Our Site uses cookies to improve your experience on our website. For more details, please read our Cookie Policy.

By closing this message or starting to navigate on this website, you agree to our use of cookies.

This page is translated using machine translation. Please note that the content may not be 100% accurate.

Investment Real Estate Market Report | 2Q FY2025

Areas subject to collection of data

Tokyo Central submarket: Minato-ku, Chiyoda-ku, Chuo-ku, Shibuya-ku, Shinjuku-ku, and Bunkyo-ku

Tokyo South submarket: Shinagawa-ku, Meguro-ku, Setagaya-ku, and Ota-ku

Tokyo North / West submarket: Suginami-ku, Nakano-ku, Nerima-ku, Toshima-ku, Itabashi-ku, Kita-ku, and Taito-ku

Tokyo East submarket: Koto-ku, Sumida-ku, Arakawa-ku, Edogawa-ku, Katsushika-ku, and Adachi-ku

Yokohama / Kawasaki region: Yokohama city and Kawasaki city

Detailed descriptions

Pick Up Area: For investment real estate, trends in the average gross yields on contract price and initial asking price, together with the number of closed contracts by submarkets are represented in the graph. The details of the transition of actual market value and properties both for sale and sold in certain neighborhoods are also shown.

Market Overview: As an overview of all the submarkets, the trend from the past to this quarter is available. Trends in the average gross yields based on contract price and initial asking price together with the number of closed contracts by area are shown for comparison.

Data Source: Information is extracted from the database containing properties offered for sale and contracts concluded through Mitsui Fudosan Realty Network (En-bloc condominiums / office buildings / apartment buildings).

- Number of Transactions & Average Gross Yield on Contract Price: Number of contracts closed in a quarter (three months) and average gross yield of them (including estimated values)

- Average Gross Yield on Initial Asking Price: Quarterly average gross yield of closed contracts based on their asking price initially quoted

*Figures in each chart represent indices based on values for 1Q / FY2017 set at 100.

(Average Gross Yield on Contract Price is shown as an index to Average Gross Yield on Initial Asking Price for 1Q / FY 2017 set at 100.)

[Note] The historical data may be revised subsequently due to maintenance carried out from time to time, such as adding newly acquired data.

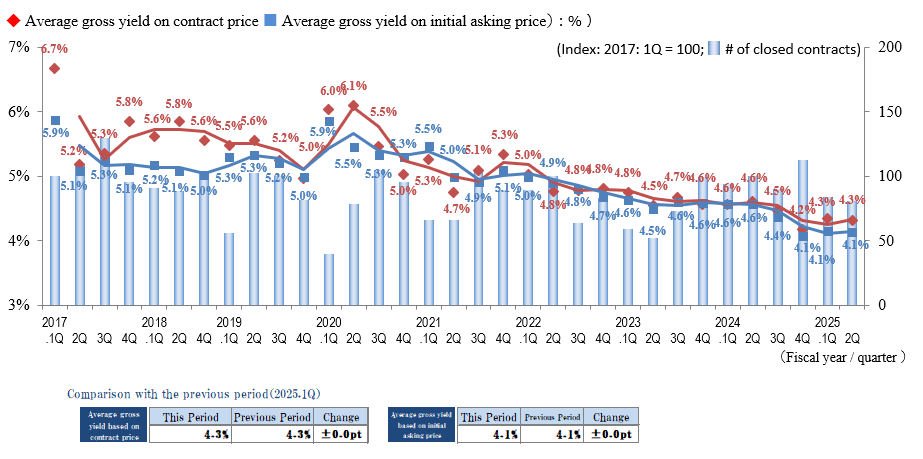

Pick Up Area -Tokyo Central submarket-

(*)Tokyo Central submarket: Minato-ku, Chiyoda-ku, Chuo-ku, Shibuya-ku, Shinjuku-ku, and Bunkyo-ku

◆Movements by Quarter: Average Gross Yield on Contract Price / Average Gross Yield on Initial Asking Price / Number of Transactions

◆Brokered Transactions of Investment Real Estate in the Submarket

The Indices of the Average Gross Yield on the Initial Asking Price and on the Contract Price both were unchanged at ± 0.0 pt QoQ in the Tokyo Central submarket in 2Q / FY 2025, while the decreasing trend YoY continued from 1Q in the number of contracts made. The leasing market in the Tokyo Central submarket is reviewed below:

■ Residences: The gentle increasing trend in rents continued. The trend was pronounced toward concluding contracts on high-end properties at high unit prices.

■ Offices: The trends toward lower vacancy rates and higher rents continued for both new and existing supplies, centered on large-scale office buildings, amid booming demand from the corporate need for improved office environments and locations to secure human resources and the full-fledged return to working in the office.

■ Retail: Despite the weakness in consumer confidence, workers incomes are improving, and although rents remained in an increasing trend centered on street-level shops in well-known areas of Tokyo Central submarket because of the continuing inbound consumption trend, the pace appeared to slow somewhat.

While as described above favorable conditions continue in the leasing market, and this has a positive effect on the investment real estate market, at the same time owners of investment real estate are faced with rising loan repayment amounts due to the effects of interest-rate hikes and the rising costs of ownership and operation, including repair costs, due to rising construction and labor costs. Accordingly, to maintain or increase effective yields, they will need to increase rents in excess of the increase in the costs of holding, and this point requires verification for individual property holdings.

