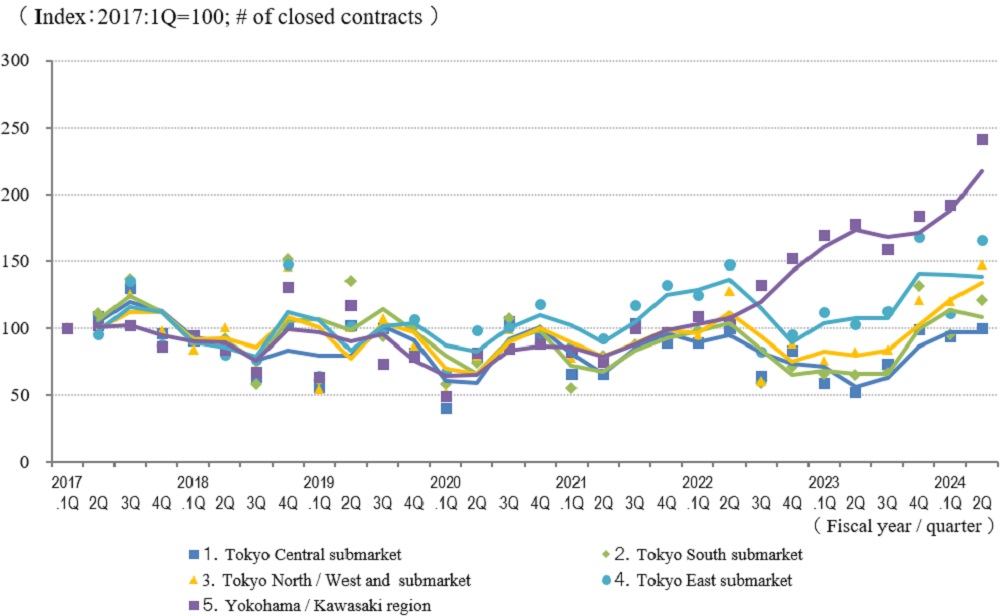

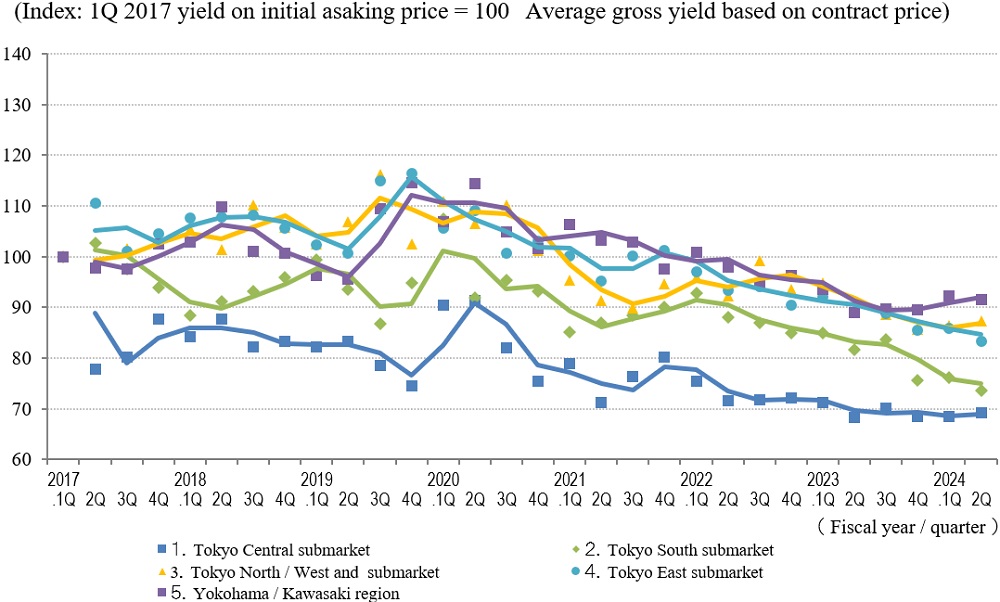

General overview

◆Movements by Quarter: Average Gross Yield on Contract Price / Average Gross Yield on Initial Asking Price / Number of Transactions for the 5 Areas

◆Movements in Number of Transactions by Area

◆Movements in Average Gross Yield on Contract Price by Area

◆Movements in Average Gross Yield on Initial Asking Price by Area

In 2Q/FY 2024 the Index of the Average Gross Yield on the Contract Price remained largely unchanged or down by 0.1–0.2 pt in each submarket. Overall, figures remained largely unchanged QoQ. The Index of the Average Gross Yield on the Initial Asking Price and the Index of the Average Gross Yield on the Contract Price both showed similar trends. Each remained largely unchanged across the area as a whole.

While the number of transactions contracted had shown pronounced QoQ drops in some submarkets in 1Q/FY 2024, this quarter, it was up both QoQ and YoY in all submarkets. In particular, the number of transactions contracted reached record highs since statistics began in 1Q/FY 2017 increased in the Tokyo West and Tokyo North submarkets and the Yokohama/Kawasaki region.

While generally favorable market conditions appear to continue, as noted in the comments on each submarket above, there are a number of looming topics that could have not a little impact on the real estate investment market and the financial markets. It will be vital to continue to monitor the market from a variety of perspectives.