In addition to the economic impact of the second Trump administration, which continues from the previous quarter, the election of a new prime minister and establishment of a coalition government in Japan are contributing to continued concerns about political uncertainty, and this continues to require close monitoring.

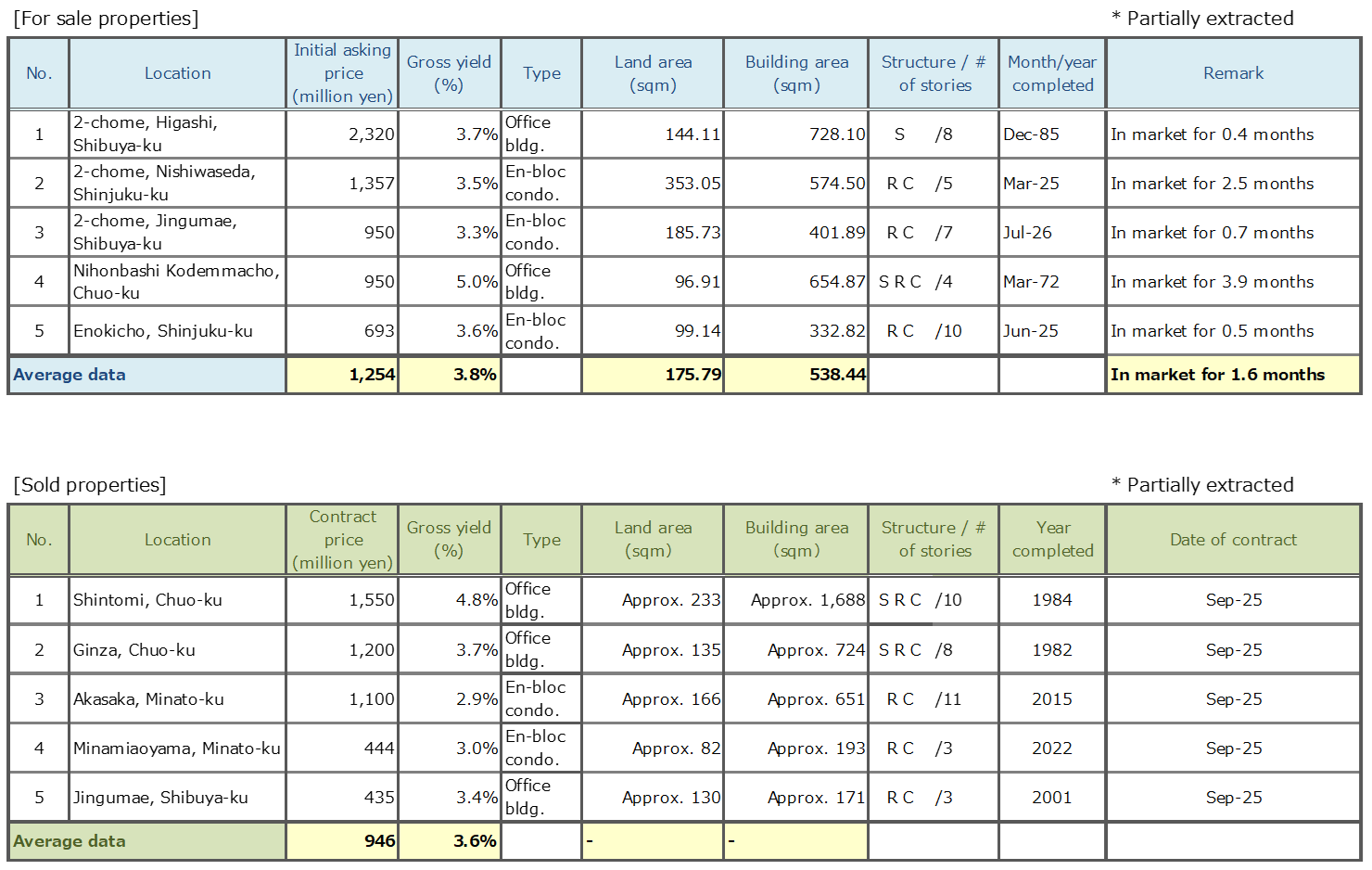

Pick Up Area -Tokyo South submarket-

(*) Tokyo South submarket: Shinagawa-ku, Meguro-ku, Setagaya-ku, and Ota-ku

◆Movements by Quarter: Average Gross Yield on Contract Price / Average Gross Yield on Initial Asking Price / Number of Transactions

◆Brokered Transactions of Investment Real Estate in the Submarket

The indices of the Average Gross Yield on the Initial Asking Price and the Contract Price in Tokyo South submarket in 2Q / FY 2025 were 4.8% (± 0.0 pt QoQ) and 5.0% (± 0.0 pt QoQ), respectively. There has been no QoQ change in the indices of both initial asking and contract prices, and a look at trends over the most recent year shows that yields largely remain flat.

While the number of contracts decreased QoQ, the extent of the decrease was limited because the number has remained at a similarly high level in each quarter over the past year. In addition, the difference between the indices of the Average Gross Yield on the Initial Asking Price and the Contract Price remained small. Since this state has continued since 4Q / FY 2023, Tokyo South submarket can be said to remain stable.

The real estate investment market in Tokyo South submarket maintains stable with strong conditions backed by the submarket's unique environment of a mixture of residential and commercial properties and high residential demand. At the same time, transactions are becoming increasingly selective, including those for existing stock, because of the rising costs of land acquisition and construction and a decrease in development sites.

Tokyo South submarket is considered a mature market that combines a residential environment, asset value, and stable earnings. While the trend can be expected to remain stable over the medium to long term in light of the favorable balance between demand and supply, high land prices and rising interest rates, which greatly impact investment profitability, continue in high-end areas, including not only Tokyo Central but also Tokyo South submarkets, and it remains essential to monitor the risks of pressure on yields.

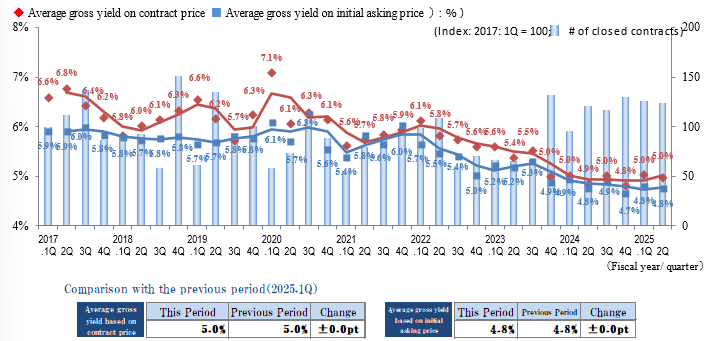

Pick Up Area -Tokyo North / West submarket-

(*) Tokyo North / West submarket: Suginami-ku, Nakano-ku, Nerima-ku, Toshima-ku, Itabashi-ku, Kita-ku, and Taito-ku

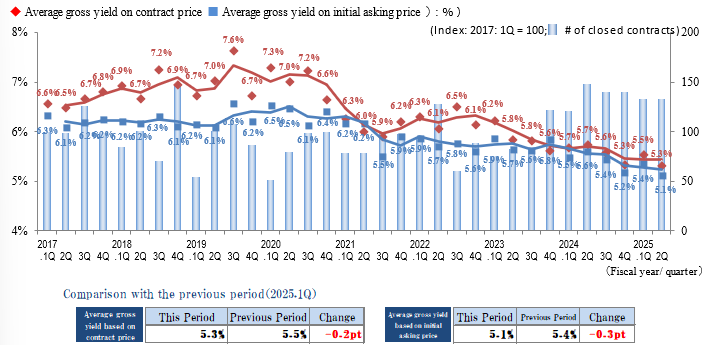

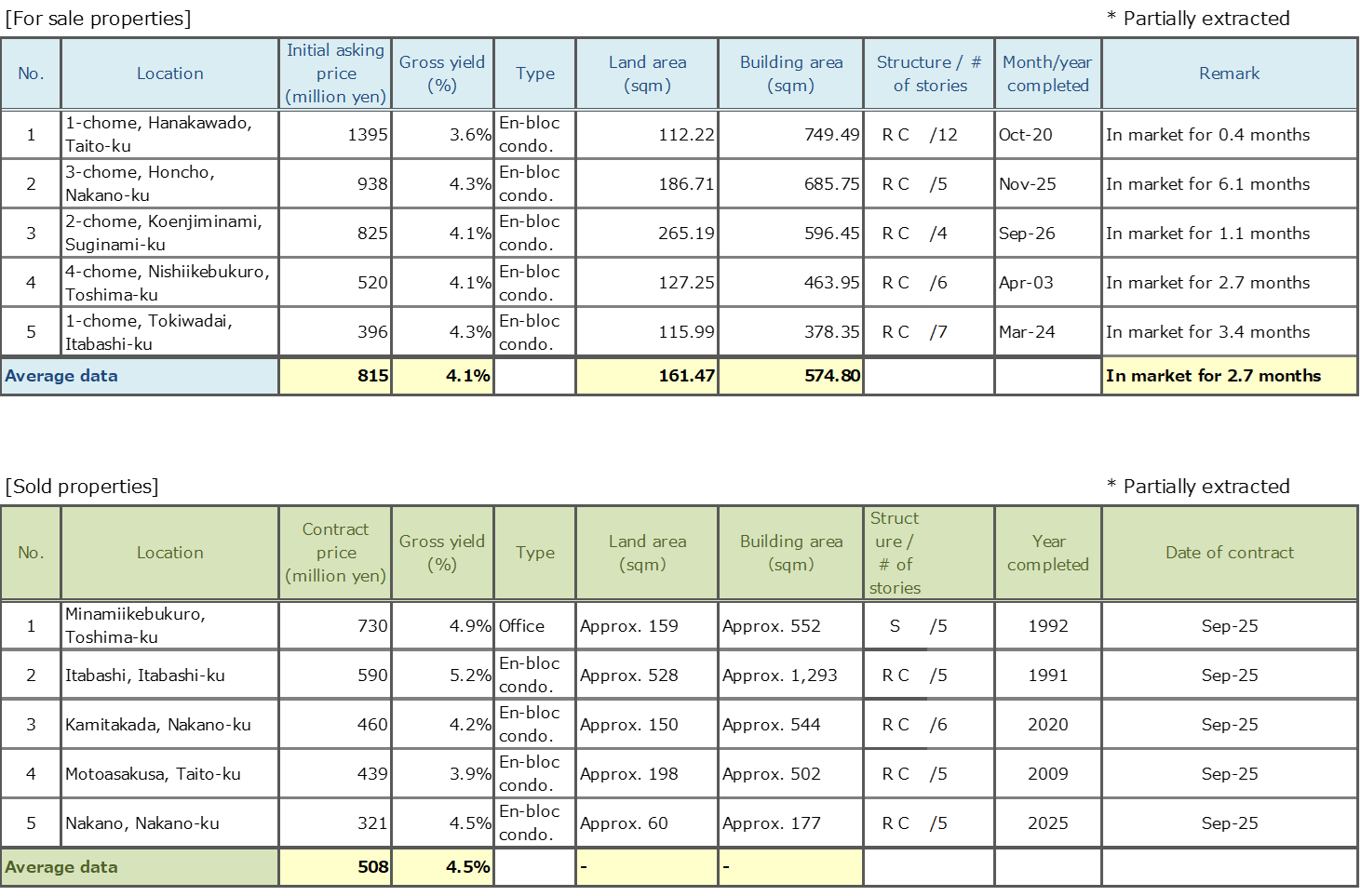

◆Movements by Quarter: Average Gross Yield on Contract Price / Average Gross Yield on Initial Asking Price / Number of Transactions

◆Brokered Transactions of Investment Real Estate in the Submarket

The Indices of Average Gross Yield on the Contract Price and the Initial Asking Price in Tokyo North / West submarket in 2Q / FY 2025 both decreased from the previous quarter (1Q / FY 2025) as prices rose. While in the previous quarter the yield increased slightly (prices fell), marking a break from the previous trend toward higher prices, the yield again decreased this quarter. A look at the extent of the decrease in the yield on the initial asking price, in particular, shows that sellers have an aggressive attitude toward price setting.

The number of contracts made remains flat from the previous quarter as the market remains active. However, a continued polarizing trend is apparent. While buyers are being found relatively more quickly for properties with yields that are affordable for prospective buyers, properties sold at much lower than market yields continue to tend to take a long time to find buyers. As noted above, transactions themselves were active this quarter, and buyers continue to adopt an attitude of ascertaining the appropriate prices. The key to concluding a contract is for the seller to set a realistic yield.

A look at trends across Japan shows that the Nikkei Average rose above 50,000 yen in response to the election of Japan's first female prime minister, and the investment market as a whole appears active (as of October 2025). While conditions remain favorable in the real estate market as a whole at present, we will continue to monitor future trends while being sensitive to trends in interest rates and construction costs and demand-supply trends by area.

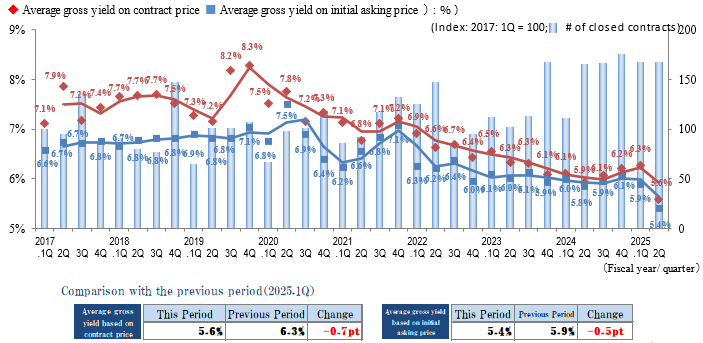

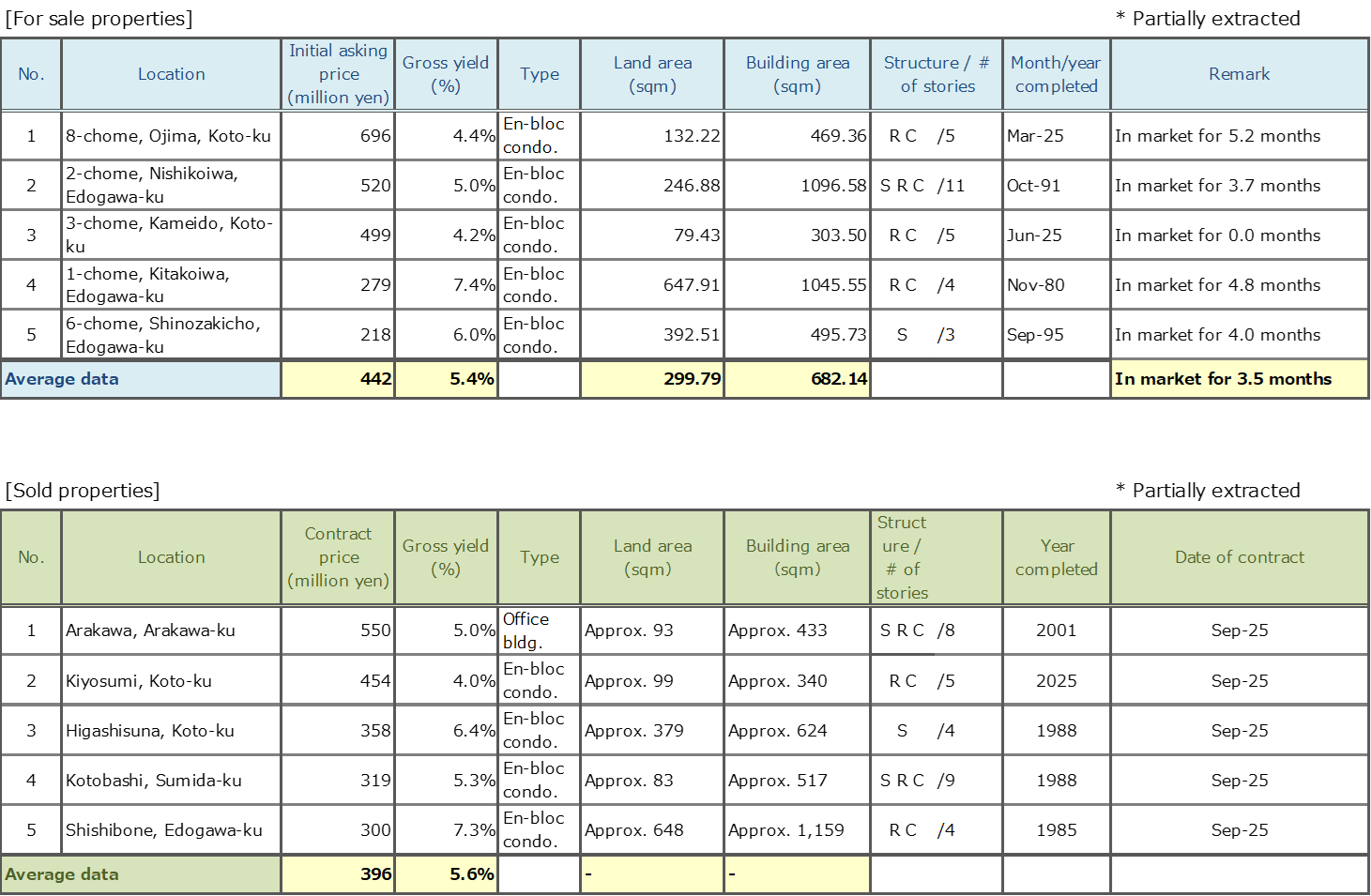

Pick Up Area -Tokyo East submarket-

(*) Tokyo East submarket: Koto-ku, Sumida-ku, Arakawa-ku, Edogawa-Ku, Katsushika-ku, and Adachi-ku

◆Movements by Quarter: Average Gross Yield on Contract Price / Average Gross Yield on Initial Asking Price / Number of Transactions

◆Brokered Transactions of Investment Real Estate in the Submarket

The Indices of the Average Gross Yield on the Contract Price and the Initial Asking Price in Tokyo East submarket in 2Q / FY 2025 were 5.6% (down 0.7 pt QoQ) and 5.4% (down 0.5 pt QoQ), respectively, while the number of contracts made remained somewhat stable. Both of these indices reached their lowest levels since FY 2017. A look at the details of properties for which contracts were made shows an increase in the number of relatively newer properties for which contracts were made at gross yields in the 4% range (condominium buildings completed within the past five years, including new construction). This can be considered one factor driving down overall average yields. However, since there is some variation in yields with such conditions as asset type, property age, and distance from the nearest station, it would be too early to judge from data for the current period only that market prices are increasing. The trend in the coming quarters must continue to be monitored.

There are similar signs of falling yields (rising prices) on properties for sale as well, as a result of the increase in newer properties for sale.

Most investors prefer areas near train stations, redevelopment areas, and newer properties. They are strongly oriented to avoiding vacancy risks, and they tend actively to acquire properties that can promise rent upsides. For this reason, there is a risk that properties that do not meet these conditions could be on sale for a long period unless an appropriate price is set. Strategic pricing is important.

Since the market demand-supply balance could change in the future with such trends as contract prices and initial asking prices, yields, numbers of transactions, and numbers of properties for sale, it will remain important to check the trends carefully.

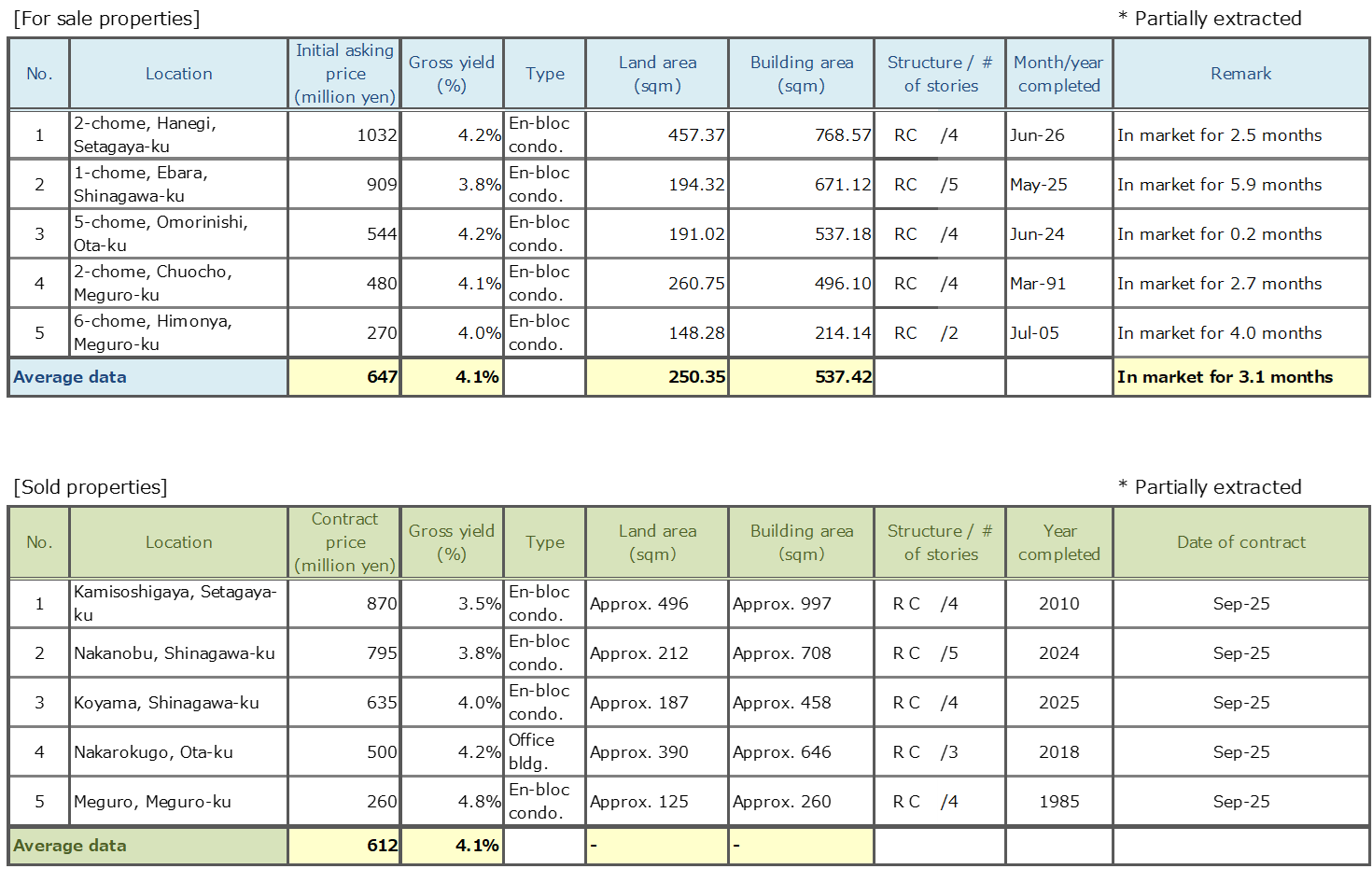

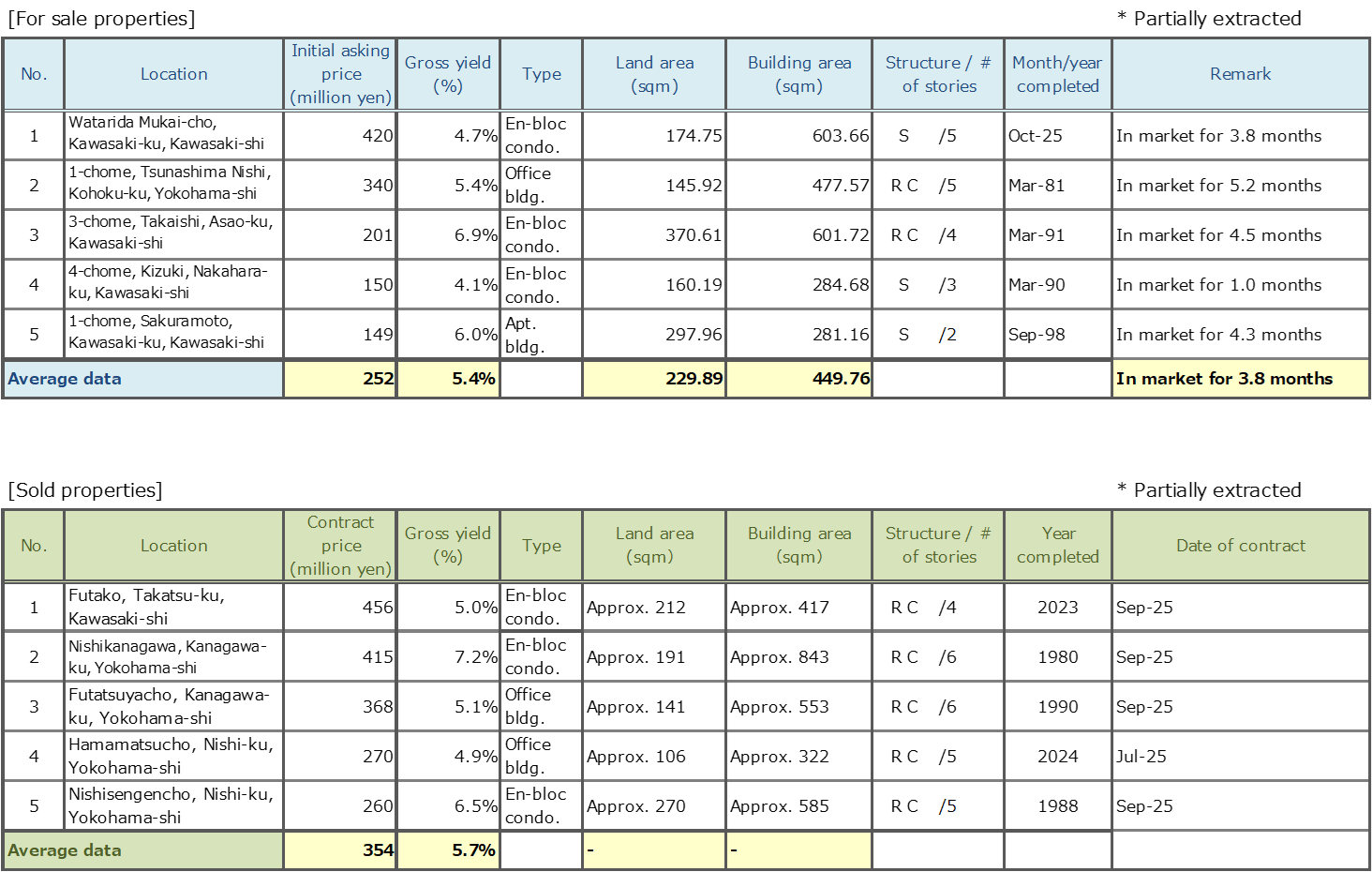

Pick Up Area -Yokohama / Kawasaki region-

(*) Yokohama and Kawasaki region: Yokohama city, Kawasaki city

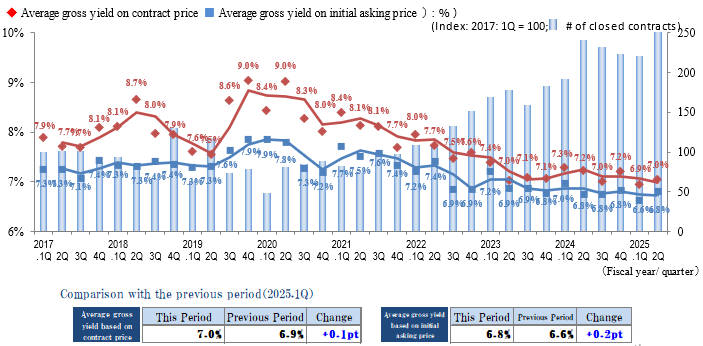

◆Movements by Quarter: Average Gross Yield on Contract Price / Average Gross Yield on Initial Asking Price / Number of Transactions

◆Brokered Transactions of Investment Real Estate in the Submarket

The Indices of the Average Gross Yield on the Contract Price and the Initial Asking Price both increased slightly (prices fell) in Yokohama / Kawasaki region in 2Q / FY 2025, rebounding to an increase this period after a decreasing trend had continued since 1Q / FY 2024. The number of contracts made in the region exceeded the previous record high (in 2Q / FY 2024) to set a new record high since data collection began in 2017. Despite the shadow of price inflation, the number of transactions remains high and active conditions continue in the market.

While a certain number of customers are considering Yokohama / Kawasaki region, where land prices are relatively lower and yields can be expected to be higher than in Tokyo Central submarket, the pronounced polarizing trend continues between the central and suburban areas in this region, and investors appear to be becoming increasingly cautious in the selection of investments.

In addition, while rent is in an increasing trend, in some cases even greater increases in construction costs are putting pressure on developers' business revenues and expenditures. Prices remain low on small-scale commercial sites in particular, which involve higher construction cost burdens.

While the economy has changed sharply with the change of government and a stock market that exceeded 50,000 yen for the first time, conditions of uncertainty continue. Moving forward, it will be essential to pay even closer attention to changing domestic and international monetary policy and economic conditions, such as exchange rates and stock prices.

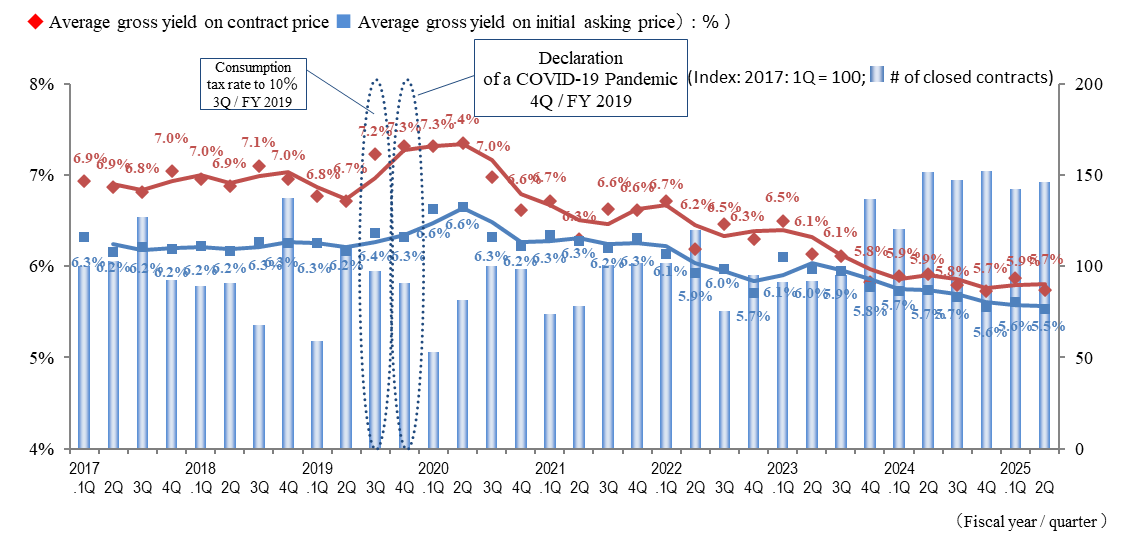

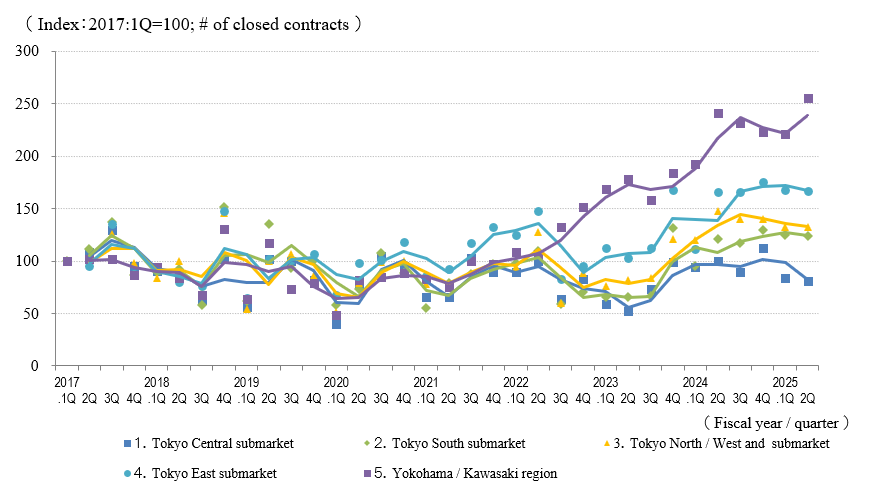

General overview

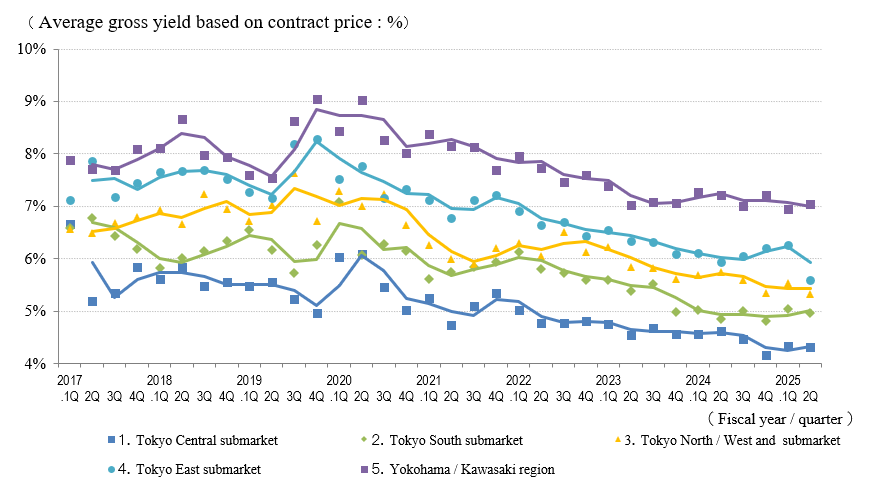

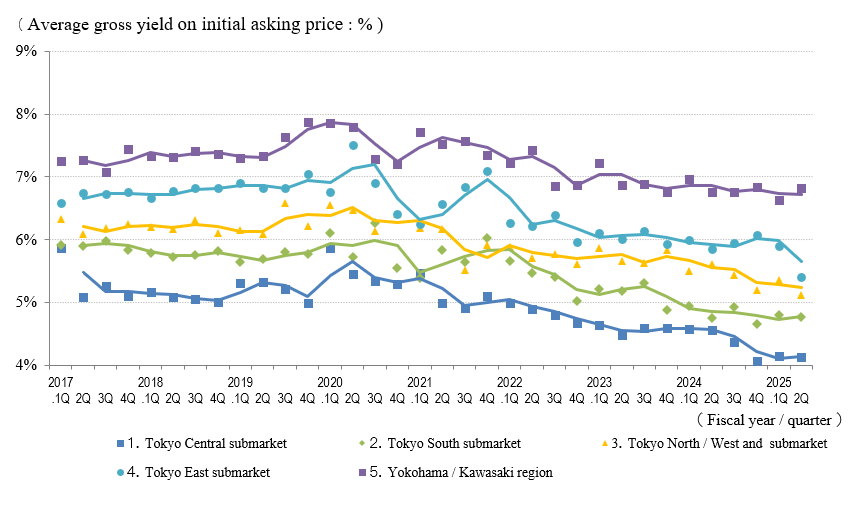

◆Movements by Quarter: Average Gross Yield on Contract Price / Average Gross Yield on Initial Asking Price / Number of Transactions for the 5 Areas

◆Movements in Number of Transactions by Area

◆Movements in Average Gross Yield on Contract Price by Area

◆Movements in Average Gross Yield on Initial Asking Price by Area

The real estate investment market in 2Q / FY 2025 showed a flat or decreasing trend in the Index of the Average Gross Yield on the Contract Price in each Tokyo submarket. At the same time, the trend in Yokohama / Kawasaki region rebounded to a slight increase. The number of contracts made showed some signs of adjustment as the number decreased YoY in in the Tokyo Central submarket and QoQ in the Tokyo South submarket. Overall, however, the number remained at a high level and the market remained active. At the same time, the polarizing trend in transactions continues, and differences in time spans until the conclusion of contracts are apparent due mainly to yields.

While investors' appetite for acquisitions shows signs of decreasing, they seem to be increasingly cautious. In an external environment in which the costs of property ownership are rising because of the interest-rate hikes and high construction and labor costs, to secure real yields, it will be essential to realize rent increases. Also, domestic and international political and economic insecurity remains high, and there is a need to monitor market trends closely.